Euro Rallies Ahead of ECB Decision, but a Ceiling Approaches says TD Securities

- Written by: Gary Howes

"Unless Lagarde commits to a series of 50s, EURUSD has limited room to gain" - TD Securities.

Image © Adobe Images

Euro exchange rates advanced in the hours leading to Thursday's European Central Bank policy update where confirmation of a July interest rate rise will likely be forthcoming.

However gains by the Euro suggest investors are actively preparing for a more 'hawkish' outcome, i.e one that could see policy makers confirm a number of rate hikes are needed to bring inflation expectations in the Eurozone back under control.

Foreign exchange strategists at TD Securities say this enthusiasm could be mislaced as they believe the prospects of a meaningful rally in the Euro are limited as the ECB might underwhelm against increasingly hyped expectations.

"Unless Lagarde commits to a series of 50s, EURUSD has limited room to gain," says James Rossiter, Head of Global Macro Strategy at TD Securities, referencing a potential 50 basis point interest rate rise. (Set your FX rate alert here).

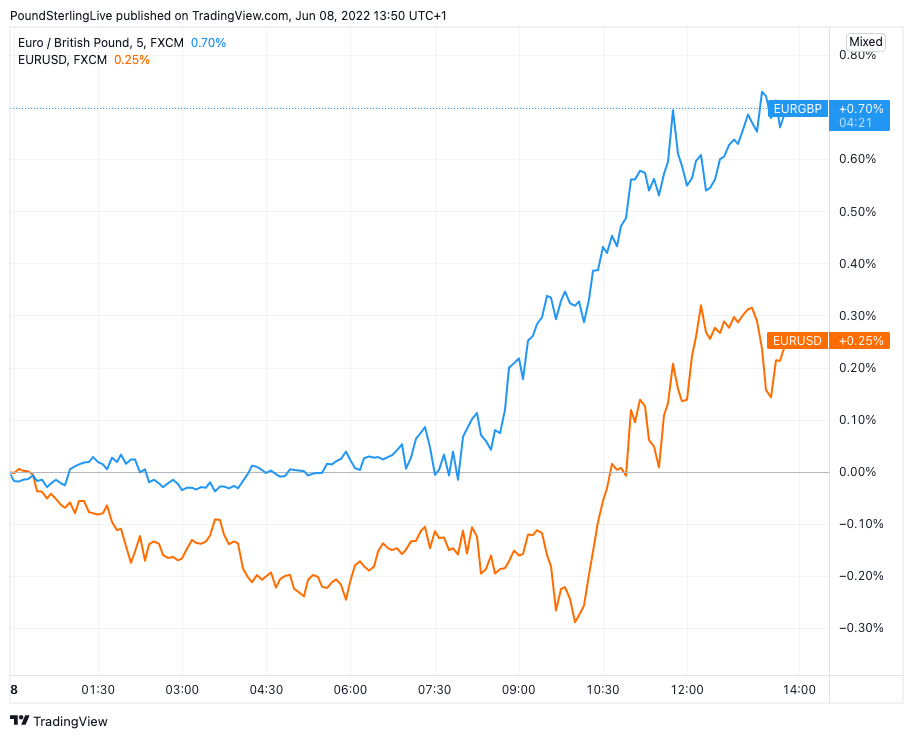

At the time of publication the Euro to Dollar exchange rate (EUR/USD) is trading a third of a percent higher at 1.0730 and the Euro to Pound exchange rate is three quarters of a percent higher at 0.8561.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

TD Securities expects the ECB to announce the end of the APP - the ECB's remaining quantitative easing programme - within weeks.

They expect President Christine Lagarde will likely acknowledge that rates will rise by 25bps at both the July and September meetings.

The ECB is also expected to underscore its determination to contain the spread between the yield paid on 'peripheral' and 'core' Eurozone bonds (for example, ensure Italian bond yields do not race higher relative to those of Germany). However details on a plan to deal with gragmentation risks are expected to be skint at this stage although reports suggest work is underway.

These expectations form the base case envisaged by TD Securities to which they apply a 70% probability.

Importantly, under this scenario they expect Lagarde to repeat the need for "gradualism" in hiking rates, pushing back on expectations for 50bps hikes.

This could disappoint Euro bulls.

Indeed, under this base case scenario TD Securities see EUR/USD falling back to 1.06.

Above: EUR rallies against the GBP and USD on June 08.

A potentially more 'hawkish' outcome that would involve the ECB confirming a 50 basis point hike is on the table is ascribed a 25% probability.

"When pressed on 50bps hikes, Lagarde says that "flexibility" means that everything is on the table, and all options will be considered in July and beyond—there's little to no pushback on 50," says Rossiter.

(We report today that analysts at Bank of America say they have updated their projections and now expect such a hawkish outcome.)

Under this scenario the Euro could rise to as high as 1.0820 according to TD Securities, a move that would likely push the Pound-Euro rate below the 1.16 level.

Brent Donnelly of Spectra Markets explains that after tomorrow’s meeting there are four meetings left this year.

"There are 135bps of hikes priced in. 135 divided by 4 is 33.8," says Donnelly.

In short, there must be a hike greater than 25 basis points to simply meet the market's expectations and anything less could spell disappointment for the Euro.

"My feeling is that tomorrow’s meeting is unlikely to lead to more hawkish pricing but could very possibly lead to less," says Donnelly.

Donnelly says the other wildcard to consider is whether the ECB can credibly signal some kind of plan to backstop the periphery with an anti-fragmentation tool. (Recall the mention of Italian vs. German spreads earlier in this report. The ECB would want to avoid the massive headache caused if Italy/Greek bond yields shot higher relative to those of France and Germany).

"I am skeptical that anything will come of this. It’s worth considering that a large rate hike with a credible anti-fragmentation tool would be massively bullish EUR but I don’t think we are anywhere close to that yet, despite this FT article last week. I am keeping the EUR short through ECB," says Donnelly.

The ECB decision is due at 12:45 BST with the press conference due at 13:30.

Compare EUR to USD Exchange Rates

Find out how much you could save on your euro to US dollar transfer

Potential saving vs high street banks:

$2,750.00

Free • No obligation • Takes 2 minutes