When the British Pound and Euro Break their Familiar Range, Expect Aggressive Price Moves say Lloyds

- Lloyds Bank expect Sterling to remain rangebound, but are wary that a big break is coming

- GBP/EUR market "is engaging in self-fulfilling prophetic behaviour"

- "When the range breaks, there is a significant risk of price action trending aggressively"

Image © Rawpixel.com, Adobe Images

Pound Sterling retains a weak tenor against the Euro heading into the mid-week session with 1 GBP buying 1.337 EUR, this represents the lowest exchange rate in ten days.

Yet, at 1.1337, the GBP/EUR is well within the bounds of familiar levels as the exchange rate continues to trade a six-month range that is identified as being close to the narrowest in its history, therefore many in the market will soon start positioning for a return higher, with 1.14 being the initial target.

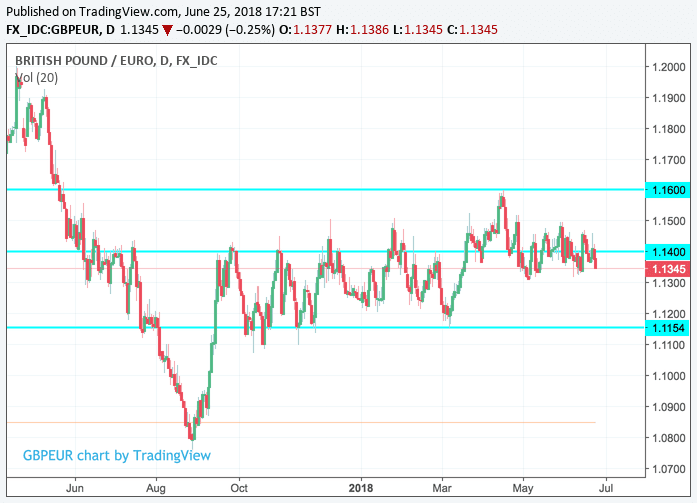

The 2018 range can be defined by a number of levels, depending on who you ask, but it's safe to say it can be defined as broadly lying between 1.16 at the top and 1.1150 at the bottom:

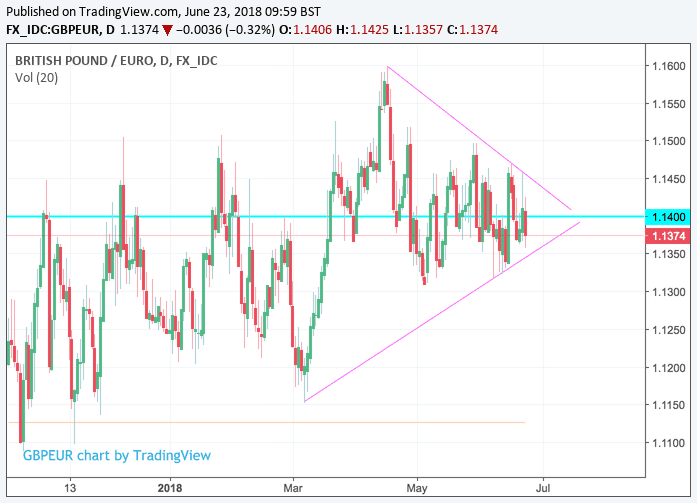

And more recently the exchange rate has narrowed further to centre around a pivot loosely situated at 1.14:

All the more remarkable, the range comes despite ongoing angst concerning what the final Brexit deal will look like and despite periodic political jitters coming out of the Eurozone; one would expect such political uncertainties on either side of the channel to really shake the market in favour of one currency or the other.

Over the past six months we have had concerns over the shape of the new regime in Italy, a change of guard in Spain and more recently uncertainty as to the longevity of Angela Merkel's ruling coalition.

Concerning Brexit, the pace of negotiations remain frustratingly slow and the market remains subject to spasms of doubt that a final deal is achievable, for example owing to the seemingly unsolvable contradictions presented by the Irish border. And then there are concerns that the Prime Minister's tenure at the top will be short-lived owing to her waifer-thin majority in parliament that often appears susceptible to her own party's disagreements as to what Brexit should look like.

