Bank of England's Super-Thursday Reignites Sterling's Downtrend

- Quotes:

- Pound to Euro exchange rate today: 1.1060, low: 1.1058, best: 1.1199

- Euro to Pound Sterling exchange rate today: 0.9040, low: 0.8925, best: 0.9042

Above: Andy Haldane - Chief Economist at the Bank of England - did not opt to vote for an interest rate rise at the August policy meeting. Sterling fell sharpy in reaction and the losses accelerated as the Bank cut UK economic growth forecasts.

Pound Sterling is under hefty selling pressure on Thursday, August 3 as the Bank of England votes 6-2 to keep interest rates unchanged.

Markets bought Sterling ahead of the event in anticipation of a 5-3 vote being delivered - a sign that perhaps the Bank would seek to underpin the value of the Pound in order to put downward pressure on rising inflation.

Disappointment to the vote composition was then compounded as the Bank indicated it had cut its growth forecast for the UK economy in 2017 to 1.7% from 1.9%.

The Pound to Euro exchange rate has fallen to a fresh nine-month low at 1.1049 on the outcome of the event while the Pound to Dollar exchange rate has given up some of its recent gains to trade at 1.3126.

Despite inflationary pressures at elevated levels in the economy, the Bank has opted to maintain favourable business conditions by keeping borrowing costs low via bond purchases and record-low interest rates. In short, we shouldn’t expect an interest rate rise at least until the start of 2018.

The immediate threat of an interest rate rise should at least guarantee some stability for businesses - unless of course they are importers who would suffer from another bout of Sterling weakness.

The Bank noted that the impact of the decision to leave the EU in June 2016 was now being reflected in weaker economic performance as consumers felt the impact of rising prices owing to the devaluation in Sterling.

Furthermore, a 20% reduction in business investment by 2020 - as compared to business investment forecasts for 2020 delivered prior to the brexit vote - are expected to weigh on the economy further.

The outlook for the Pound against the Euro has now turned negative on all timeframes we believe.

More Sterling Weakness Ahead

“The Pound has been hit by a dovish double-whammy," says David Lamb, head of dealing at FEXCO Corporate Payments. “The Monetary Policy Committee has returned firmly to type, with an increased number of the Bank’s rate-setting grandees voting for the dovish orthodoxy. And with the Bank’s Inflation Report predicting both a slowdown in economic growth and continued rising inflation, the doves are now set to rule the roost for the foreseeable future.

The Bank's signal that no interest rates should be expected in the forseeable future, "have hit Sterling like a bucket of cold water, and prompted the Pound to lose most of the gains it made against the Dollar earlier this week," says Lamb.

“With the MPC so wary of derailing Britain’s fragile growth with a rate rise – and the Bank forecasting further economic weakness – the prospects of a rate hike have once again disappeared below the horizon. Sterling’s brief spell of strength has sunk with them.”

Robin Wilkin at Lloyds Bank Commercial Banking says the "probabilities are more aligned" for a fall towards the 1.0905-1.0869 which forms a key support region for the GBP/EUR exchange rate.

According to Lucy Lillicrap at Associated Foreign Exchange, the trend lower remains firmly intact.

“Attempts to reverse ongoing Sterling weakness here have not proven conspicuously successful in recent weeks and while the angle of descent is still relatively shallow prices nonetheless look to be 'stair-casing' their way back towards 1.1000 again,” says Lillicrap in a note released at the head of the new month.

Ultimately, the 1.0940 (October 2016) is vulnerable as well says Lillicrap.

Meanwhile, ING Bank note that their forecast target at 1.11 for GBP/EUR has been broken and they now expect the exchange rate to remain below here for a protracted period of time.

ING's Viraj Patel has described the decline in Sterling following today's BoE event as being justifiable as it serves to remind markets the there is only one game in town for the Pound - Brexit.

And on this front, there is not much positive news with Cabinet still split on whether or not a transitional deal that sees continued membership of the single market and customs union for a limited period is appropriate.

Is the fall in value of Sterling impacting your international payments? Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

The Bank Opts Not to Defend the Value of the Pound

Ahead of the event we wrote that there may be a desire by some members of the Bank of England to raise interest rates despite UK economic activity slowing sharply in 2017 following a robust 2016.

GDP growth in the first and second quarters of the year clocked in at 0.2% and 0.3% while wage growth remains overshadowed by inflation. Sentiment towards the economy is slipping, particularly as consumers are suffering a pinch from falling levels in disposable income.

And herein lies a clue as to why the Bank might have chosen to send a 'hawkish' signal - inflation is uncomfortably high, even if the Bank forecasts a gradual decline back to their 2% target.

Those members who voted for an interest rate rise in June argued that there is a risk inflation expectations become entrenched and the economy is lumped with an inflationary problem.

As widely acknowledged, the recent rise in inflation is because the fall in the Pound has lifted the cost of imports which has filtered into consumer prices and impact consumer spending.

Therefore, some members of the MPC believe a stronger Pound Sterling is in order. One way of achieving such an outcome would be to raise interest rates; but were such a move be perceived as being a tad too agressive then sending a signal on future interest rate rises might prove to be just the ticket.

And a 3-5 vote would be one way of sending such a signal.

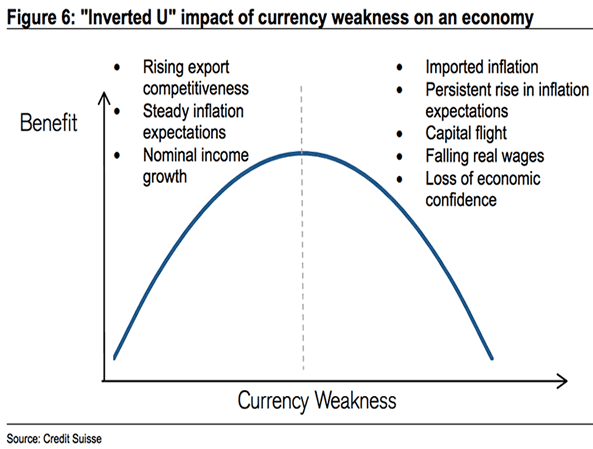

"MPC members like Forbes and Haldane have raised fears that the pass through from the GBP devaluation of the past year may be morphing from a one-off shock into a persistent problem that boosts longer-term inflation expectations, raising the likelihood of systematically missing the inflation target in the future, or having to hike rates in a more dramatic fashion down the line to avert that outcome," says Shahab Jalioos at Credit Suisse.

Jalinoos believes the economy might be at a tipping point where GBP’s benefits with regards to promoting exports is outweighed by the negatives of costlier imports.

In such an environment, "the arguments in favour of hiking rates to stabilise the currency can gain weight quickly. This can even be the case when the cause of the problem is an exogenous shock."

So a 5-3 vote in favour of raising interest rates would have aided Sterling and helped quell inflation.

Clearly the Bank is not concerned about the value of Sterling and believe that its negative impacts on the economy will be transitionary.

This is nevertheless an assumption and we would be wary of a second round of inflationary pressures if today's event proves to have been a trigger to more sustained losses in the Pound.