Euro-Dollar: 1.1010 at Risk on Fed and ECB Outcomes says XM.com

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate has declined from 1.1275 to 1.1076 ahead of the dual risk events posed by the Federal Reserve and European Central Bank. Charalampos Pissouros, Senior Investment Analyst at XM.com, tells us what to expect.

The US dollar traded lower against most of the other currencies on Tuesday, but it seems to be stabilising today as investors may have turned to a more cautious trading strategy ahead of the FOMC decision later today.

A 25bps hike is a done deal in the eyes of investors, but the financial community appears to be split on whether another hike could be delivered before the end credits of this tightening crusade roll.

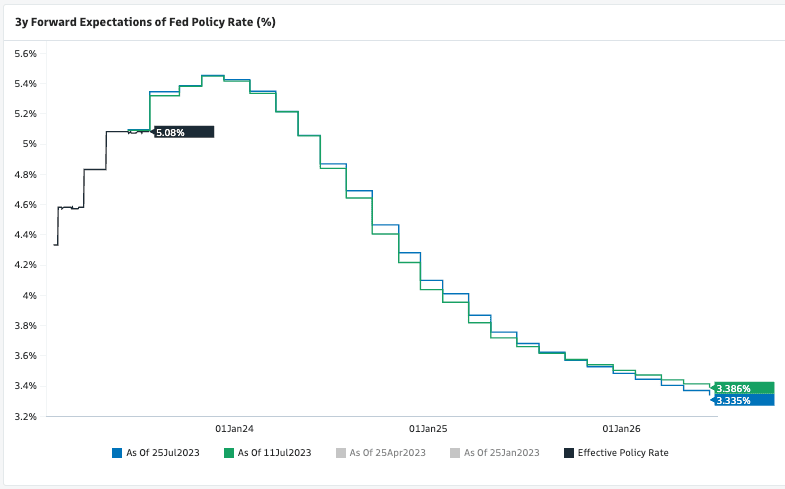

With inflation slowing more than expected in June, they are also anticipating a series of rate cuts throughout 2024.

Above: Market-implied expectations for the future of U.S. Fed interest rates, showing expectations for cuts starting in 2024. Image courtesy of Goldman Sachs.

Specifically, they are seeing interest rates ending next year almost 90bps below current levels.

Having all that in mind, a 25bps hike is unlikely to trigger volatility on its own.

Investors may focus on whether the statement will hint at more rate hikes and whether Fed Chair Powell will once again push back on interest rate cuts as he did last time.

With core inflation more than double the Fed’s 2% objective, signalling the end so early may be an unwise choice.

Thus, officials may reiterate the view that the fight against inflation is not over, while at the press conference, Powell could reiterate the view that rate cuts are "a couple of years out."

However, it remains to be seen whether another round of hawkish rhetoric will be enough to convince market participants to scale back their rate cut bets, as some of them may be holding the view that prior hikes could still work in bringing inflation further down in the coming months.

If Powell and co fail again to hammer home their message, the dollar could slide, while the opposite may be true if investors realize that the Fed has no intention to stop raising rates now and that rate reductions are not on next year’s agenda.

Euro/dollar could fall below the key support zone of 1.1010, marked by the inside swing high of June 22, but whether it could head decently lower this week may also depend on the outcome of the ECB decision tomorrow.

Above; EURUSD at daily intervals.

A 25bps increase seems to be set in stone, but with several ECB policymakers arguing that a September hike is not a done deal and Monday’s PMIs revealing a sharp slowdown in business activity, investors have well changed their minds with regards to the Bank’s future course of action.

They still see decent chances of another hike being delivered by December, but they have raised bets of rate reductions during 2024. A couple of weeks ago no cuts were on the table.

Now, they expect interest rates to end next year 25bps below current levels.

Thus, the spotlight may fall on ECB President Lagarde as traders are likely eager to find out whether she has also softened her stance or whether she will appear in her hawkish suit again, dismissing the Eurozone’s economic slowdown and prioritizing getting inflation in check.

Elsewhere, the Australian dollar is today’s main loser, despite gaining notable ground against its US counterpart yesterday.

The slide in the aussie was the result of a larger-than-expected slowdown in Australia’s quarter-on-quarter CPI, taking the year-on-year rate down to 6% from 7% and raising speculation that the RBA could forgo a rate hike next week.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes