The Euro is Stuck in Rut, Says Nordea

Euro-area growth and inflation are too low to support the currency and it this is unlikely to change during the current European Central Bank President's tenure.

The Euro will weaken in the short-to-medium-term, says Scandinavian lender Nordea Bank, especially versus the stronger Dollar, as growth in the Euro-area remains comparatively sluggish.

The forecast suggests the current bearish trend in the Euro-US Dollar pair, for example, which has seen the exchange rate fall from 1.21 to 1.14 in only a few weeks is likely to extend.

Nordea's more bearish forecast is based on an analysis of monetary policy in the Euro-area and its impact on the single currency.

The European Central Bank (ECB) in Frankfurt decides monetary policy, which has a significant impact on the value of the Euro.

The ECB regularly meets to set the base interest rate which is the main conduit by which monetary policy impacts on the Euro.

When the ECB raises interest rates, for example, the Euro rises and when it cuts them it falls.

This is because higher interest rates attract greater flows of foreign capital into the Euro-area, which boosts demand for the Euro, thereby increasing its value.

This is because foreign investors prefer to send their money to higher interest rate jurisdictions due to the promise of higher (interest) returns.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

In a nutshell, Nordea's negative forecast for the Euro is based on the view that the ECB will delay when it next decides to increase interest rates from Q1 2019 to December 2019.

Although the ECB is not expected to cut interest rates, delaying a rise is enough to warrant a fall in the Euro, as currencies price in expectations of the future; and also because vis-a-vis other currencies where interest rates are being raised more rapidly the Euro's unchanging rate will seem lower relatively-speaking.

Why do central banks like the ECB raise interest rates?

The answer is when inflation is rising and the economy is in danger of overheating.

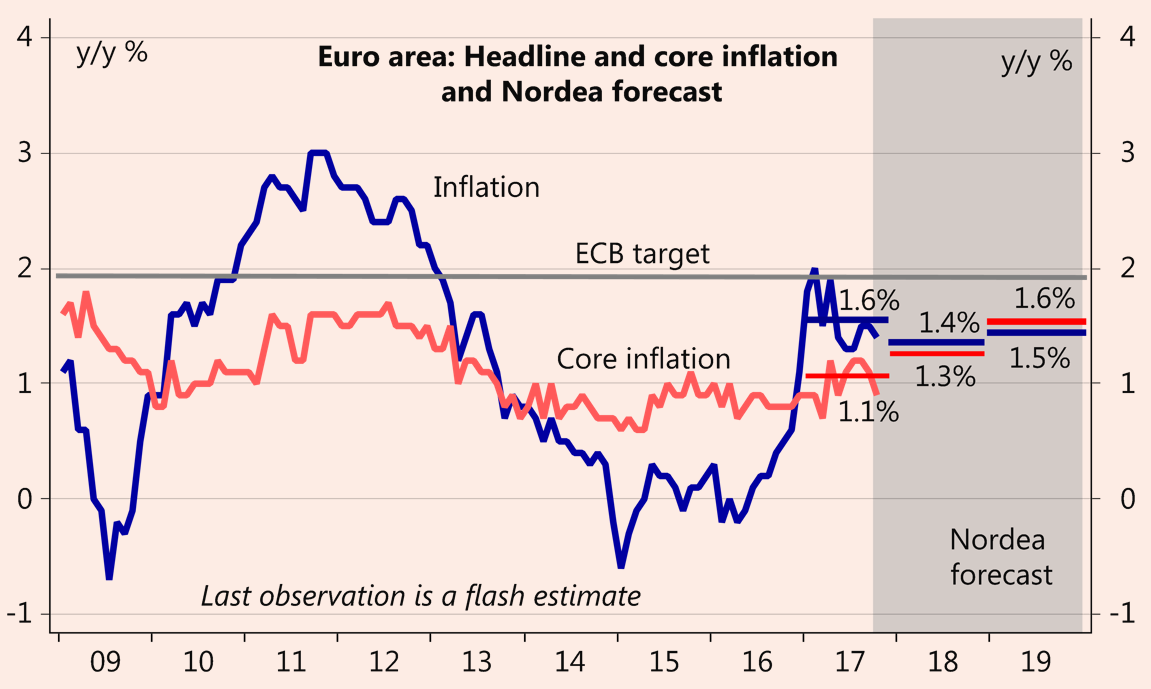

The foundation of Nordea's forecast is that inflation in the Euro-area is set to remain rather flat for longer-than-expected, so interest rates will also remain correspondingly flat (see below).

"The risks to our inflation forecast are now clearly downside as it seems that it takes longer than expected before robust economic growth starts to feed Euro-area inflation," says Nordea Analyst Holger Sandte

The new forecast means that according to Nordea the current president of the ECB Mario Draghi will not see a rate hike during his tenure as he is expected to leave in October 2019.