Pound-to-Euro Exchange Rate Week-Ahead Technical Forecast, Data and Events

Technical studies confirm Pound Sterling is liable to appreciate further against the Euro over coming days while markets will remain fixated on Brexit negotiation process and the release of service sector PMI data on Tuesday .

The British Pound rose against the Euro during November; gains were small but they were gains nevertheless and an improved momentum in the exchange rate seen over previous weeks leaves the charts looking slightly more bullish.

To put this into context however, when we say "bullish" we mean the exchange rate is moving higher but within the confines of well-trodden territory - the GBP/EUR appears to be stuck in a sideways-orientated rut.

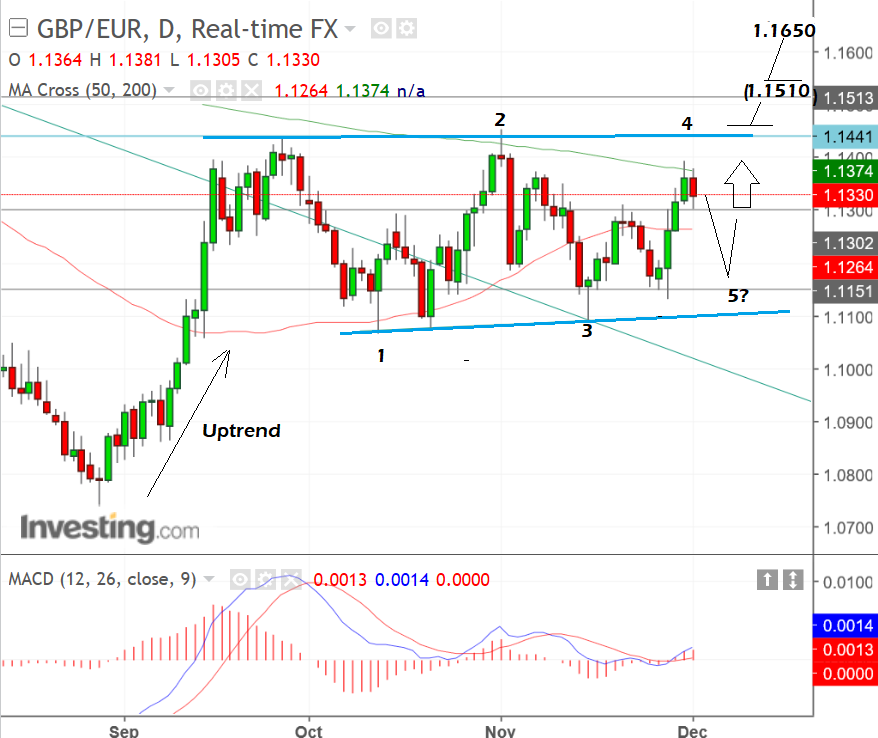

The chunk of price action we are referring to is that which has taken place since the late September highs, between the two turquoise lines in the chart below:

These sorts of ranges appear on charts all the time and represent indecision or a wait-and-see approach being adopted by traders. Basically, no-one can decide which way the currency pair will go and this is understandable considering the all-important decisions regarding Brexit negotiations that will be made this month.

We believe a decision on moving talks forward - or not - has the ability to move the exchange rate out of the range. However, until then we are left eyeing moves within these confines.

Technical lore has it that ranges normally breakout in the same direction as the trend which preceded their formation.

In this case, the trend was up, so the range is expected to breakout higher - continuing that trend.

The look and feel of the chart also recommend this: it just somehow would not 'look right' if the pair broke out lower.

The range is probably close to completion now, which also means a breakout is probably also close at hand.

Normally consolidations have five constituent waves and this one has formed four so far, so there may be one more move down within the range before the breakout happens.

Breakout confirmation would come from a break above the 1.1454 highs.

The first target is at 1.1650 which is based on the height of the range extrapolated by 61.8% higher.

The 61.8% is related to the 'golden ratio' - an ancient mathematical constant which dictates proportions in nature and finance.

