Pound Sterling vs. Euro 5-Day Outlook: Important Week of Data Releases: Here are the Numbers to Watch

A key set of data releases will determine travel in the British Pound in the week commencing October 16 with earnings on Wednesday forming the highlight.

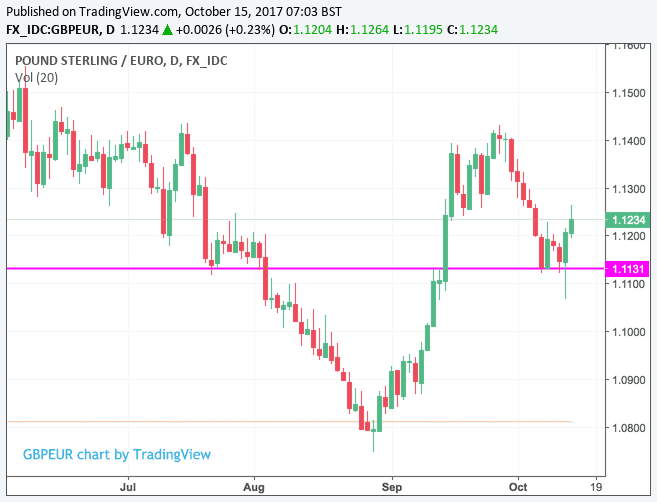

The Pound-to-Euro exchange rate advance 0.90% in the previous week to settle at 1.1237 as the Pound finally managed to build a floor and then reverse a portion of the significant losses suffered in the first week of October.

Support - a level in the market where buyers stepped in to buy Sterling - appears to have formed in the vicinity of 1.1130 and we reckon only a sequence of particularly negative events for the Pound over the course of coming days will trigger a decline below here.

(Or, a sequence of pro-Euro events of course!)

Politics have been the key driver of Sterling this month - in the first week of October Prime Minister Theresa May’s position as leader of the country was put into doubt during the Conservative Party Conference and the second week saw the completion of the crucial fifth round of Brexit talks.

May survived and while no major breakthrough in Brexit talks have been reached, there are a number of hints that a breakthrough is likely before the turn of the year.

But the drivers of Pound Sterling are expected to move away from politics as we progress through mid-October.

“Expect the narrative for GBP to slowly shift towards the November ‘Super Thursday’ Bank of England meeting,” says Viraj Patel, an analyst with ING Bank N.V. in London. “Here we see upside risks as the Bank are not only likely to hike by 25bp, but the risks are that Governor Carney signals that this is more than a ‘withdrawal of stimulus’ hiking cycle.”

At present markets are forecasting a 0.25% interest rate rise to be delivered in November, commensurate with the communications for such a move set out by the Bank of England and its officials at various points in September.

The Bank suggest an interest rate rise is needed to ensure inflation does not runaway - it is already closing in on the 3.0% level and is thus a full 1% above their mandated target level. By raising interest rates the Bank would be able to slow spending but higher rates also = a stronger Pound as foreign investors are attracted to increased yields in the UK.

Tuesday: Inflation Data, Bank of England's Carney to Appear before Parliament

The question being asked from the Pound’s perspective is whether further interest rate rises are likely beyond November. Much depends on the data out this week.

Inflation data is due on Tuesday, October 17 with headline CPI for September forecast to read at 3.0% on an annualised basis, up from 2.9% registered in the previous month. Monthly CPI is forecast to read at 0.3%, down from 0.6% seen previously.

If numbers come in above 3.0% this would indicate inflationary pressures in the economy are running above expectation and perhaps more than one Sterling-supportive interest rate rise is required in coming months.

The Bank of England is mandated with maintaining inflation as close to 2% as possible with the Monetary Policy Framework noting:

“If the target is missed by more than 1 percentage point on either side – i.e. if the annual rate of CPI inflation is more than 3% or less than 1% – the Governor of the Bank must write an open letter to the Chancellor explaining the reasons why inflation has increased or fallen to such an extent and what the Bank proposes to do to ensure inflation comes back to the target.

This could therefore be the week that Governor Mark Carney gets his pen out and sends a letter to Chancellor Philip Hammond.

