Frantic Demand for Euros Heaps Fresh Pressure on Pound Sterling

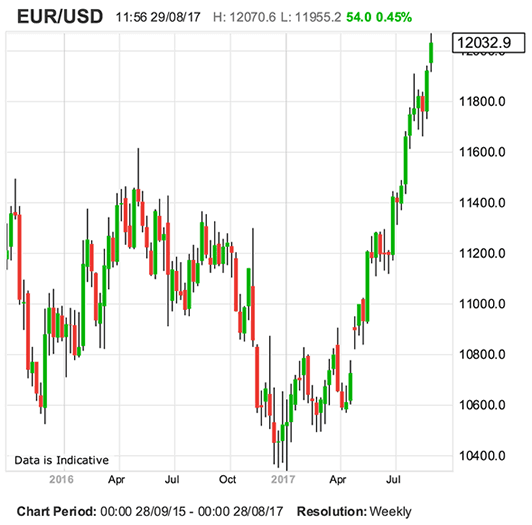

The Euro is on the charge against the US Dollar once more and the British Pound has been caught in the crossfire.

It’s the Euro show today.

The single currency has surged through a key barrier against the US Dollar which means the Euro is steamrolling other major currencies.

The EUR/USD broke above 1.20 in a move that stimulated demand for the Euro right across the board.

Pound Sterling is giving away ground as a result; the Pound to Euro exchange rate is down 0.30% at 1.0758 ensuring a fresh eight-year low for the pairing.

But, Sterling's fall is less than the 0.50% decline suffered by the Dollar which suggests the Pound is putting up a touch of resistance.

This is a technically driven market right now and some of that support for the Pound is coming from a GBP/USD which is higher by 0.20% at 1.2950 owing to a repricing of expectations for the next US Federal Reserve interest rate rise.

Markets have pushed the date back further with market pricing the next rate might only come in September 2018.

This is well below the Fed’s own expectations and has pulled the rug from below the US Dollar.

Wow! Markets now think the Fed will not raise rates until SEPTEMBER 2018. Massive deviation from the Fed's dot plot. pic.twitter.com/Li9uhEqlMq

— jeroen blokland (@jsblokland) August 29, 2017

Also weighing on the Dollar are ongoing concerns surrounding North Korea.

North Korea has fired a missile over Japan's Hokkaido region, sending residents running for cover.

The missile, which landed in the waters off Japan's eastern coast, is thought to be the first nuclear-weapon capable ballistic missile the North has ever sent over the country.

Those commentators who watch North Korea say this could be its most provocative act yet.

The move has sent demand for US treasuries higher, sending the yield on treasuries lower. This in turn scuppers support for the Dollar.

So we have a Sterling in the passengers seat at present - it is going higher against the US Dollar and lower against the Euro.

GBP/USD Outlook

Analysts at LMAX Exchange they will look for GBP/USD to be well supported, with any additional weakness limited to the 1.2600s in favour of an eventual push back up to fresh 2017 highs and towards the next key objective in the 1.3500-1.4000 area further up.

“Still, there is risk for an extended period of choppy consolidation before the bullish continuation plays out, which means rallies could be well capped below 1.3100,” say LMAX Exchange in a technical briefing dated August 29.

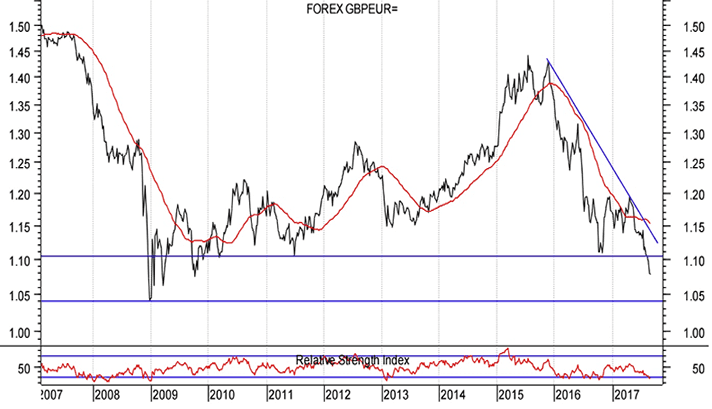

GBP/EUR Outlook, Oversold but Who will Catch the Falling Knife?

This is one incredibly oversold currency pair.

We reflected in our technical analysis releaed ahead of the new week that the Relative Strength Index (RSI) on the weekly chart now reads at 29 - a reading below 30 is indicative of oversold conditions.

On the daily charts the RSI reads at 19.3 (bottom pane in the below), the last time we saw such a read was back in October 2016. The exchange rate recovered from such oversold conditions and entered a strong recovery that took the market all the way back to 1.20.

We would note that the RSI rarely stays below 30, so beware a comeback.

But, we cannot also ignore the fact that this is a trending market and there is no saying when a comeback is likely.

“The major downside target – as shown on the weekly chart below – is still the low that was reached in December 2008, when an all-time low of €1.0275 was recorded. Although that’s still some way off the overall impression is that it could yet be tested before this sell-off reaches a conclusion,” says Bill McNamara at Charles Stanley.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Back to Brexit as Third Round of Talks Get Underway

Above: David Davis, Michel Barnier (C) European Commission.

At the start of the week Sterling is taking direction from other currency pairs and global market conditions but traders will soon focus on Brexit once more.

The third round of negotiations are underway in Brussels with a conclusion due on Thursday, August 31.

The assessment delivered by E.U. negotiator Michel Barnier following the completion of these talks will be key to Sterling direction; if he says progress has been made then we would expect Sterling to pop.

If he reveals there is more work to do, and that the two side remain far apart, we would expect selling pressure to remain intact.

We believe a great deal of work needs to be achieved for a Sterling-positive outcome to be delivered. The assessment delivered by the President of the European Commission, Jean-Claude Juncker, on August 29 is that the U.K's recently published position papers were not satisfactory in his view.

The initial assesment delivered by the head of the European Parliament, Guy Verhofstadt, to a position paper regarding future customs arrangements was that the U.K.'s proposals amounted to "a fantasy".

The E.U. appears to be driving a hard line and we there is the sense that only an acceptance of the E.U.'s position will be acceptable.

Therefore, how much can be negotiated in these negotiations is questionable.

What matters for the Pound is that the E.U. proves willing to let the Brexit deadline of March 2019 lapse if it means maintaining the upper hand.

This could result in a disruptive Brexit and there is certainly further weakness in Sterling to be had if this is indeed the outcome.