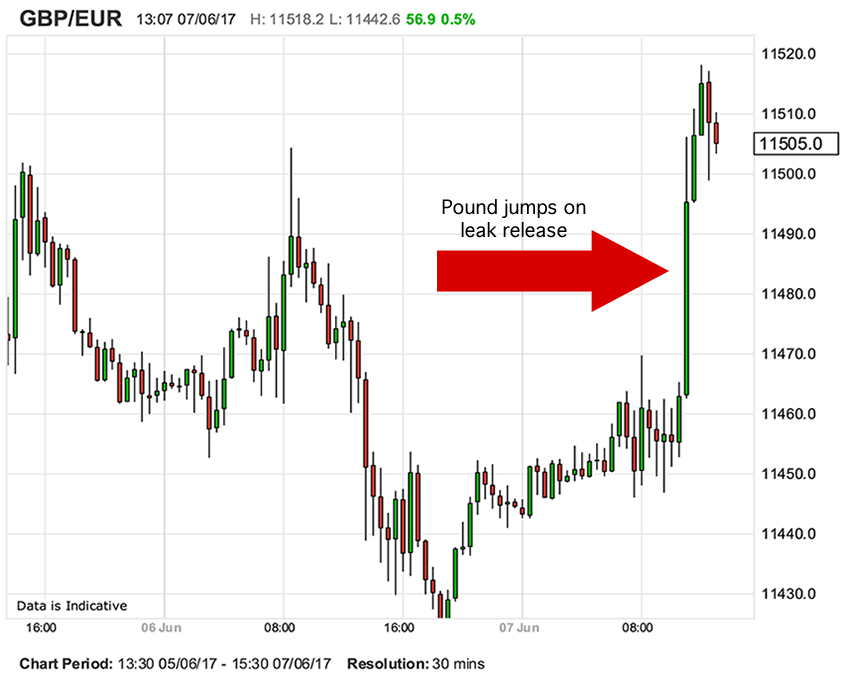

Leaked ECB Forecast sends GBP/EUR Exchange Rate 0.5% Higher

Above: Speculation that ECB President Mario Draghi would announce the Bank is heading towards ending its money-printing programme on June 8 has been quashed by a leaked inflation report.

The Euro exchange rate complex was seen to be under notable pressure following a leaked report report that the European Central Bank (ECB) is to cut inflation forecasts at its Thursday, May 8 meeting.

We have been warning readers to remember that it is not just about the UK election this week - we have the ECB’s June rate meeting to contend with on June 8.

This month’s meeting is important as markets are expecting the ECB to announce changes to its economic forecasts and potentially shift its tone on future policy.

The Euro was seen as the best-performing currency amongst the G10 for 2017 on expectations that the ECB would soon announce it is to wind down its programme of printing money.

Indications of higher interest rates are also expected.

However, this air of optimism has been punctured by suggestions inflation forecasts are to be downgraded.

The whole premise that the ECB is to raise rates and end its programme of money-printing relies on the assumption that the Eurozone inflation is rising in a sustainable manner towards the Bank’s 2% target.

#EURUSD slumps after #ECB draft cuts inflation forecasts for 2019

— David Morrison (@David_SpreadCo) June 7, 2017

What has Happened?

Bloomberg report that - “an official familiar with the matter” - says the ECB’s draft projections show inflation at roughly around 1.5% each year in 2017, 2018 and 2019.

The previous projections in March foresaw rates of 1.7%, 1.6% and 1.7%, respectively.

On the back of the news the Euro was seen down half a percent against the Dollar and Pound and only SEK is doing a worse job today.

This suggests that the ECB is unlikely to strike the bullish tone that many who had been speculating on a stronger Euro had hoped for.

The currency must therefore correct lower.

“Headlines suggesting that the ECB will revise its inflation forecast lower through 2019 suggests that the hawks will struggle to make the case for an early normalization of the ECB’s policy settings,” says Shaun Osborne at Scotiabank. “The EUR is under-performing in the wakes of the news.”

Mark McCormick, North American Head of FX Strategy at TD Securities meanwhile expects the EUR/USD to fall below 1.10 again. But this should represent a good opportunity for buyers to step in:

"Recent headlines have also suggested the ECB may lower their inflation forecasts across 2017-2019, potentially watering down a hawkish message. This is likely to keep a lid on bund yields and could weigh on EURUSD. We have been highlighting how EUR looks ripe for a correction with HFFV below 1.10.

"Still, we remain strategic buyers of dips and would reload below 1.10."

Shahab Jalinoos, a research analyst with Credit Suisse will be adopting a similar strategy on any Euro weakness.

"We would look to buy EUR on dips, in line with our forecast profile and outstanding trade recommendation, as the underlying trend is likely to remain intact if the market simply rolls these outcomes forward to September," says the analyst in a briefing to clients released on June 7.

Credit Suisse have recommended a trade that seeks to profit on the Euro's advance against Pound Sterling.

They forecast EUR/GBP at 0.88 in three months and 0.90 in twelve months.

This equates to 1.1364 and 1.11 in Pound to Euro terms.

At the time of writing the Euro to Pound exchange rate is quoted at 0.8692, and GBP/EUR at 1.1503.