Such a move would be symbolic, but by raising interest rates in November the Bank will be seen to be taking concrete actions in dealing with rising inflation.

Of course, were inflation to read below the expected 3.0% marker, the Pound could come under pressure this week, notable pressure if a big fall in inflation were reported.

Also on Tuesday, Carney himself will appear before members of Parliament’s Treasury Select Committee in which he will be grilled over recent policy decisions, and where he sees policy going over coming months.

“The session should provide clarity on how big a majority the MPC will have when it hikes rates in November as we expect – overly dovish tones from both could suggest a closer vote, but ultimately we think the BoE will hike,” says a note from TD Securities ahead of the event.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Wednesday: Watch Wage Data

But perhaps more important than inflation data itself, is data that tells us something about how inflation data will look in the future.

This is why labour market data from the Office for National Statistics on Wednesday, October 18 are key, and wage data specifically.

The average earnings index - with bonuses included - is forecast to rise 2.1%. A number greater than this would be seen as positive for the Pound as it would signal that domestic inflationary pressures are building. When pay packets increase, demand increases which in turn pushes up prices.

The Bank of England would view such a dynamic as evidence that further interest rate rises are required if inflation is to be contained. It also suggests a robust economy that can absorb one or two interest rate rises in coming months.

A beat of the 2.1% forecast by markets would therefore be good for the Pound, but a lower number would be negative for the currency.

Wage increases have been slow in coming as the productivity of the average UK worker remains constrained. The exact reason for this lack a lack of productivity is not yet fully understood, but only when we see strong increases in productivity will we likely see pay packets make jumps higher.

“Surveys broadly indicate that employers remain on a hiring spree, with the employment component of the Services PMI at a 19-month high. Meanwhile, there are reports of salaries being bid up amid labour scarcity, with the REC Report on Jobs finding that permanent salaries had risen at the fastest pace since October 2015,” say analysts at Investec in a note to clients.

We would suggest markets will be pessimistic heading into this data release owing to data out last week from the ONS which showed UK labour productivity, as measured by output per hour, was estimated to have fallen by 0.1% from Quarter 1 (Jan to Mar) 2017 to Quarter 2 (Apr to June) 2017 while over a longer time-period, labour productivity growth has been lower on average than prior to the economic downturn.

A beat on expectations would likely be the more surprising outcome and therefore the impact on Sterling - to the upside - would be greater. So watch for a decent rally in Sterling were the data to beat.

Thursday: The Health of UK Shoppers

The week of data ends off with the release of UK retail sales which are a key indicator of consumer confidence.

Markets are forecasting monthly retail sales for September to read at -0.2%m down on the 1.0% seen in the previous month.

So expectations are low here and a beat would certainly give Sterling a lift into the latter half of the week.

Friday: Politics Still With us, Watch EU Leaders Summit

While data will be key readers should remember that the EU leaders’ Summit on October 20 where Heads of State of the European Union will gather to discuss progress made on Brexit thus far.

We already know that it will be agreed negotiations are not ready to move on to discussions of trade.

But we have also noted reports that the EU could be willing to move on to talks in the near future were May to offer up some concessions. The Pound rallied last week on the news as it suggests the EU and UK are actually closer together on outstanding issues than initially expected.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

The Euro's Big Data Release

The headline event for the Euro on the data calendar comes mid-week with the release of Eurozone inflation numbers.

Annualised CPI inflation for September is forecast to read at 1.5%, in line with the previous month’s read.

The implications for the Euro of the data follows a similar logic to the relationship which exists between the Pound, Bank of England and UK inflation data.

However, in the case of the Euro and the European Central Bank, inflation remains stubbornly below the 2.0% target which disallows the ECB from pursuing interest rate rises in the near-future.

However, there is the calculation that inflation is headed higher and the ECB will be allow to withdraw monetary stimulus in the form of quantitative easing. Markets reckon a call on ending this Euro-suppressing programme in either October or November.

This assumption has been behind the Euro’s rally through the course of 2017 and should inflation data read more-or-less around the 1.5% mark this narrative is likely to remain intact this week.

Only a drastic slip in inflation will undermine the Euro recovery we believe and any significant beat on expectations will surely fan the fire under the Euro.