British Pound's Technical Rebound Against Euro Extends Above 1.10, Still Eyed as a Short-Term Phenomenon

Pound Sterling is seen enjoying near-term positive momentum as a technical correction in the market holds a firm grip on price action.

Pound Sterling trades near five-week high against the US Dollar at 1.3186 having gone as high as 1.3224 on Friday, September 8. The Pound-to-Euro exchange rate is meanwhile seen at 1.0995 and earlier in the session appeared on the cusp of breaking 1.10 but has since retraced to 1.0973.

There are no headlines or data behind the multi-day recovery in Sterling and the gains are part of a continuing technical correction in the market.

“There were again plenty of headlines on the stalemate in the Brexit-negotiations last Friday while the UK economic data calendar was well filled. However, those topics played no important role in Sterling trading,” notes Piet Lammens, an analyst with KBC Markets in Brussels who notes that while recent UK data has been OK it “ had little impact on trading.”

The analyst notes Sterling has show remarkable resilience, given the fundamental backdrop, a view shared elsewhere in the analyst community.

“We believe that both a softer UK economic outlook and domestic political risks are now adequately priced in and only an escalation in either would result in further idiosyncratic GBP downside,” adds Chris Turner, head of foreign exchange strategy at ING Group.

Pound Correcting from Oversold Conditions

At the heart of the technical correction in Sterling is the view that it has been punished unfairly, particularly on shorter-term timeframes.

"The Pound has rebounded over the last week from heavily oversold levels recorded during August," says Lee Hardman, Currency Analyst with MUFG noting the market is recovering form excessively negative sentiment.

Looking at the calendar, the Brexit debate will again dominate the headlines with the UK government attempting to find a majority for its Brexit bill that will allow the government to copy EU law into UK law.

Make no mistake, a failure of the Brexit bill to pass will cause the kind of uncertainty which could significantly shift trade in Sterling.

This week also brings with it the Bank of England interest rate decision on Thursday and inflation and wage data on Tuesday and Wednesday respectively. See what data is expected here.

“A successful vote might be slightly positive for Sterling. Even so, last week’s price action suggests that Sterling is gaining some momentum anyway. This correction might continue as investors further reduce sterling shorts after the Summer sell-off,” says Lammens.

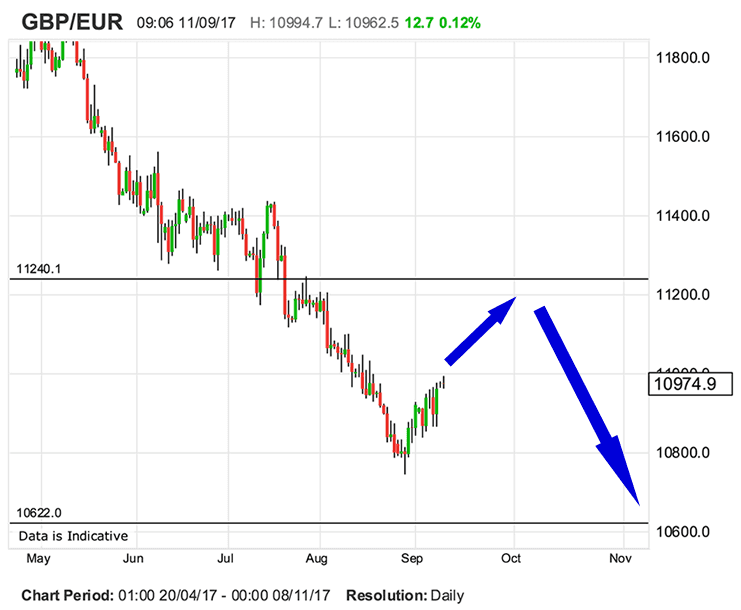

Medium-Term Still Going Lower

However, the analyst reckons strength in the Pound will likely remain a short-term phenomena.

“From a technical point of view, EUR/GBP cleared 0.8854/80 resistance, opening the way for further gains,” says Lammens. (This is support in GBP/EUR at 1.1294/1.1261).

Medium-term, KBC Markets maintain a buy EUR/GBP on dips approach as they expect the combination of relative Euro strength and Sterling softness to persist.

“The 0.9415 ‘flash-crash spike’ is the next target on the charts. However, we wait for a correction, e.g. to the technical support in the 0.88/89 area, to sell Sterling again versus the Euro,” says Lammens.

Turning the exchange rate around, the flash-crash low in GBP/EUR is therefore at 1.0621. The near-term correction higher is seen extending to the 1.1364/1.1236 area.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.