The fact the R1 monthly pivot is situated at 1.1665 also informs our target, as it is likely to act as an obstacle to further upside, due to more sellers entering the market at that point, anticipating a pull-back and wishing to capitalize on it.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Data and Events for the Pound

The main fundamental drivers dictating price action at the moment are political in nature and focused on the twin concerns of how Brexit talks are going, and how stable the government is, and this is likely to continue in the week ahead.

The Pound rose last week on news the deadlock in Brexit negotiations is close to being broken, and the two sides were close to agreeing on a divorce bill, the Irish border and citizen rights. Should this be confirmed at the mid-month European Council meeting of E.U. leaders talks will be allowed to move onto the more important subject of trade.

Yet, ultimately nothing has been confirmed and the Pound has risen on hearsay alone so there are risks of disappointment.

There is a possibility more concrete confirmation may be forthcoming in the week ahead when Theresa May visits Brussels to talk 'turkey'.

"Next week, May heads to Brussels to meet with Jean-Claude Juncker and this is her first opportunity to provide the U.K.'s divorce bill offer and to talk about their plans for the Irish border. Then on December 6th, EU ambassadors resume preparations for the summit," says BK Asset Management Managing Director and forex guru Kathy Lien.

The other main political driver impacting on the Pound is the stability of the government.

From a hard-data perspective, the week opens with Construction PMI at 9.30 GMT on Monday, December 3 which will give us insights into how the sector fared in November.

The consensus amongst analysts is that it will rise to 51.0 in November, from 50.8 in October.

Services PMI is on Tuesday at the same time and is forecast to fall to 55.0 from 55.6 previously; this is the most important reading of the week as the services sector accounts for more than 80% of U.K. economic activity.

Analysts at TD Securities think the market is underestimating the sector and a pro-Sterling result beat on expectations could be delivered:

"We look for upside risks to the November Services PMI. Spillovers from optimism in the manufacturing sector (where business-to-business activity has remained strong) as well as from the rest of Europe (where the PMIs and growth are accelerating into year-end) should help support optimism in the sector."

The week ends with the Trade Balance and Industrial and Manufacturing Data out at 9.30 on Friday, December 8.

The trade deficit is expected to widen slightly to -11.5bn in October from -11.25bn and confirm the country's hefty reliance on imports remains intact; something that concerns analysts who believe the Pound could one day have to adjust materially lower in order to balance the situation.

Both Manufacturing and Industrial production are forecast to rise by 0.1% in October; disappointment here could see Sterling end the week in soft fashion.

Data and Events for the Euro

Despite positive data in the previous week, which showed unemployment falling in the Eurozone and Consumer Confidence rising, the Euro did not strengthen as much as expected due to doubts about whether Angela Merkel can form a pro-EU grand coalition government.

One of Merkel's closest allies, the head of the Christian Social Union (CSU) Horst Seehofer is under attack from members of his own party who want to oust him and replace him with Markus Söder who would be much less supportive of a coalition with Merkel.

The CSU is scheduled to vote on the matter on Monday, which although it cannot legitimately replace Seehofer, could force him to resign.

The other touch-point on the calendar for German politics is likely to be Thursday, December 7, when Merkel will sit down for talks with Martin Schultz the head of the SPD, the other large party earmarked for coalition, with Seehofer, if he is still standing also present.

From a hard data perspective, Services PMI for November is out at 9.00 GMT on Tuesday, December 5.

The data is made up of responses by key managers in the Services sector and provides a leading indicator of the health of the sector.

Eurozone Services PMI is expected to remain unchanged at 56.2.

Also out on Tuesday is Retail Sales for October at 10.00, which is forecast to show a -0.7% fall - a considerable slowdown from the 0.7% of the previous month of September.

On Thursday at 10.00 Q3 GDP results will be released, however, these are the second estimates and unlikely to differ markedly from the first estimates which showed growth of 2.5% compared to Q3 in 2016 and 0.6% compared to the previous quarter.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.