Pound-to-Euro Forecast Update: One Target Met, but Breakout Remains Elusive

GBP/EUR has rallied up to - but failed to breach - our forecast target at 1.15. However, the Pound can still break higher we believe.

Pound Sterling advanced 0.5% against the Euro over the course of the past week, but the gains could have been greater had it closed near the week's highs at €1.1507.

Our technical studies made ahead of the week suggested that there was a good chance GBP/EUR hits our initial target at 1.15 which was duly met. Beyond here, was our next target at 1.1600, but the ECB meeting led to a strengthening of the Euro versus the Pound which ultimately saw Sterling pare its gains and put its advance on hold.

We did warn that the ECB meeting would prove to be a make-or-break moment for this exchange rate's rally, and so it was.

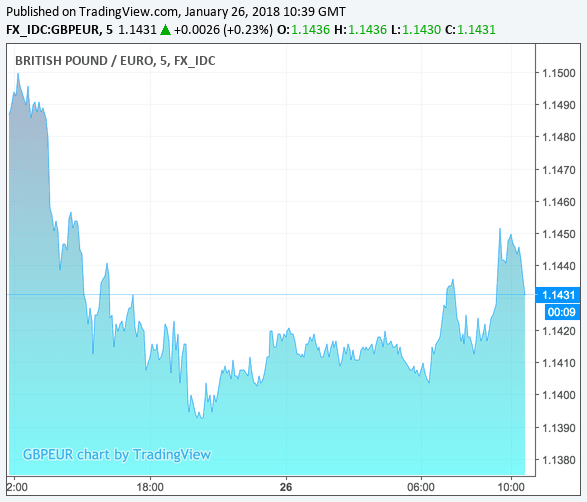

As a consequence, the GBP/EUR rate has fallen back down into the range (circled on the chart below).

The pull-back from the range highs may or may not be temporary, it is too early to say.

Until it moves lower we retain our overall bullish outlook and continue to hold the view that a break above the December 8 highs at 1.1510 would lead to a continuation higher to the upside target at 1.1600, where the R2 chart level is likely to present an interim obstacle to further growth.

The fact the range is composed of five distinct waves, labeled a-e, and that ranges normally have a maximum of five waves suggests it is now complete and increases the chances of an upside breakout eventually developing.

The R2 is a monthly pivot - a level used by traders to ascertain the trend and directly as a location for making trades, often in the opposite direction to the trend in anticipation of temporary weakness at that level caused by increased supply.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.

UK Economic Growth Defies Gloomy Warnings

Pound Sterling has caught a bid on Friday, January 26 on data showing the UK economy grew at a robust pace in the final quarter of 2017.

The ONS have released GDP data that shows the UK economy grew 0.5% in the final quarter of 2017; ahead of analyst forecasts for growth of 0.4% in the quarter.

Year-on-year GDP growth read at 1.5%, better than the 1.4% that was forecast by analysts. Growth for 2017 stands at 1.8%.

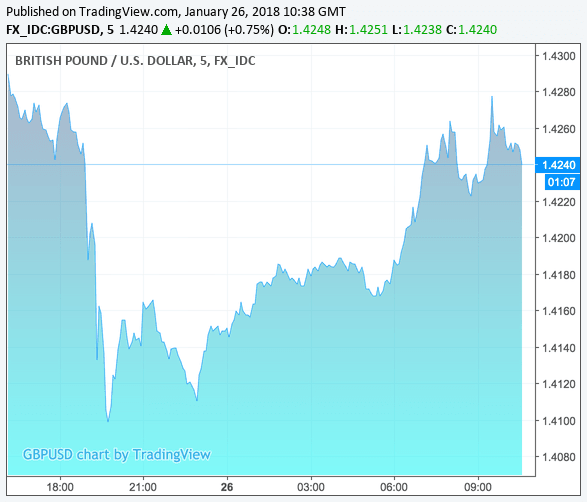

The Pound immediately went higher on the release with the Pound-to-Euro exchange rate rising up to 1.1449 having opened the day at 1.1417. The Pound-to-Dollar exchange rate leapt 0.77% to hit 1.4258 having opened the day down at 1.4150.

"The general lower Dollar theme remains intact and in play across the board into London market trade with the Pound benefiting. GDP numbers are giving another push for the Pound-Dollar," says Neil Jones, an analyst with Mizuho Bank Ltd.

Above: Sterling has recovered overnight falls against the Dollar and Euro on the back of the better-than-expected data.

The preliminary estimate of fourth-quarter GDP revealed that the economy picked up pace in the final three months of 2017 confirming the UK put in a better show than many economists had been anticipating.

Growth for the year as a whole stands at 1.8%, barely lower than 2016’s 1.9% outturn.

"Note too this was almost four times as strong as the post-referendum consensus prediction," notes Paul Hollingsworth, UK economist with Capital Economics. "What’s more, growth would have been a touch stronger if it weren’t for the closure of the Forties oil pipeline in December, which knocked off 0.05pp off GDP growth in Q4."

The data has done enough for now to keep the pro-Sterling sentiment on global foreign exchange markets alive. Could next week see the GBP/EUR finally crack on higher?

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.