British Pound to See Brief Respite Against Euro

- Written by: Gary Howes

- Pound to Euro exchange rate today: GBP/EUR = 1.1187

- Euro to Pound Sterling exchange rate today: EUR/GBP = 0.8939

Technical strategist David Sneddon at Credit Suisse is still bullish on the Euro’s prospects against Pound Sterling, despite the recent step backwards by the Euro witnessed this week.

The analyst’s call, contained in a strategy note to clients dated July 25 comes as the Euro’s decisive rally against Sterling and the Dollar pauses for breath.

A number of analysts say this behaviour by a dominant currency should be expected before the trend higher ultimately resumes.

The Euro has fallen back to 1.1652 against the US Dollar having been as high as 1.1674 earlier in the week. Against Sterling, EUR/GBP is at 0.8945 having been as high as 0.8984 at the start of the week.

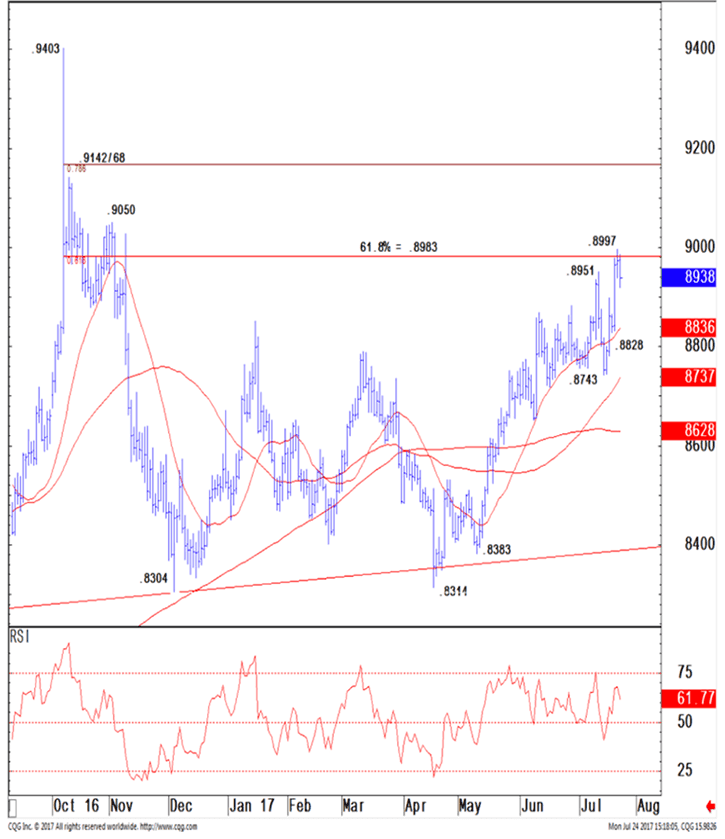

“EURGBP has been unable to directly extend its break above the 61.8% retracement of the October/November 2016 fall at 0.8983, and has corrected lower,” notes Sneddon.

Sneddon believes the pause will be temporary.

“Fresh selling has been found at the 61.8% retracement barrier at 0.8983, but we stay bullish for 0.9050,” says Sneddon.

The target at 0.9050 in EUR/GBP equates to 1.1048 in Pound to Euro exchange rate terms.

“We allow for weakness to extend further near-term, but view this as corrective, and once it has run its course look for an extension above 0.8983/97 to open up further strength to 0.9028 next, with the November 2016 high at 0.9050 expected to try to cap at first,” says the Credit Suisse analyst.

However, a direct break can target 0.9142/68 – price resistance and the 78.6% retracement level.

EUR/GBP at 0.9142/68 gives a Pound to Euro exchange rate decline down to 1.0939/1.0907.

Support moves to 0.8920 initially, then the 38.2% retracement of the current rally at 0.8900/.8899, “where we would expect buying,” says Sneddon.

Below can aim at 0.8867, with 0.8832/28 ideally holding to keep the risks directly higher.

However, Robin Wilkin at Lloyds Bank tells his clients that they should not be surprised if the corrective move lower in the Euro broadens and leads to deeper losses.

Wilkin is looking at the EUR/GBP exchange rate charts and notes the Euro is actually rising against Sterling in well defined channel:

This should prove instructive to the outlook.

"The combination of channel and Fib resistance around 0.9000 and intra-day studies still in unwind mode suggest a broader correction can be seen in the cross," says Wilkin.

Important support is seen lying down at 0.8865-0.8810 which gives a GBP/EUR rise to resistance at 1.1280/1.1351.