EURUSD Could be Set for Test of 1.08: Forex.com's Weller

- Written by: Sam Coventry

Image © Adobe Images

Matthew Weller, Global Head of Research at FOREX.com, reports that the U.S. dollar is experiencing a rise against all major rivals, including the Euro, despite the absence of significant U.S. economic data.

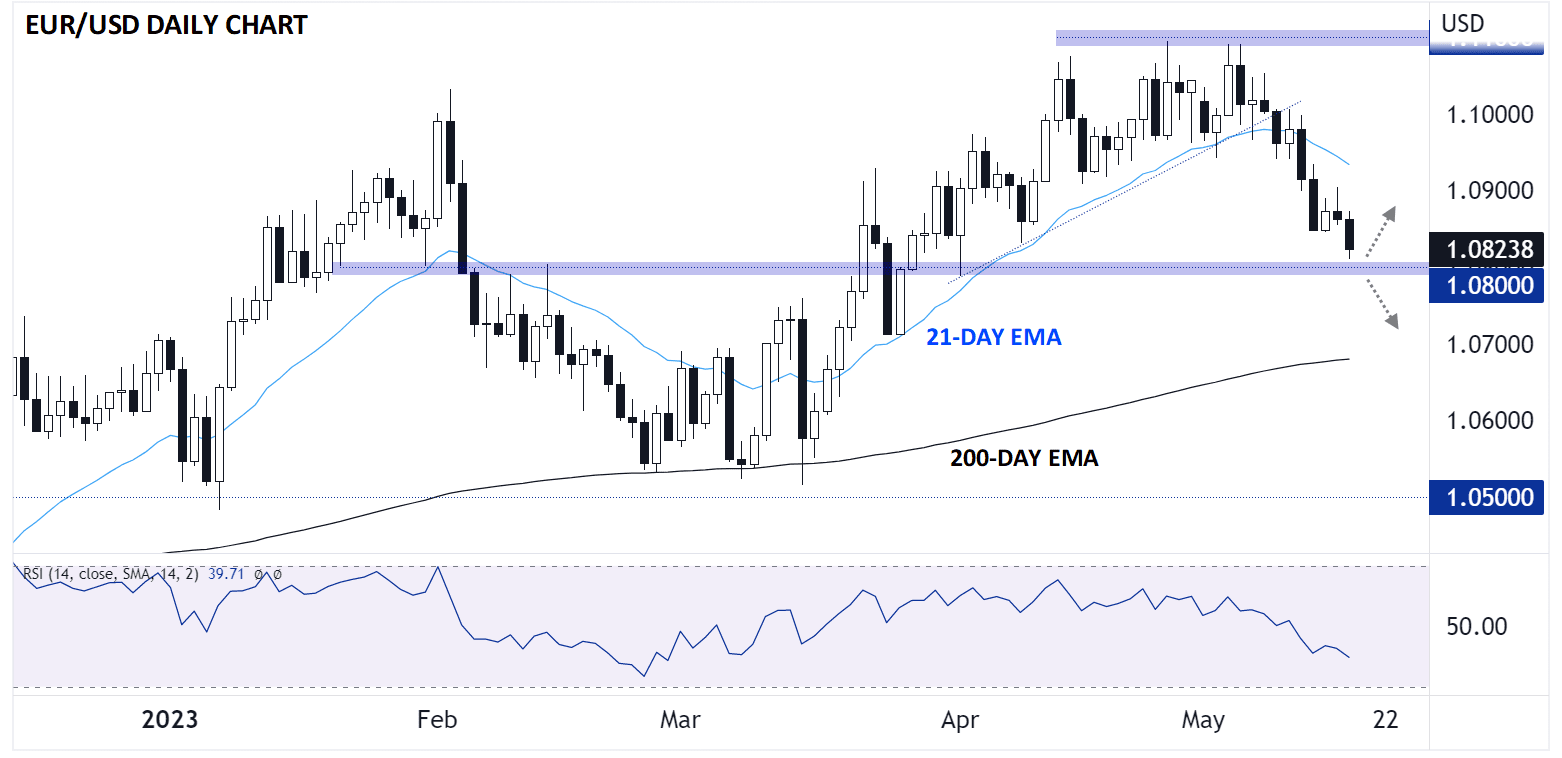

Last week, the EUR/USD pair broke down from its sideways range of 1.09-1.11, indicating a potential top.

Weller suggests that the next level of support to monitor is around 1.0800, and a breach below that could expose the 200-day EMA near 1.0700.

The call comes as the U.S. dollar demonstrates strength against major currencies, and Weller notes that technical factors are driving the market moves, rather than fundamental data.

However, a slight negative revision to the Eurozone's April CPI (0.6% m/m vs. 0.7% initially) may be contributing to the euro's weakness, he suggests.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Meanwhile, the U.S. debt ceiling debate remains unresolved, with President Biden shortening his trip through Asia to focus on reaching an agreement.

Although the meeting between President Biden and Speaker Kevin McCarthy was described as "productive and direct," there is currently no clear evidence of an imminent agreement between the two sides.

Weller reminds traders that as the world's reserve currency, the U.S. dollar may benefit in the short term from any market panic if a deal is not reached by the end of the month.

He points out that a similar scenario occurred in 2011 when the U.S. credit rating was downgraded due to a failure to promptly raise the debt ceiling.

Analyzing the EUR/USD chart, Weller emphasizes the significance of recent price action:

"After trading in a sideways range below 1.1100 in late April and early May, the currency pair broke below a near-term bullish trend line and its rising 21-day EMA, indicating a potential near-term top."

"Despite a minor bounce to around 1.0900 at the beginning of this week, the pair lost its bullish momentum and dropped to a six-week low below 1.0830," says Weller.

Looking ahead, Weller highlights that the EUR/USD is approaching a crucial level of previous resistance-turned-support at 1.0800, where bullish traders may attempt to halt the downtrend later this week. However, if that level is breached, the likelihood of further downside movement toward the 200-day EMA near 1.0700 would significantly increase.

Traders and investors will continue to monitor these developments closely, taking into account technical factors and the ongoing US debt ceiling debate as they navigate the currency markets.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes