Techs: EUR/USD Pull-Back Unlikely to Last

Image © Adobe Images

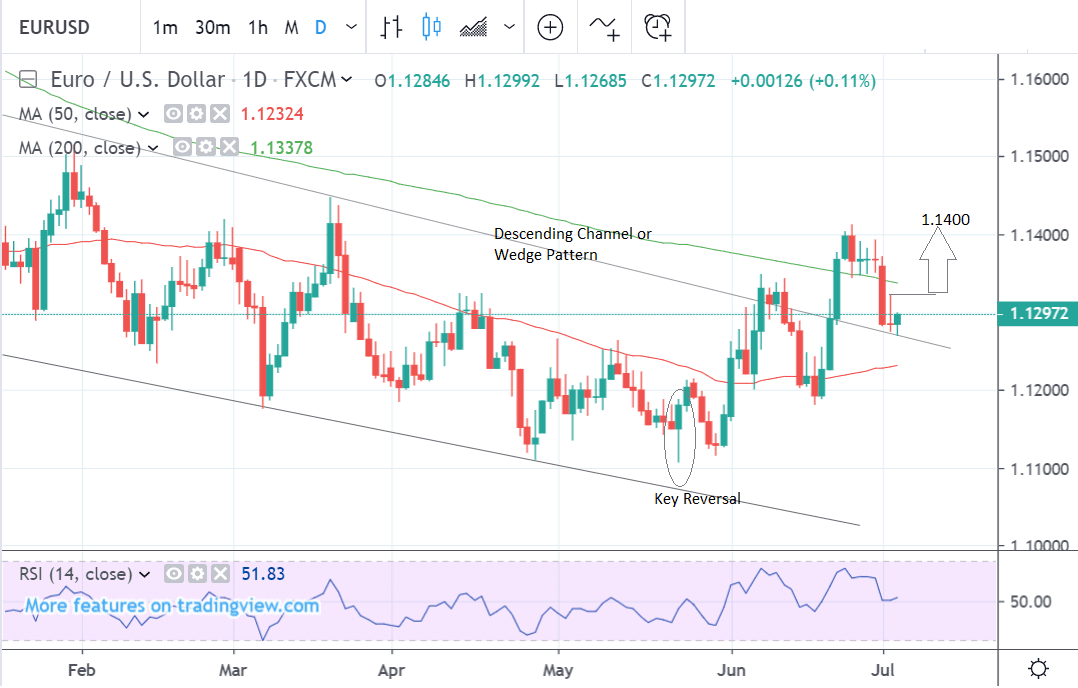

- EUR/USD has weakened and fallen to key level

- Likely to use the current support to recover

- Channel breakout a key bullish sign

The weakening of the Euro after the G20 Summit, and subsequent announcement of Christine Lagarde as the next President of the European Central Bank (ECB), is unlikely to extend suggest the charts.

The Euro fell after the G20 as improved investor sentiment reduced safe-haven flows, a dynamic that has been supportive of the Euro of late, then Lagarde’s appointment further pressured the currency as she is seen as a monetary policy 'dove' who will maintain the ECB's current run of ultra-easy monetary policy which has supressed the currency's value.

The EUR/USD is currently quoted at 1.1290, but had been as high as 1.1412 last week.

The good news for Euro 'bulls', however, is that the weakness is probably just passing. Charts indicate compelling technical evidence that the uptrend will probably resume.

The pair recently broke out from the confines of its descending channel and this was a very bullish sign.

This also came after a ‘key reversal’ in May. This is when the market falls to a new historic low, reverses and then closes higher than the previous high - all in the space of 24 hours. It is seen as signaling a long-term bottom.

Since the breakout, the pair has also fallen back down and found support at the upper channel line of the former descending channel - another classic feature following a major breakout. Such ‘throwbacks’ as they are known, commonly precede a resumption of the trend higher.

We, therefore, forecast a move up to 1.1400 over the next few weeks conditional on a break above Monday’s high at 1.1322. But the pair could go even higher after that.

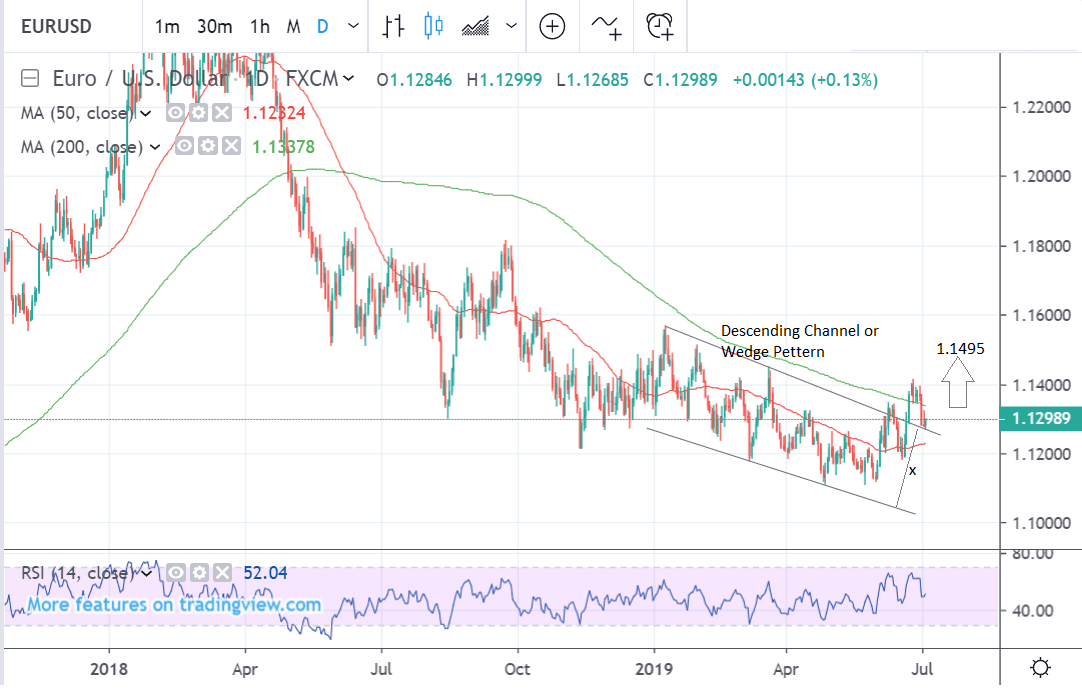

A broader historical view of the exchange rate shows signs the pair may be putting in a major bottom. The descending channel seen at a distance could also be a ‘bullish wedge’ pattern which often punctuate downtrends.

The breakout after wedges have completed is often quite powerful and volatile. An initial target can be generated by taking the height of the channel, labeled ‘x’, and extrapolating it higher by 61.8%. This provides a conservative upside target for the breakout. In this case it indicates a target at 1.1495.

Since the pair has not yet reached that target we see a good chance of it continuing higher. The probability remains high that the pair will meet it eventually, further suggesting a recovery is on the cards.

Time to move your money? Get 3-5% more currency than your bank would offer by using the services of foreign exchange specialists at RationalFX. A specialist broker can deliver you an exchange rate closer to the real market rate, thereby saving you substantial quantities of currency. Find out more here.

* Advertisement