The GBP/EUR Rate "Extremely Cheap" - Won't Fall to Parity says ING Bank's Patel

- Written by: James Skinner

"We would need to see an additional layer of bad news to fuel any further politically-induced GBP selling. This seems unlikely in the absence of a Brexit disaster situation unfolding"

Pound Sterling and the Euro are unlikely to par in value argues an updated analysis on the pair issued by ING Bank N.V.

The Pound has become “an easy target for currency markets,” but ultimately the weakness is at risk of running its course with the fundamental misvaluation between the two currencies starting to look extreme.

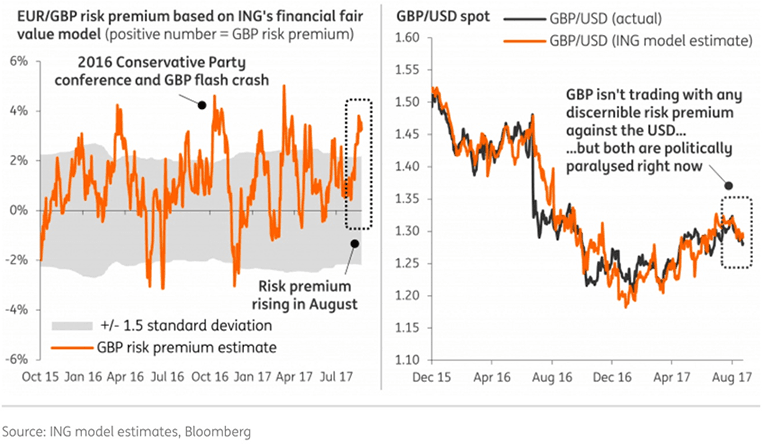

“GBP is beginning to show signs of idiosyncratic selling, similar to previous periods when domestic political risks have flared up,” says Viraj Patel, an analyst with ING Bank in London. “This tends to be a short-run phenomenon, with GBP's material undervaluation acting as a limiting factor for sustained weakness.”

Patel believes the “idiosyncratic selling” of Sterling is a result of the combination of “a post-Brexit economic reality check and ongoing political anxiety has made the UK economy an outlier relative to its faster growing European peers.”

BUt, ING believe this economic divergence story has largely run its course.

“We would need to see an additional layer of bad news to fuel any further politically-induced GBP selling. This seems unlikely in the absence of a Brexit disaster situation unfolding - that is a complete breakdown in UK-EU negotiations and renewed cliff-edge risks. Political will from both sides suggests the worst-case scenario will be avoided,” says Patel.

Selloff is now an Overshoot, but Politics Could Still Weigh

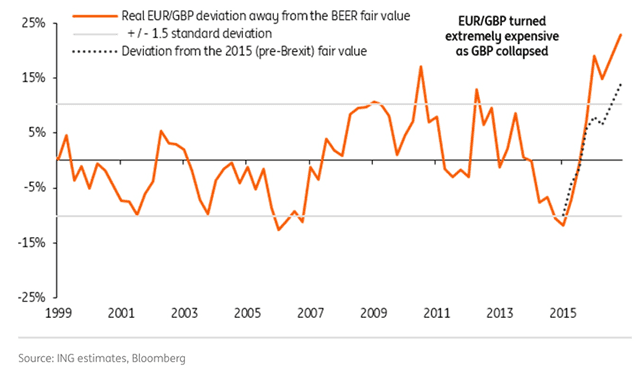

Sterling is undervalued by as much as 20% relative to the Euro, according to one measure used by foreign exchange strategists at ING, which they say is something that has been brought about in-part by the Eurozone having become a beacon of relative political stability when compared with the U.K. and the U.S. of late.

“GBP could remain under pressure ahead of key domestic and Brexit political risk events in October. But we view this as an overshoot of more fundamentally-justified levels, rather than a sustained trend in EUR/GBP towards parity,” says Viraj Patel, a strategist at ING.

ING see GBP as “extremely undervalued,” with the very stretched valuation likely putting a limit on the scale of further downside.

EUR/GBP is rich by a staggering 20% based on our medium-term Behavioural Equilibrium Exchange Rate (BEER) valuation framework.

