The Pound Enters the 'Buy Zone' Against the Euro

- GBP/EUR pulls back into a potential 'buy zone'

- Formation of bullish candlestick pattern to give 'green-light'

- Next target at or just below range highs (1.1525-50)

© Savo Ilic, Adobe Stock

The Pound-to-Euro exchange rate rose up and peaked at 1.1525 on Thursday, just below the range highs following the Bank of England (BOE) rate meeting, at which talk of higher interest rates led to a spike in the Pound.

The spike was rejected at 1.1525, however, and GBP/EUR has since fallen back down to the 1.1430/40s.

The four-hour chart below shows the long 'rejection' candle (circled) and the subsequent pullback.

The pull-back is only expected to be temporary before the more dominant short-trend uptrend resumes.

In addition, the current level could be the ideal place for investors to get in and join the uptrend, for two main reasons.

Firstly, a level called the R1 monthly pivot is at 1.1430, which is situated just below the current market level, and it is expected to put a floor on further downside.

Pivots are price levels used by professional traders to gauge the trend and as points of reference and as entry points for buy and sell orders.

When the price touches a pivot it often bounces back up (in a downtrend) and this effect is exacerbated by short-term technical traders betting on the bounce and thus adding further to the buying pressure.

This means the exchange rate is likely to find extra support at the current level making it more likely to attract buyers, reverse and start going higher again.

Secondly, the pair is trading in between the 10 and 20 period moving averages (MAs) which is traditionally seen as a 'buy zone' as according to some trading instructors (such as tradewithprecision.com) it is a high probability zone to buy the asset at an optimum price and join the dominant trend.

The reliability of the 'buyzone' depends on how strong the trend is, and in this case, the trend is robust on the short-term but not in the long-term charts, so we advise a little caution should still be exercised.

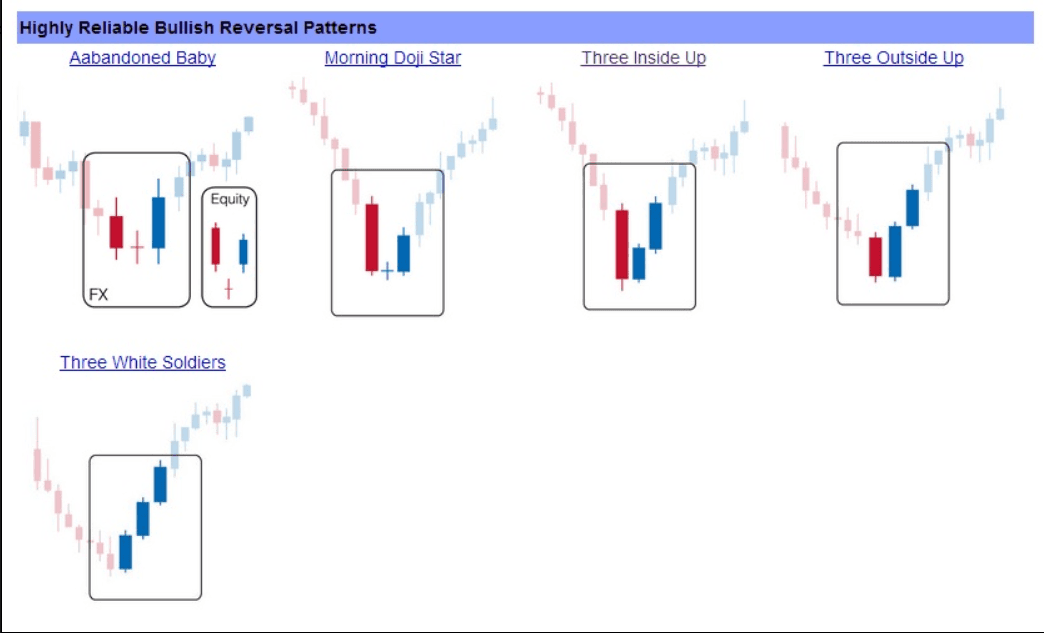

The formation of a bullish reversal candle in the buy zone would be a necessary confirmation for a buy signal, such as one of those featured in the images below.

(Images courtesy of the Forex Pips Centre blog)

The target for the subsequent upmove would be 1.1525 and then the 1.1550 range highs/upper channel line.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

Glass Cieling

The range highs at 1.1550 will continue to present an obstacle to the exchange rate as it forms the upper limit of a band that has been in place for six months now (see pic below).

The cieling of the range, therefore, will probably reject the exchange rateas it has done on multiple occasions in the past (circled in red above).

There is also a possibility the pair could break out of the range altogether, but, for confirmation we would ideally need to see a break clearly above the range highs.

Another monthly pivot, R2, is at 1.1581, however, not far above the range ceiling which is likely to be a further obstacle to the trend and so we would also wish to see a clearance above R2 before expecting further upside.

Such a break would be confirmed by a move above 1.1620, which would eventually probably lead to an extension to the next target at 1.1770, which is the minimum price objective calculated using the traditional technical method for forecasting breakouts, which is to take the golden ratio (0.618) of the height of the range, and extrapolate it higher from the break.

On balance, we see a greater overall chance of an upside breakout of the range eventually, than a downside breakour for reasons outlined in our last article on the pair here.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.