Euro Sell-Off Allows British Pound Welcome Support

- GBP/EUR exchange rate hits this month's best in mid-week trade

- Falling EUR/USD offers the Pound a bid

- But Pound's vs. Euro gains could be temporary warn Rabobank citing elevated domestic political risks

The Pound-to-Euro exchange rate is looking better supported this week and has today recorded a monthly best at 1.1428 thanks largely to a broad-based sell-off in the Euro, at the time of writing the pair is at 1.1415. A look at the retail market shows banks are offering rates in the 1.11 area, while competitive specialists are offering rates in the 1.1320 region.

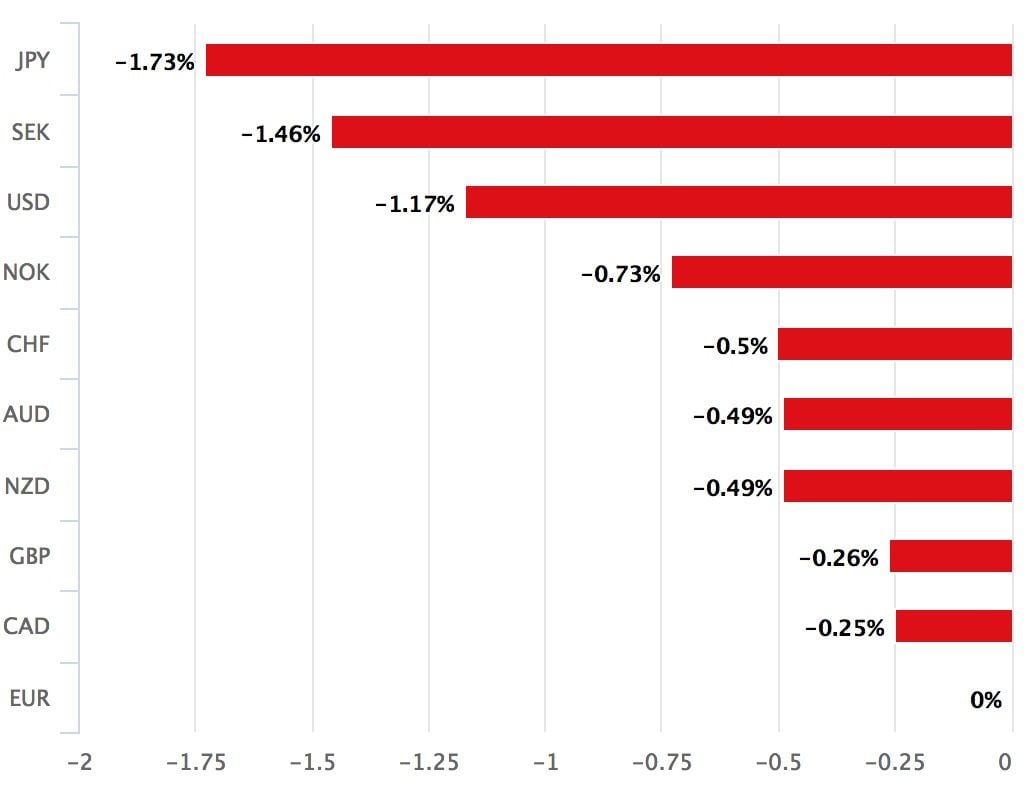

The Euro's woes are piling up with the single-currency being the worst-performer of the past trading week:

Above: The Euro's performance against a host of major currencies over the course of the past five trading days.

Why is the Euro under pressure? It appears that markets are taking a cue from the EUR/USD exchange rate which is breaking down in a notable way, falling to fresh 2018 lows at 1.1851.

This breakdown is sucking a host of other EUR pairs into its vortex, EUR/GBP included. This has allowed a struggling Sterling some respite ahead of a key make-or-break Bank of England event later in the week. "EUR/GBP jumped to the 0.8810 area. Later in the session, overall Euro weakness reversed this EUR/GBP up-tick," says Piet Lammens, an analyst with KBC Markets.

Above: A one-way ticket for the EUR/USD is hampering the broader Euro exchange rate complex.

Readers of Pound Sterling Live won't be surprised by this action; we reported on Friday, May 4 that "a stuttering Euro would offer Pound Sterling a reprieve" eyeing a host of reasons to believe the Euro was entering a difficult period. Issues at play include expectations that the European Central Bank was unlikely to offer Euro-bulls anything meaty to bite into in the near-term as far as policy goes.

This view is in turn based on the observation that the Eurozone's data pulse is slowing with a slew of economic growth data disappointing against economist expectations.

"The ECB's argument of 'solid growth and thus medium term price increases' is crumbling slightly" says Antje Praefcke at Commerzbank, "the Q1 GDP data for the Eurozone illustrated that growth momentum is easing slightly."

Inflation data for April also missed expectations, failing to provide "a valid argument supporting the Euro bulls either," notes Praefcke, adding, "the disagreements surrounding the EU budget on the other hand make it clear to us that there are still major differences within the EU, and that the europhoria following the election of President Emmanuel Macron was exaggerated. In other words: I see no convincing reasons supporting the Euro at present."

While the Euro is clearly on the back-foot, we would urge against over-enthusiasm by those yearning for a stronger GBP/EUR exchange rate at this juncture - the market has a few hurdles lined up which might trip any recoveries before Sterling really hits a stride.

"While the Pound is likely to be highly sensitive to the tone of economic data going forward, we would expect political uncertainly to cast a long shadow," warns Jane Foley, strategist with Rabobank in Amsterdam. Foley notes the struggles Prime Minister Theresa May is suffering regarding pushing her preferred post-Brexit customs partnership plan through Cabinet.

Senior Conservative and key Brexit enthusiast Boris Johnson effectively rubbished the plans on Tuesday May 8 highlighting the deep tensions and sheer difficulty inherent in the Brexit project. Johnson said a customs partnership scheme would not see the UK "taking back control" of its trade policy, laws, borders or money after Brexit, raising suggestions he could resign from Government if his objections are ignored.

The Government is still yet to decide between two options on future customs arrangements with the EU, which continue to split May's key allies. The customs partnership scheme, believed to be favoured by May and Chancellor Philip Hammond, would see the UK collect EU tariffs for goods coming into Britain on behalf of Brussels.

"The PM must thus go back to the drawing board in an attempt to reach a solution with the EU that is acceptable to all and avoids a hard border in Ireland. This is a high risk game for all concerned. The EU as well as the UK potentially has a lot to lose if a post Brexit trade deal cannot be reached," warns Foley.

For Foley, the Pound's outlook is troubled near-term, while longer-term a recovery is envisioned.

"It remains our house view that the bones of a UK/EU free trade agreement will be on the table before the start of Brexit in March 2019. For this reason we are forecasting a stronger Pound on a 12 month view. That said, this is a very short timeframe to hammer out an agreement on trade and we expect political uncertainty to push EUR/USD to the 0.89 level in the coming months," says the analyst.

EUR/GBP at 0.89 gives a Pound-to-Euro exchange rate at 1.1236.

In 12 months Rabobank forecast EUR/GBP at 0.84, giving a GBP/EUR target at 1.19.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.