5-Day Pound-to-Euro Exchange Rate Technical Forecast + Events, Data to Watch

Above: The UK's David Davis and the EU's Michel Barnier will continue to press for progress on Brexit negotiations. Image (C) European Council.

British Pound and Euro to consolidate near-term but technicals hint big break higher is due, dependent on progress on Brexit headlines over coming days which are currently dominated by issues of the Irish border.

Ahead of the new week the Pound-to-Euro exchange rate confirms the market remains in a consolidative pattern, lying in a range between 1.1075 and 1.1450; Sterling fell a quarter of a percent over the course of the prior week to settle at 1.1178.

The immediate outlook - that should cover the coming five days don't suggest any major directional breakthrough is likely - but our technical studies hold some intriguing observations for those hoping for a better exchange rate.

Indeed, the charts hint at a higher exchange rate being reached at some time in the near-future as the market moves out of its consolidative period.

Prior to the current bout of consolidation, the GBP/EUR pair was in an uptrend:

We are now looking for the exchange rate to break higher, out of the uptrend, based on how markets tend to resolve such periods of consolidation.

As an example of how the Pound could emerge from the current consolidative period with an advantage, we use an example of a similar pattern on the Centene Corp share price which shows how the market was in an uptrend, consolidated for six months, but then broke out and extended the previous uptrend:

Although the odds marginally favour an eventual upside breakout in GBP/EUR, because consolidations tend to break out in the direction of the trend prior to their formation, we are no-where near the range highs and the pair is actually falling quite sharply within the consolidation range.

Although the odds marginally favour an eventual upside breakout in GBP/EUR, because consolidations tend to break out in the direction of the trend prior to their formation, we are no-where near the range highs and the pair is actually falling quite sharply within the consolidation range.

This suggests that even if Sterling does break higher eventually, patience is required.

The four-hour chart below shows more clearly how the current down move - which began at the Nov 21 highs rolled over - is evolving.

Particularly noteworthy is the strong down bar circled in red, which is indicative of heavy selling and particularly negative sentiment.

This combined with the now-established sequence of lower highs and lower lows, strongly suggests to me that this move down is not yet finished and the pair could continue lower to an eventual target at the range lows at 1.1100.

For confirmation of such a move, we would ideally wish to see a break below the 1.1160 lows, first.

The MACD momentum indicator (circled) is moving down, suggesting more downside on the horizon.

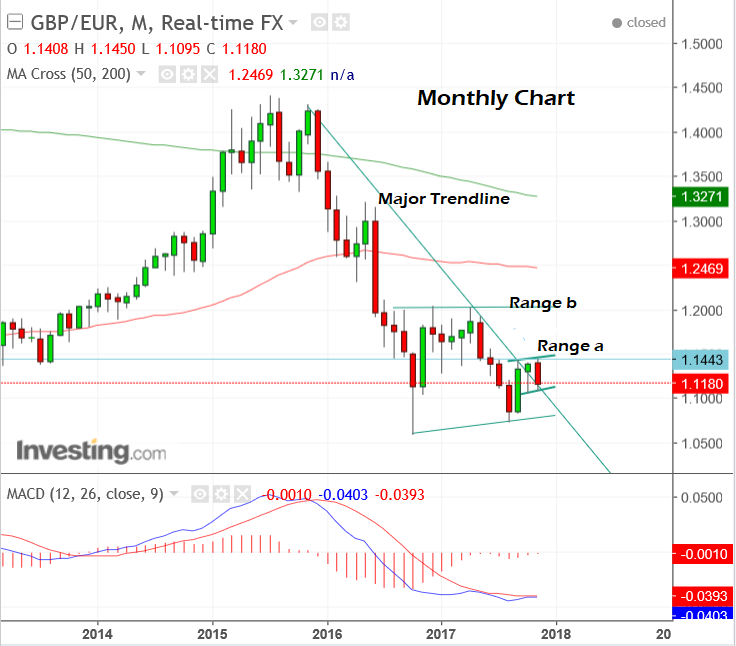

It is also worth holding in the back of the mind that over the long-term, the trend is, on balance, probably still down as can be seen on the monthly chart below - notwithstanding the recent break of the major trendline.

Which all goes to say that the 'current' as in the sea, may still be pulling lower, overall.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Data and Events to Watch for the Pound

Whether the Pound can ultimately break higher against the Euro will depend on progress over Brexit negotiations; it appears this issue will increasingly dominate sentiment on Sterling into year-end with a key EU summit on the matter in mid-December being a highlight.