“Even if we control for the post 2015 rise in GBP fair value due to improving UK terms of trade and declining UK government consumption, EUR/GBP would still be overvalued by 14%,” says Patel.

When the medium-term valuation reaches such extreme levels Patel reflects that it tends to be difficult for the currency to weaken materially given the limits imposed by the underlying fundamentals.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Brexit Disaster to be Avoided

An underlying fundamental to watch is of course Brexit.

With Westminster recently having set out plans to negotiate a transitional period for implementing Britain’s withdrawal from the European Union, and shown signs that it might be willing to compromise on some of its so-called red lines, Patel and his team sees scope for a messy divorce to be averted.

“For GBP's politically-driven weakness to persist and extend all the way towards parity against the EUR, we would argue that 'hard Brexit' risks would need to notch up another gear,” says the analyst.

This is while the prospect of a further cut to sterling interest rates, which would weaken the Pound, has all but dissipated with the increase in inflation brought about by the existing weakness of the Pound.

“For short-term domestic rates to move lower, we would need to see evidence of weak consumer activity turning into a hard-landing for the UK economy. Our economists see this as highly unlikely and are not expecting the economy to take a significant turn for the worst,” says Patel.

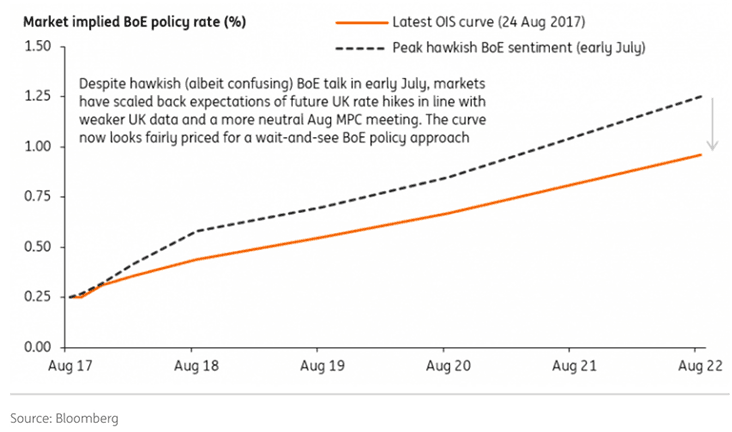

Contrary to any prospect of lower interest rates, markets have spent much of the year to date speculating that the Bank of England might actually raise its benchmark interest rate in order to nudge the currency higher and stave off inflation.

However, a concurrent weakening of consumer spending and an easing of inflation pressures has put the rate-hike narrative to bed for the time being. But importantly, ING reckon the curve is now fairly priced i.e. a substantial deterioration in data must take place for the curve to flatten further.

And, the UK economy could pick up into year-end as it typically does.

"Judging from seasonal patterns, US key figure momentum almost always peaks in Q4 and troughs mid-year. Usually better US momentum spills over to better UK momentum with a few months’ lag. This time might be no different,” says Andreas Steno Larsen at Nordea Markets.

With sentiment already so positioned against Sterling, a better-than-expected data pulse into year-end will certainly help.

The comments come as the market braces for the appearance of Mario Draghi at the Jackson Hole Symposium later on Friday.

Traders have been hoping that the European Central Bank chief will give a hint as to the likely direction of Eurozone monetary policy over the coming months.

The pound to euro exchange rate edged lower during early trading in London, falling by 0.15% to be quoted at 0.9204. It is down more than 7% for the year to date and has shed more than 20% of its value since the June 2016 Brexit referendum.

Johnson's Comments on Brexit Bill Points to More Constructive Position

As ING note - it will take a substantial deterioration in Brexit talks to prompt the Pound / Euro rate down to parity.

It would appear that the UK Government is taking the issue seriously with comments from Foreign Secretary Boris Johnson catching market attention.

Johnson, a pro-Brexit figure in the Government who had earlier dismissed talk of paying a bill, has confirmed the UK will meet its obligations on the matter.

Johnson told BBC Radio 4 that the UK would abide by its financial obligations "as we understand them".

The EU has said it wants to see progress made on the matter of the bill before advancing talks. Recent concessions by the UK make this the more likely.

This is positive for Sterling we believe.