Euro-Dollar Breakout Puts 2021 Highs in Crosshairs

- Written by: James Skinner

- EUR/USD tests Feb highs and eyes 2021 peak

- As EU economies reopen, yields rise, USD falls

- But Fed minutes loom, U.S. yields also advance

- EUR/USD reference rates at publication:

- Spot: 1.2214

- Bank transfers (indicative guide): 1.1780-1.1860

- Money transfer specialist rates (indicative): 1.2099-1.2124

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

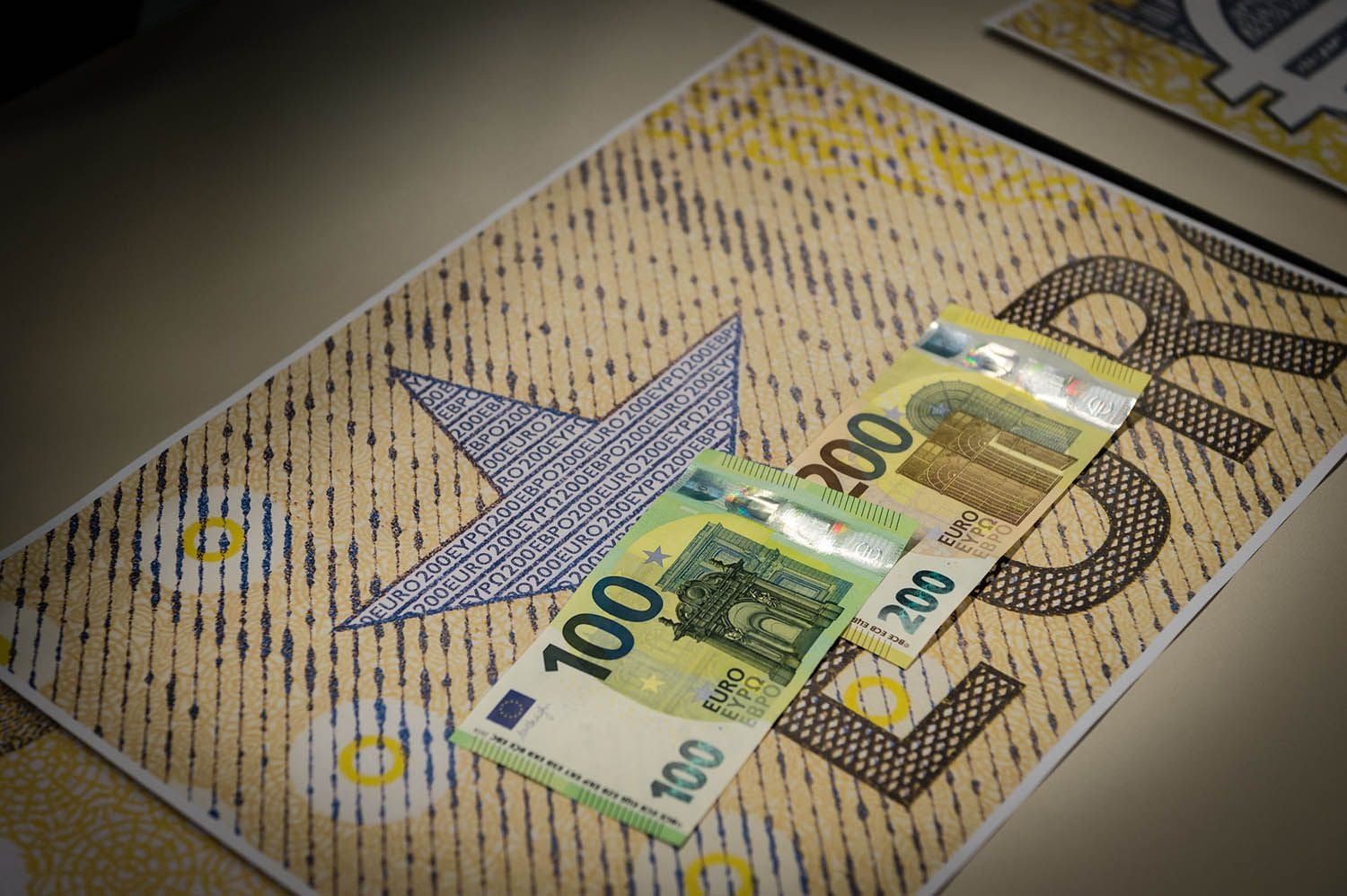

The Euro-Dollar exchange rate came close to turning a page on months of declines and lacklustre performance on Tuesday when it attempted to overcome February 2021 highs on the charts, above which the single currency would then have its year-to-date peak of 1.2349 in the crosshairs.

Europe’s single currency advanced broadly on Tuesday but clocked up its strongest gain over a retreating U.S. Dollar, which saw widespread declines against all majors, with EUR/USD climbing above 1.22 for the first time since late February.

Euro-Dollar was inches away from 1.2240 and its highest since February 25, almost turning the page on a period in which it fell as low as 1.17 by the earliest days of April when vaccine procurement troubles and a third wave of infections were inciting fears that the continent would be left behind in this year’s anticipated economic recovery.

“This is regarded as the last defence for 1.2349, the 2021 high,” says Karen Jones, head of technical analysis for currencies, commodities and bonds at Commerzbank, who’s a one-to-three week target of 1.2349 and a three-to-six month forecast of 1.2619.

As it happens the backdrop to the Euro’s Tuesday rally was one that saw major continental economies taking their first steps in the reopening process alongside the UK, which has been among the fastest in the world rolling out coronavirus vaccinations, suggesting much less if any scope at all for other economies to pull ahead of Europe’s.

Above: Euro-Dollar rate shown at daily intervals.

Some in the analyst community were also speculating on Tuesday that the European Central Bank (ECB) could be set to announce some form of reduction to the amount of European government bonds it buys under the bank’s pandemic-inspired quantitative easing programme as part of its June policy decision.

“There is a reasonable case to suggest that the FX market will be pricing this in on the run up to the June meeting, meaning the Euro may stay supported against the Dollar,” says Joe Tuckey, an analyst at Argentex.

Tapering expectations may have been responsible for recent and ongoing increases in Eurozone bond yields, which could in turn have played a role in lifting the Euro this week.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

Tuckey said on Tuesday that this could help deliver a “clear break above 1.2170” which would then be likely to draw fresh buying of the Euro while Commerzbank’s Jones says a daily close above 1.2240 would open a door for the single currency to then begin taking a look at January highs around 1.2349.

“Higher inflation is only US dollar positive if it prompts the Fed to bring forward monetary tightening plans and lifts US yields. But those initial hopes have been dampened for now by the dovish response from Fed officials in recent days,” says Lee Hardman, a currency analyst at MUFG.

Much depends however on the trajectory of the Dollar and price action in the U.S. government bond market over the coming days as American bond yields have developed a habit this year of pulling the rug from under risky currencies.

Above: Euro-Dollar rate shown at daily intervals alongside 10-year German and U.S. government bond yields.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

As a result, Wednesday’s release of minutes from the latest Federal Reserve (Fed) meeting will likely be key to the evolution of price action through the rest of the week.

“The combination of still loose Fed policy and higher US inflation leaves the US dollar vulnerable to further weakness in the near-term,” Hardman says.

The Dollar surged and many other currencies declined last week after U.S. inflation surprised sharply on the upside of economists’ expectations when it rose to an annualised 4.2% for April, which was more than twice the Fed’s target level.

However, the U.S. central bank has made clear in recent months that this kind of above-target price growth is exactly what it’s attempting to generate with the ultra easy monetary policy that has seen it cut interest rates back near to zero and buy around $120bn of U.S. government bonds each month.

Above: Euro-Dollar rate shown at weekly intervals alongside U.S. Dollar Index.

“This is a more challenging phase for markets, including the prospect of more strong inflation prints and commodity price corrections will leave risk appetite unsettled, creating periodic bouts of USD upside. But the Fed is likely to stick to their “transitory” guns, so sustained USD upside will be tough to come by,” says Richard Franulovich, head of FX strategy at Westpac.

In addition, rate setters at the Fed have continued to stress in their regular speeches on various topics that repairs being carried out on the U.S. job market are nowhere near making the “substantial further progress” necessary for them to think about even discussing potential future changes to their Dollar-negative policy settings.

It was thought that the U.S. economy created or recovered from the coronavirus just shy of a million jobs in March but that number was revised lower to just more than three quarters of a million this month.

This was at the same time as the Bureau of Labor Statistics said the economy had created only 266k jobs in April, which came as a disappointment to a currency market that had been looking for another 900k+ addition to non-farm payrolls employment last month.

“Vice Chair Clarida said “we have not made substantial further progress" on the Fed's goals for employment and inflation (a necessary requirement for tapering), and he (again) added “we will certainly give advanced warning before scaling back those purchases”. Clarida continued to downplay the spike in the April CPI report by saying upward pressures on inflation are likely to be "transitory" due to mismatches between supply and demand as the economy reopens,” says Kevin Cummins, chief U.S. economist at Natwest Markets.