It is at this summit that EU leaders will decide whether or not to greenlight, or redlight, the progression of negotiations onto the all-important issue of trade and the future relationship.

Businesses and Sterling will need this process to begin as soon as possible.

"The next couple of weeks will see a lot of noise in the build up to this - noise that we think could be ultimately positive for GBP, especially if it continues to ascribe a 'good chance' to there being progress made in Brexit talks," says Viraj Patel an analyst with ING Group N.V.

But much like the many-headed Hydra, a mythical creature that Hercules fought, which regrew two new heads for every one he cut off, so the Brexit negotiations keep growing new problems for Prime Minister Theresa May just as she has seemingly dealt with one.

Just after appearing to agree on a divorce bill that will help propel Brexit negotiations onto the issue of trade, a new problem has presented itself in the form of the border between Northern Ireland and the Republic of Ireland.

Irish Prime Minister Leo Varadka has threatened to veto any EU agreement to progress Brexit negotiations if he feels progress on the Irish border is inadequate; this is quite an interesting stance considering such a veto could push the EU and UK to a hard-Brexit and no European country has more to lose on a hard-Brexit than Ireland considering the UK is easily their largest trading partner.

A senior Irish diplomat in the EU has said it would really be better all round if the UK remained in the trade and customs union - or at least the customs union as then there would be no border issue.

One solution would be to essentially keep Northern Ireland in the EU (exempting it from Brexit) so that the border could be left open, however, this idea has been met with firm resistance from the DUP, Theresa May's partners in government, and her only key to a parliamentary majority.

With no clear solution, the Irish border issue is now likely to further delay the onset of the next stage of Brexit talks, and Theresa May has only got until December 4 to come up with a solution.

This impasse creates something of a binary risk for Sterling.

"Whether or not the EU summit will be able to give the green light for further negotiations remains a binary risk. So, we don’t expect GBP investors to place big directional bets until there is clarity on this issues," says Austin Hughes, at KBC Markets in Dublin. KBC Markets have turned from being positive on the Euro vs. the Pound two weeks ago to now being neutral.

Clearly, how the Ireland issue evolves in the coming week, will probable be a factor impacting on Sterling with any substantial break-down suggesting the Brexit process will be slowed down.

"The bigger hurdle to clear in order to reach “sufficient progress” is agreement on the Irish Border. The Irish Government’s position is that an “electronic border” is not viable. As a result, it won’t settle for anything less than a UK commitment to regulatory equivalence between Northern Ireland and the Republic in line with EU standards," says Andrew Wishart, UK Economist with Capital Economics.

Wishart notes the UK’s current intention is to leave the Single Market and the Customs Union and regulatory equivalence across the Irish border would require a customs border between Northern Ireland and the rest of the UK, which David Davis has ruled out. But Mr Barnier pointed out in a speech on Monday that contrary to arguments this would come at the cost of the integrity of the UK single market, many rules in Northern Ireland already differ from that in the rest of the UK.

From a hard-data perspective, the main release in the coming week will be Manufacturing PMI on Friday, December 1, at 9.00 GMT, which is forecast to show an uptick to 56.5 from 56.3 previously.

Investment bank TD Securities expect the result to be even higher as Eurozone growth spills-over into the UK:

"While strength in its euro-area counterparts is being driven by broad-based growth there, spillovers to UK businesses should nevertheless give the measure a lift, and November's CBI indicators seem to suggest continued healthy growth by firms," they said in a week ahead round robin.

Data and Events for the Euro

The European growth story has kept fuelling the rise in the Euro and for the currency, to continue, it may need fresh fuel in the week ahead from data releases.

The key releases are inflation and employment on Wednesday, November 26, which should show an uptick in headline inflation to 1.6% (from 1.4%) in November and Unemployment remaining at 8.9% in October.

This will be followed by Manufacturing data for November, out on Friday, December 1 at 9.30 GMT.

The already very strong October reading of 60.0 may be hard to beat and most economists are expecting November to show the same result.

Interestingly, BK Asset Management Managing Director Kathy Lien, sees a risk of the Euro weakening in the week ahead, as hopes continue to evaporate that the ECB will stop printing money, which has a diluting effect on the Euro.

Every official of the European Central Bank (ECB) who controls monetary policy has reasserted the current policy expectations that the presses will remain on, and she doesn't see them changing their stance anytime soon.

"Since the last monetary policy meeting, ECB officials have taken every opportunity to remind investors that they have no plans to change their policy outlook until late next year. This outlook view could lead to the euro's underperformance but EUR/USD positive sentiment needs to shift first," says Lien.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.