The Euro Jumps as Eurozone Eurozone Inflation Data Signals Conditions are Right for ECB to Withdraw Stimulus

- Euro to Dollar exchange rate: 1.1729, up 0.45%

- Euro to Pound Sterling exchange rate: 0.8966, up 0.32%

A slew of inflation and economic growth data out of the Eurozone has kept the Euro in winning ways ahead of the weekend.

The single-currency moved higher against all its competitors (except the SEK) after inflation numbers suggested there is enough inflationary momentum in the Eurozone justify a withdraw of stimulus at the European Central Bank over coming months.

The assumption held by markets is that a programme of 'tapering' the extraordinary stimulus will soon soon start at the ECB, and this has been the driving force behind the Euro over recent weeks and months.

That force is clearly still in charge.

At their July meeting the ECB warned that no such moves will be forthcoming unless inflation improves and therefore inflation data was always going to be absolutely key to the evolution of the Euro's story.

Latest data suggests the ECB doesn't have to worry about inflation and their caution might be misplaced.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Inflationary Pressures are Building

France has seen inflation come in at -0.3% in July, taking annualised inflation up to 0.7%. This is hardly inspiring but crucially the data is better than analysts had forecast.

Spanish inflation data hit consensus with a reading of -0.7% for July, taking the annualised rate to 1.5%.

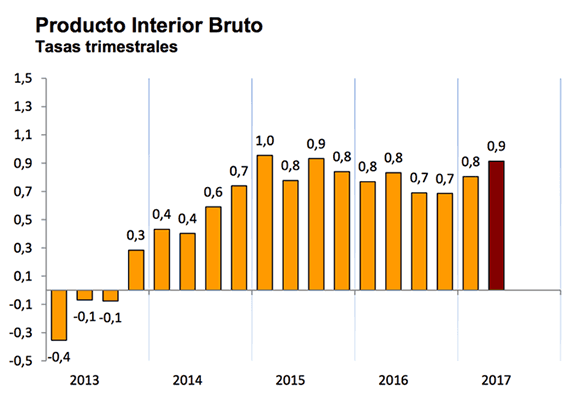

It was also reported that quarterly GDP read at 0.9% which suggests the Spanish economy is in rude health with annualised growth reaching an enviable 3.1%.

Spain is now one of the fastest growing developed nations and will aid the view that the broader Eurozone - not just Germany - is starting to pick up some momentum.

Above: The Spanish economy is growing at a clip.

The big number that currency markets were watching was however always going to be the German numbers.

And data from Europe's largest economy did not fail to impress.

Monthly inflation read at 0.4% in July, up on the previous month's 0.2% and ahead of consensus forecasts for 0.2%.

Annualised inflation now reads at 1.7% - close to the ECB's 2% target.

The reaction by currency markets says it all - the Euro exchange rate complex is steaming ahead as markets now have a little more conviction that the conditions are ripe for the ECB to start shifting policy.

All eyes now turn to the Eurozone-wide inflation numbers from Eurostat, due on Monday, July 31 to confirm the country-specific trend.

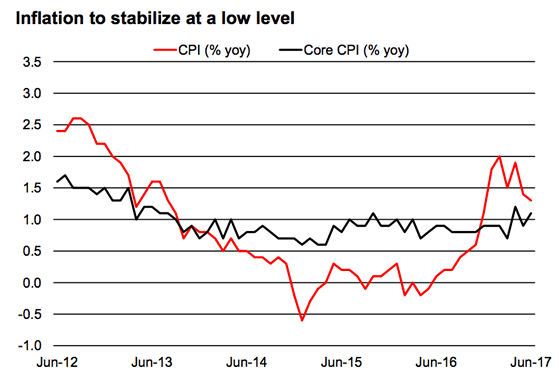

Analysts at UniCredit Bank in Milan, Italy expect headline inflation to have stabilised at 1.3% year-on-year in July, its lowest level so far this year.

They also warn core inflation might ease back by 0.1pp to 1.0% year-on-year.

If correct, then the Euro-bulls might be in for a bit of disappointment ahead of the new month.

"However, this is not a high-conviction call, since a large part of the June acceleration was driven by holidaysensitive spending items, whose prices are volatile even in the wake of minor changes in seasonal patterns. It is difficult to predict if or when any correction may happen," says a briefing on the matter from UniCredit.

As we can see, Eurozone inflation has not been heading in the right direction of late, and there is a risk that this trend is confirmed.

So there remain risks to the Euro's rally.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here