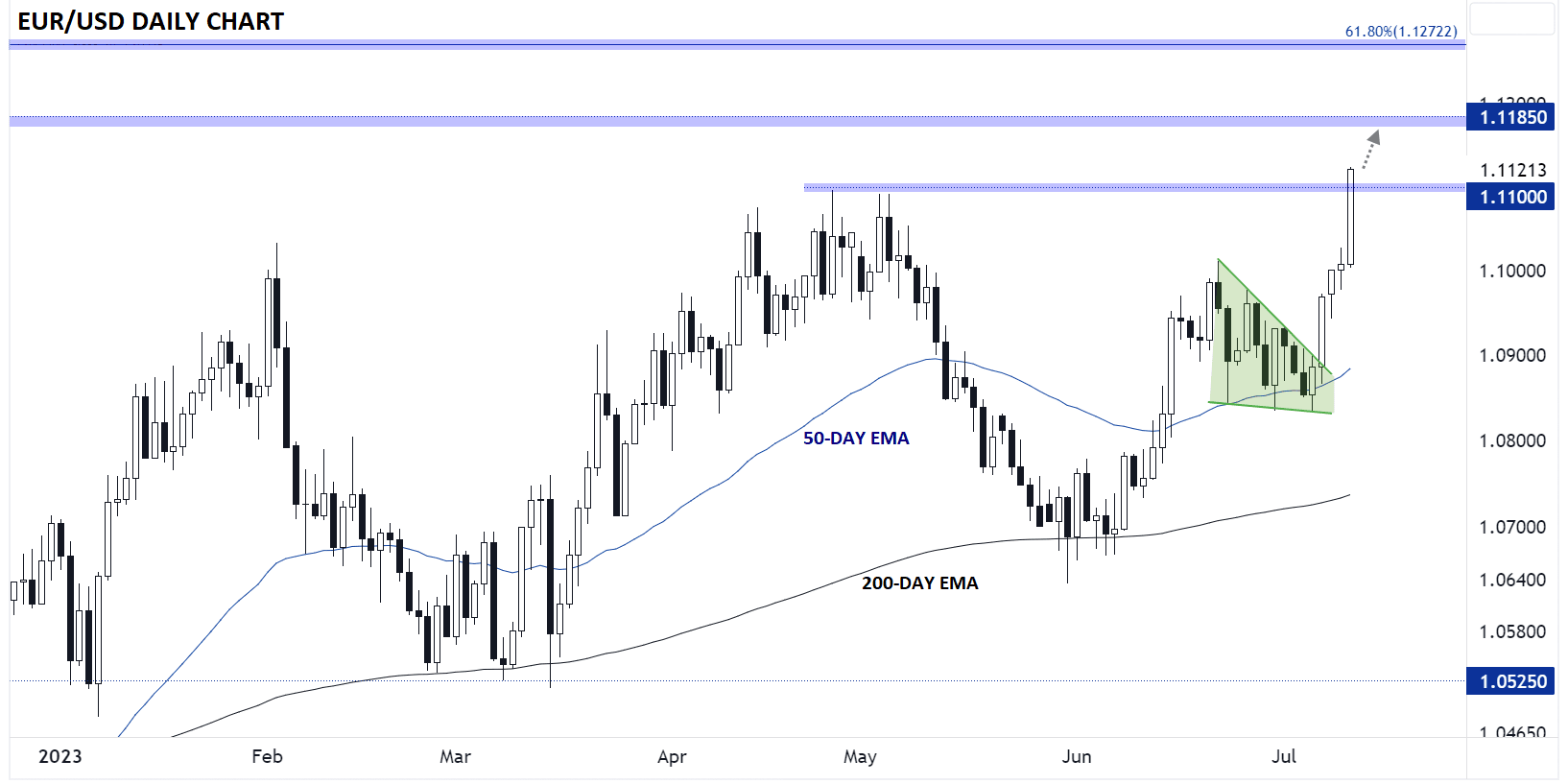

16-month High for EUR/USD Rate, 1.1185 is Next Technical Objective

- Written by: Gary Howes

Image © Adobe Images

The Euro to Dollar exchange rate (EURUSD) rose a per cent to hit a 16-month high at 1.11 following the release of U.S. inflation data that undershot market expectations and further gains are possible says one analyst.

A headline 3.0% year-on-year print for June, down on May's 4.0%, sent a clear message to markets that the Federal Reserve was on the cusp of winning its battle against inflation and the end of the interest rate hiking cycle was therefore close at hand.

"The U.S. CPI report sent a jolt of lightning through markets," says Matthew Weller, Global Head of Research at FOREX.com.

Although headline inflation fell sharply, core inflation rose 4.8% y/y in June, which is still well above levels that would be consistent with the Fed's goal of 2.0%.

Therefore, at least one more rate hike is likely to come later in July, although the odds of a follow-up move in September have all but been vanquished by the July inflation data drop. Expressing these expectations was a fall in U.S. bond yields weighed on the Dollar, offering EURUSD a route to new multi-month highs.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

"The US dollar is the weakest major currency pair on the day, but the move in EUR/USD is especially notable. As we go to press, the world’s most widely-traded currency pair is surging by more than 100 pips to break above 1.1100, its highest level in 16 months!" says Weller.

Looking at the chart, Weller notes a close near current levels would confirm the breakout and open the door for a continuation toward the March 2022 high at 1.1185.

Image courtesy of Forex.com.

"With a break through that resistance zone potentially exposing the 61.8% Fibonacci retracement of the entire 2021-2022 drop at 1.1270," he adds.

But should strength fade and EURUSD reverses back below 1.1100 by today’s close, the pair risks signalling a near-term bullish exhaustion.

This could open the door for a retracement toward previous-resistance-turned-support at 1.10 heading into next week, says Weller.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes