Pound Forecast to Build on Gains Against Euro in Coming Week; 1.1425 Targeted

Our technical studies suggest the Pound-to-Euro exchange rate could rise further in the week ahead, but moves will also be contingent on actions announced at the Bank of England on Thursday.

Pound Sterling is seen buying €1.1316 on the open markets in early London trade on Monday, October 30 having opened the new week at 1.1316.

In our previous week-ahead forecast we said the GBP/EUR exchange rate would probably rise to 1.14 on the condition that it broke above 1.1236; whilst it did break above this level, it only reached 1.1333 and therefore missed target.

Nevertheless, the Pound did still rise 1.0% against the Euro over the duration of the week confirming our directionality was correct, and our initial studies of the exchange rate made ahead of the coming week confirm momentum remains positive.

We note the exchange rate remains above a major multi-month trendline and the 50-day moving average, indicating a bullish outlook:

We would expect the rate to continue higher, first to the still-valid 1.1400 target and then beyond to a fresh target at 1.1425, on condition that it successfully breaks above the 1.1333 highs.

The 1.1425 target is just below the 200-day moving average (MA) at 1.1430 which is a tough level of support and resistance and an obstacle to further price growth.

The pair is likely to stall, pull-back and possibly even reverse at the 200-day MA as more sellers are expected to enter the market in expectation of a correction.

The look and feel of the MACD momentum indicator in the lower pane is sympathetic to the bullish outlook in that it appears to be rounding out and about to rise out of a shallow trough-like bottom, thus reflecting the expected rise in the exchange rate.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Events and data for the Pound: BoE Centre Stage

The big event to watch in the week ahead is the Bank of England's Inflation Report and Monetary Policy Decision, due on Thursday, November 2.

Money markets are currently pricing in a 90% chance that the Bank will raise interest rates - so the immediate risk to Sterling is if they don't raise rates. In such a scenario expect the Pound to plummet.

Such a move would be unlikely however as the Bank's Monetary Policy Committee know their reputation is at stake; in short, there will be few who take the words of Governor Mark Carney and his lieutenants seriously should he not follow through with a 0.25% rate rise.

An interest rate rise on its own would be neutral, as it is well signposted. What matters is communication regarding future policy moves - is there going to be a follow-up rate rise in 2018 or not? If yes, this would be positive for Sterling, if no, this would be bearish.

Financial markets are now pricing in a rise in 2018 which is more in line with Carney's view and so he may express satisfaction that they are correctly pricing probabilities.

"The picture is still cloudy enough for some UK rate-setters to question the need for immediate action. Nevertheless, we expect the Committee to move ahead with a 0.25% increase," says Lloyds Commercial Banking's Senior Economist Rhys Herbert. "With regard to the Bank’s forward guidance, of most interest will be whether Carney reiterates his previous assertion that markets are underestimating the potential for interest rate rises."

Yet at the same time, Carney is still expected to emphasise that interest rate rises are likely to be "gradual".

The big debate for Sterling going forward is whether the interest rate is a once-and-done affair or the start of a new cycle. Whichever side you fall on is likely to determine whether you are bullish, or bearish on Sterling.

“For investors, the key question is whether or not there will be further hikes next year. Market expectations are for at least one further 25bp hike next year. In contrast, we think the MPC will be making a mistake by hiking now, and that they will recognize this in the coming months,” says Daniel Vernazza, UK economist at UniCredit.

On the other side of the coin is the view that we are at the start of a new cycle of rate rises.

“It is not clear to us that UK growth is about to falter suddenly. There may be further Brexit negotiation uncertainty, but there is arguably a lot of it already. Instead, we prefer to trade with conviction the idea that this is not a policy mistake and that the BoE is on a hiking cycle,” says Jordan Rochester at Nomura.

As a result, Rochester is betting the Pound-to-Euro exchange rate will rise towards 1.15 near-term.

PMIs

Another major release for the Pound in the week ahead is the results of the October Purchasing Manager surveys for Manufacturing, Construction, and Services.

These are out at 9.30 on Wednesday 1, Thursday 2 and Friday 3 respectively.

Manufacturing it forecast to fall to 55.8 from 55.9 by the consensus of economists, although, some such as Lloyds's Herbert see an even lower result as likely due to the decline in the CBI Industrial Trends survey last week.

However, this is with the proviso that the Manufacturing PMI has been overall in an upbeat trend.

Lloyds Bank's Herbert is more constructive about Services PMI which he expects to come out at 54.0, however, the consensus expectation is for a fall to 53.2 from 53.6.

Finally, in the coming week Brexit Minister David Davis is to be questioned on the progress of negotiations on Tuesday at 16.05 (UK), and clearly how he answers is likely to impact the Pound given how hypersensitive the currency is to Brexit headlines.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

News, events, and data for the Euro

The Euro fell dramatically following the European Central Bank (ECB) meeting last week after the market decided the ECB was not removing stimulus - which is negative for the Euro - rapidly enough.

Nor is it likely to raise interest rates until the back end of 2018.

Higher interest rates tend to strengthen currencies by attracting more capital inflows so the knowledge that the ECB is not expecting to raise them for another year, was a blow for the Euro, especially when compared to most other currencies where central banks are already raising rates.

Given the emphasis on interest rates, a major release in the week ahead will by Eurozone inflation data at 10.00 (UK) on Tuesday 31, since inflation is a major driver of interest rates.

All that Euro bulls can hope for is that inflation data for October shows a faster-than-expected rise in inflation as this might indicate interest rates would have to be raised earlier than Q3 2018.

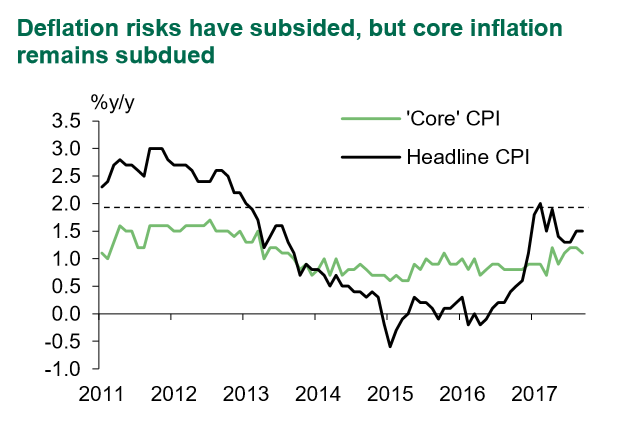

Yet according to Lloyds Commercial Banking's Senior Economist Rhys Herbert, the higher likelihood is that inflation in October will be lower due to the base effect from lower oil prices.

"Owing to energy price base effects, we forecast headline CPI inflation to tick down to 1.4%y/y in October from 1.5%y/y in September," said Herbert.

The impact of base effects is likely to worsen over time not get better:

"These negative base effects will intensify in the coming months, potentially pushing headline inflation towards 1% early next year," he added.

Strip out the volatile oil and food components and inflation remains static at 1.1%, and only a rise in 'core' inflation from there could help the Euro get over the negative expectations raised at the ECB meeting.

"A better guide to underlying price pressures is ‘core’ inflation, which excludes food and energy. We forecast core CPI to be unchanged at 1.1%y/y in October and, while it has ticked higher in recent months, it is still well below target," said Herbert.

Viva Catalonia!

Market analysts have changed their mind over how influential the political drama in Catalonia is for the Euro.

From being considered market moving initially it's influenced subsided.

Yet now once again it appears to be coming to the fore again as a negative driver for the Euro, although its magnitude is difficult to ascertain.

Spain has got heavy handed with the Catalan's after they unilaterally announced independence with the latest twist in the drama consisting in Spanish PM Rajoy basically re-annexing Catalonia, sacking the entire government and announcing elections on December 21 to decide the matter.

Yet the Catalan PM Puigdemont does not support the idea of elections and continues to claim Catalonia is independent; people are taking the streets of Barcelona waving Catalan flags, and general chaos reigns.

Clearly how the drama unfolds and whether it escalates or eases will be a contributory factor for the Euro in the coming week.