Five-Day Forecast for GBP/EUR Exchange Rate: Technical Studies, Data and Events to Watch

The last move down was steep and bearish and we see a probable continuation of the bear-trend to an eventual target at the significant round-number level of 1.1000.

The British Pound has stabilised against the Euro at the start of the new week following the release of worse-than-forecast Eurozone economic data and signs that the heavily-sold currency was due a relief-style rally.

The GBP/EUR exchange rate was quoted at 1.1182 at the time of writing, having been as low as 1.1125 earlier in the day and at eight-month lows during the previous week.

The Euro relinquished some of its recent gains after Eurozone PMI data underwhelmed against analyst expectations and suggest that the Eurozone's economy might not be growing at the pace required to prompt the European Central Bank into exiting its stimulus programme.

The data suggests the economy might be nearing a peak with manufacturing PMI reading at 56.8, below the 57.2 forecast by analysts.

Services PMI for July read at 55.4, lower than the 55.5 forecast and the composite number read at 55.8, below the 56.2 forecast.

"The reason for the Euro’s (recently rare) showing of weakness was a disappointing set of region-wide PMIs. The services figure remained unchanged at 55.4 after the German and French numbers missed estimates, while the manufacturing reading unexpectedly hit a 3 month low of 56.8," says Connor Campbell, an analyst with Spreadex.

The Euro has fallen on the data as this serves as a gentle wake-up call to traders that they might have been betting too hard and too fast on a stronger Euro exchange rate.

Some consolidation in pairs like EUR/GBP and EUR/USD is therefore possible in the near-term. Strategist Dr. Vasileios Gkionakis at UniCredit in London says the “case can be made for a tactical” Euro sell-off because “too much is baked into the market from a short-term perspective”.

A consolidation in the uptrend is therefore expected in some quarters, and this data appears to be the trigger.

A pro-Euro stance amongst traders stems from expectations that the ECB is soon to announce how it will end its quantitative easing programme while preparing for further interest rate rises.

Traders can now clearly see a future of no ECB stimulus which should allow the currency to rally to fair-value which is much higher than current levels suggest over coming months.

“Looking at the medium-term picture, we find little to no excuse not to expect more Euro upside: the mix of supportive currency valuation,” says Gkionakis.

Technical Studies: GBP/EUR Downtrend Intact

We don't however expect Sterling to advance too far.

The Pound to Euro exchange rate (GBP/EUR) remains in an extended downtrend signified by a series of lower highs and lower lows being recorded on the daily charts.

The downtrend saw the July 12 lows at 1.1170 breached last week and the exchange rate has moved down to a new low at 1.1113 established last Friday (July 21):

The last move down was steep and bearish and we see a probable continuation of the bear-trend to an eventual target at the significant round-number level of 1.1000.

Such a move, however, would require confirmation from a break below the 1.1113 lows.

The one potential spoiler is the lack of downside momentum in the MACD indicator.

Whilst the exchange rate is making new lows, the MACD is not corroborating these lows, suggesting a lack of selling pressure.

However, this is not a significant enough indication on its own to dissuade us from our central case that the exchange rate will continue to trend lower.

Analyst Lillian Lillicrap at Associated Foreign Exchange has also consulted the charts, but from a longer-term perspective.

She notes that, "the effective angle of descent has hitherto remained somewhat shallow with regular reactions a feature but this negative sequence will probably accelerate at some point."

Lillicrap has long been bearish on Sterling's technical prospects against the Euro, and recent price action in the exchange rate would suggest her expectations are playing out.

"If prior/notable 1.0950 lows give way an extension lower cannot be ruled out thereafter and only a weekly close back above 1.1500 first/next postpones this outcome," says Lillicrap.

Get up to 5% more foreign exchange by using a specialist provider. Get closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Key Data for the Euro

The main data release for the Euro this week are the just-released PMI data.

PMI’s are surveys which measure activity within a given economic sector.

As detailed above, the numbers disappointed somewhat and serve to suggest that growth in the Eurozone might be stabilising, albeit at high levels.

In France, the services PMI slipped from 56.9 to 55.9 (mkt 56.7), while in Germany the manufacturing PMI fell from 59.6 to 58.3.

"Most of the commentary from the reports was of the tone that the sub-indices had come off of their multi-year highs but are still at very healthy levels. Of note, there was no indication that the stronger euro was a concern so far," says Jacqui Douglas, Chief European Macro Strategist with TD Securities.

Apart from PMI data the only other major release is the IFO sentiment gauge for Germany.

The IFO is based on surveys with business professionals.

The gauge measures their view of the current situation as well as their outlook for the medium-term.

It is expected to result in a slight dip in sentiment in July.

This shouldn’t impact adversely on the currency.

Key Data for the Pound

GDP is expected to continue trundle along at sub-par levels around the 1.5-2.0% mark which we have grown accustomed to in 2017.

The first set of estimates for growth in the second quarter are released on Wednesday July 26 at 9.30 BST, and are likely to be the most significant release for the Pound in the week ahead.

They are currently expected to show a slightly slower 1.7% rise in GDP in Q2 compared to a 2.0% rise at the same time last year (in Q2 in 2016).

Such a result will pull growth down to the lower boundary of the current GDP growth rate range.

Quarter-on-quarter, growth in Q2 is likely to be 0.3% higher than it was in Q1, when it was only 0.2%.

The other release of note is Mortgage Approvals in June, from the British Banking Association (BBA).

These are also out at 9.30 on Wednesday July 23.

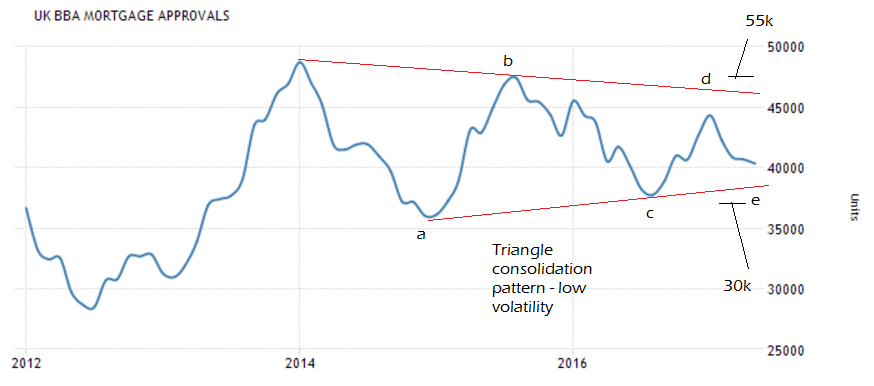

Mortgage Approvals have been oscillating in a subdued range for years since the great recession as illustrated in the graph below.

They have, however, formed an interesting triangle pattern over the last few years which provides clues of what might happen next.

Triangles almost always a precursor of periods of high volatility, and although we can’t tell which way the volatility will extend, it is highly probable there will be either a large swift spike higher or lower in the data.

The triangle has probably almost finished as it has formed 5 component waves - a,b,c,d,e - which is the minimum number to prove completion.

For confirmation, we would be looking for a move above 47,500 in an upside break; or below 37,000 in a downside break.

Using the height of the triangle at its widest as a guide we forecast a post-break volatile spike of about 8,000 -12,000 approvals higher or lower, so assuming the previously mentioned levels are breached, the upside target is 55k level and the downside 30k.

Given housing is such a key leading indicator for the economy this may be a key early warning for the general health of the economy going forward and thus the Pound.

A spike lower in approvals would probably drag down Sterling and vice versa for a spike higher.