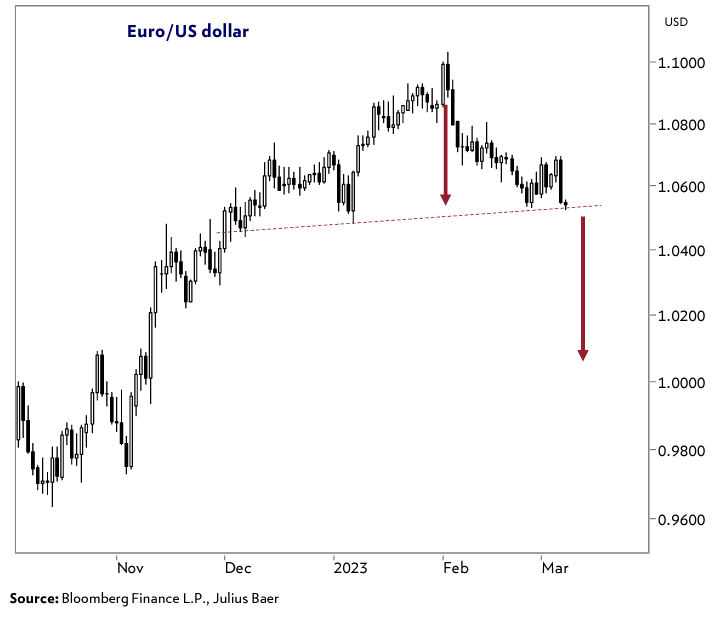

EUR/USD Could be Poised for Test of Parity: Julius Baer Technical Strategy

- Written by: Gary Howes

- EUR/USD down 4.36% from February highs

- USD rebound looking more than a mere correction

- Julius Baer shutters USD shorts

- Says EUR/USD pointed lower

Image © Adobe Images

Technical strategists at Swiss bank Julius Baer have closed all short U.S. Dollar short positions in the wake of recent price action.

Their tactical stance on the U.S. Dollar Index (DXY) is upgraded to Neutral, amidst expectations it is likely to consolidate in a tight range.

The Dollar has rallied through February and into March amidst stronger-than-expected U.S. economic data and warnings that the Federal Reserve will take interest rates to levels higher than it had previously been expecting.

The strength of the move following Federal Reserve Chair Powell's recent appearance before Congress fuelled the Dollar to early-January highs.

In response, Julius Baer's technical strategy team recommends closing all its existing currency positions, noting the fundamental shift following amidst a resurgence in the Dollar.

Closed positions include a 'long' EUR/USD trade, 'short' USD/CHF, 'short' USD/JPY and 'short' USD/SEK.

"We recommend closing all positions," says Mensur Pocinci at Julius Baer. "US dollar recovery to resume."

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes

Concerning the outlook for the Euro, further losses are likely against the Dollar, according to Pocinci's reading of the charts.

"A 'head & shoulders' top puts EUR/USD uptrend at risk close US dollar short positions," he says in a recent strategy update.

The Euro to Dollar exchange rate fell 1.22% on Wednesday as markets digested Powell's most recent guidance.

It is quoted at 1.0565 at the time of writing with further losses back towards parity now seen as possible, according to Julius Baer's technical strategists.

"The EUR/USD has seen only a minor rebound from the February lows. It has now established a possible ‘head & shoulders’ top. A decline below 1.05 would open the way back to parity," says Pocinci.

"Thus, as the risks for a decline are increasing, we downgrade the rating back to Neutral and recommend closing all short US dollar positions," he adds.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes