Euro-Dollar Week Ahead Forecast: Fed Tests Resilience as Eurozone GDP Eyed

- Written by: James Skinner

- EUR/USD supported at 1.1750 & near 1.1704

- Aided by global virus woes for other currencies

- Fed may test resilience ahead of EZ GDP data

Image © Adobe Images

- EUR/USD reference rates at publication:

- Spot: 1.1785

- Bank transfers (indicative guide): 1.1373-1.1455

- Money transfer specialist rates (indicative): 1.1679-1.1703

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

The Euro has weathered recent market turbulence better than many other currencies but may see its resilience tested again this week by the Federal Reserve (Fed), which dominates the currency market agenda ahead of Friday’s eagerly-awaited Eurozone GDP data for last quarter.

The Euro-to-Dollar exchange rate has continued to defy a bearish market by resisting the gravitational pull of levels much below the recently ceded 1.18 handle, despite a testing international environment and a buoyant Dollar.

Europe’s single currency has remained elevated even as others have come under pressure amid concerns about the impact that new variants of the coronavirus could have on economies around the world.

“Correlations with other G10 currencies are all falling. Until today, EUR had remained close to the 1.1800 level,” says Lee Hardman, a currency analyst at MUFG in a Friday note

“We expect the EUR to continue grinding lower against the USD encouraged by further Fed discussions over QE tapering at the upcoming FOMC meeting,” Hardman adds.

Hardman and the MUFG team noted last Friday that the Euro’s correlation with other major currencies has been falling and observed that it has recently traded like “a pegged currency.”

One factor which could potentially explain a part of this is the Euro’s popularity as a “funding currency,” which saw it sold in exchange for the likes of the Pound, Australian, New Zealand and Canadian Dollars among others throughout the year-to-date.

Above: Euro-to-Dollar rate shown at daily intervals.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

This is because for investors to close earlier wagers on the above referenced currencies they have to buy back the Euro.

However, with this “funding currency” role being connected to the Eurozone’s low interest rates, there is a flip side to it that could make the single currency vulnerable again this week in the event of any suggestions from the Fed that it’s moving closer to ending its emergency support for the U.S. economy.

Such suggestions or anything more explicit could be the difference between whether the Euro-to-Dollar rate ends the week back above the 1.18 level or down near 1.1700.

“The marginal new low has again not been confirmed by the daily RSI and we suspect we will see a corrective rebound into the 1.1860/1.1930 band. Below 1.1750 attention will revert to the September, November and March lows at 1.1704/1.1600,” says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

The Fed indicated in June and markets have since speculated heavily that it could soon announce plans for the end of its quantitative easing programme.

Rate setters at the bank also indicated they could raise borrowing costs sooner than was previously guided for due to a better-than-expected performance from the American economy and higher-than-expected inflation.

“The main message from Fed Chair Powell’s post-meeting press conference should be consistent with his testimony before Congress in mid-July when he signaled no rush for tapering as “substantial further progress is still a ways off”. However, he will clearly remind market participants that the taper countdown has officially begun,” says Kevin Cummins, chief U.S. economist at Natwest Markets.

Wednesday’s decision is the highlight event of the week for the global currency market but on Friday attention will turn back to the Eurozone economy, which has recently become a more supportive influence on the Euro.

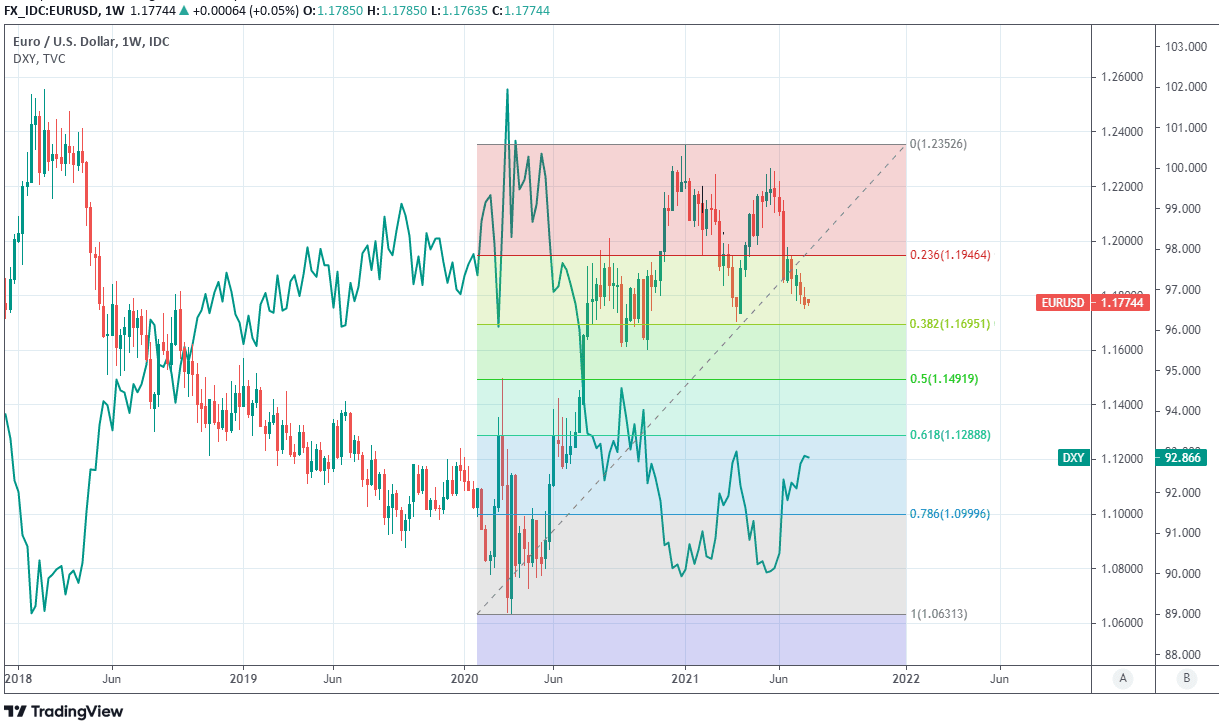

Above: Euro-to-Dollar exchange rate shown at weekly intervals with Fibonacci retracements of 2020 recovery indicating possible supports and U.S. Dollar Index.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

“Hopes for much stronger growth in 3Q are under a little pressure, however, as the Delta variant hits confidence,” says Chris Turner, global head of markets and CEE regional head of research at ING.

“In all, we see EUR/USD staying soft this week, with an upward adjustment in US money market rates likely pressuring EUR/USD towards major support at 1.1700,” Turner adds.

GDP data for the three months to the end of June is expected to confirm on Friday that Europe’s economy exited recession and turned a corner last quarter, while IHS Markit reports of activity in the manufacturing and services sectors suggested last week that the recovery may have gathered momentum in July.

Consensus looks for the economy to have grown at a quarter-on-quarter pace of 1.5%, reversing its -0.3% contraction from the opening months of the year, although some economists look for a stronger number.

“We expect euro-area GDP to have grown 1.7% q/q in Q2 after contracting 0.3% in Q1. Manufacturing and services PMIs both remain elevated, while hard data releases point to a mixed recovery – euro-area retail sales have recovered to pre-pandemic levels, but industrial production remains subdued due to prolonged supply-chain disruptions,” says Christopher Graham, a Europe economist at Standard Chartered.

“We expect the pick-up in economic activity to strengthen in Q3, as indicated by recent high-frequency data,” Graham adds.