Techs: GBP/EUR Forecast to Gain Over Short-Term

Pound Sterling is seen advancing against the Euro at the start of the new week.

The gains come in line with our week-head forecast that suggested the pair should enjoy some near-term strength.

At the time of writing 1 GBP = 1.1493 EUR, while 1 EUR = 0.8743 GBP.

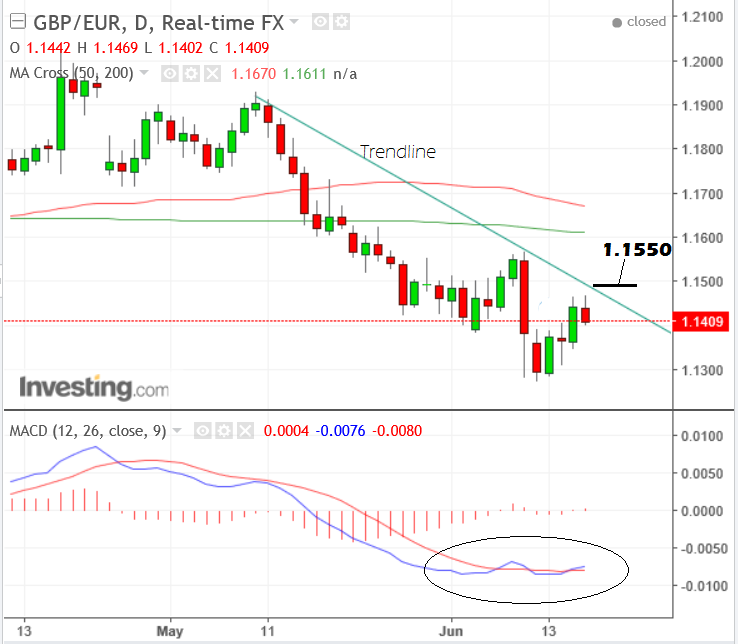

The Pound to Euro exchange rate has risen up to almost touch a down-sloping trendline.

Our short-term technical studies of the market's structure leave us positive and we believe there could be some more upside, at least in the immediate future.

This is not a conviction call owing to the outsized influence a fast-changing political landscape has on the currency.

We observe the MACD momentum indicator is forming what looks like a bullish ‘double bottom’ reversal pattern.

If it moves above the -0.0069 neckline it will be a very positive signal for the pair as it would suggest momentum has turned positive and further follow-through is therefore possible.

On the four-hour chart the pair has already established a mini-uptrend composed of a rising sequence of higher highs and lows.

We expect this to extend up to the level of the downtrend line at 1.1475.

At the trendline it will probably stall, and possibly pull-back, given it would be expected to come under more selling pressure.

We would ideally wish to see a clear break above the trendline to expect an extension of the mini-uptrend – this would be confirmed by a move above the 1.1475 level.

Such a move would probably reach 1.1550 initially, and then even higher afterwards.

Data and Events to Watch for the Pound

There are no major data releases due so the main event of the week will be the start of Brexit negotiations on Monday, June 19.

Britain's Brexit minister David Davis and the European Union's chief negotiator Michel Barnier will start negotiating Britain's departure on Monday, starting a two-year divorce process due to end by March 2019.

Major issues that will be discussed, include, the size of a "divorce" bill, how the U.K. will trade with the EU once it leaves, and the status of EU nationals and Britons living in the EU.

Markets now assume British Prime Minister Theresa May's failure to secure her party a majority will lead to a softening of the government's Brexit stance with a greater priority being placed on securing a closer trading relationship with the EU.

Fighting for her political survival, May has been trying to strike a deal with the Democratic Unionist Party, but there is still little clarity on the status of the relationship, although currently it appears to be along the lines of a loose coalition.

Following Thursday's surprisingly hawkish MPC debate, where 3 members voted for a 25bps hike in rates and where the minutes took a hawkish tone, "markets will be on the lookout for any comments from BoE officials. Note that Governor Carney’s postponed Mansion House speech will be rescheduled," says Victoria Clarke at Investec.

The week will likely be dominated by politics once again, particularly so given that the economic data calendar is very quiet.

The domestic focus will be on whether the Conservative Party reaches a final deal with the DUP over a confidence and supply agreement, which would provide the government with a narrow majority in the House of Commons.

Reports this week have suggested that a deal between the two parties was close, but that due to the tragic fire at Grenfell Tower a conclusion would be delayed until next week.

Also due next week is the Queen’s Speech which has been rescheduled to Wednesday.

Data and Events for the Euro

It is a light week for Eurozone data with the European Central Bank (ECB) revealing their current thinking on the economy within their latest monthly Economic Bulletin released on Thursday at 09.00 BST.

Then Friday see’s the release of preliminary Purchasing Manager data (PMI) on manufacturing and service sector activity for May at 09.00 BST, amid expectations for a modest decline.

Ahead of Euro zone PMI's, France and Germany will release their own PMI reports at 08.00 BST and 08.30 BST respectively.