Distill all of the above into the Pound-to-Euro exchange rate and is it actually any wonder the pair is going hideaways? "There is a high degree of uncertainty surrounding key binary-type event risk (Brexit), reducing the medium-term directional conviction among corporate and institutional participants. This phenomenon is also well observed in analysts’ sentiment," says Gajan Mahadevan, a Quantitative Strategist at Lloyds Bank.

Mahadevan is also of the opinion that "the market, to an extent, is engaging in self-fulfilling prophetic behaviour" thanks to "strong technical support and resistance regions combined with historically low volatility".

This in turn drives expectations that price action will remain subdued, and "creates a feedback loop that increases the market’s confidence that range parameters will hold."

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Don't be Complacent, this Could Still be a Risky Bet

At present the highest probability outcome over coming days and weeks is that the range holds and the GBP/EUR exchange rate maintains levels we are all familiar with. We saw an host of strategists make directional calls on Sterling-Euro around the time of the Bank of England's June policy event, based on the assumption that the ongoing range will continue to hold and GBP/EUR is therefore a safe bet.

But, there is a risk to such complacency we are told.

"The current climate raises the question can a currency, contained within a range, still be risky?" asks Mahadevan. "In short, yes" is his answer.

"Currently, risks to the GBP/EUR appear to be roughly offsetting, but that may not remain the case. The fact that these drivers could converge at any point in time, to either support EUR or GBP, means we must remain constantly vigilant, especially as the tendency following a break of an entrenched range is for a marked price move," adds the analyst.

And, we are told, when the Pound or Euro break out of their current quagmire, there could be notable moves in store and a strong directional move, either higher or lower in GBP/EUR.

"The psychology behind the current range environment is firmly entrenched, as evidenced by the strong technical support and resistance regions and low levels of volatility. Yet, history suggests when the range breaks, there is a significant risk of price action trending aggressively (as was the case following prolonged ranges in 2006/07 and 2013/14)," says Mahadevan.

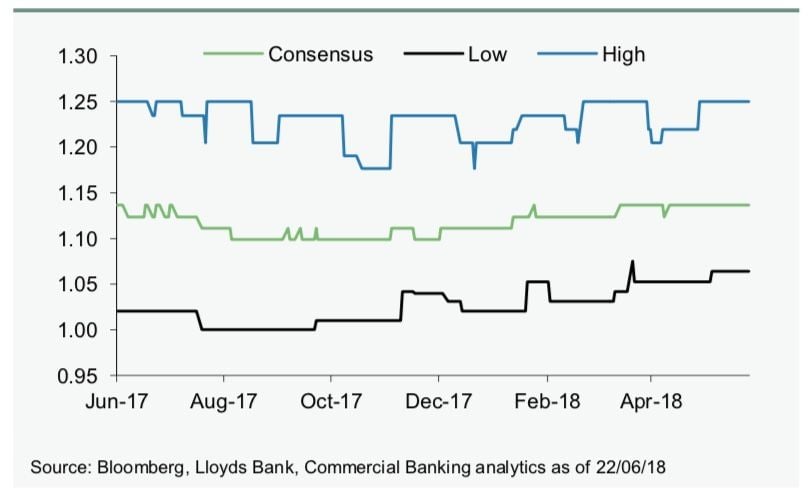

Indeed, a look at consensus forecasts for the exchange rate suggests GBP/EUR will end the year at 1.14, the 18% difference between the most bullish (1.25) and most bearish (1.06) forecast highlighting a sizeable degree of uncertainty.

So, with warnings to market participants to stay wary of a break in the GBP/EUR exchange rate, either or lower, where do Lloyds see the exchange rate going?

"Risks remain balanced for now. As a result, we continue to forecast the range in GBP/EUR holding – expecting 1.10 at end-2018 and 1.09 at end-2019," says Mahadeva.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.