EUR / GBP Outlook: Morgan Stanley Eye Breaking of £0.90

Expect the Euro to make further gains against the British Pound say analysts at one of the world’s largest investment banks.

“We are buyers of most EUR crosses, helped by currency unhedged equity market inflows into the Eurozone and a market perception that political risks have reduced,” says Morgan Stanleys chief analyst Hans Redeker of the EUR/GBP exchange rate's prospects going forward.

The call from Morgan Stanley comes amidst a period of outperformance by the Euro which is the best-performing of the world’s ten major currencies for 2017 as foreign exchange markets increasingly anticipate a bout of interest rate rises at the European Central Bank in the not-too-distant future.

The EUR/GBP exchange rate is currently seen at 0.8679 having been as low as 0.8313 in March thanks to a wave of positive momentum witnessed of late.

This makes for a current Pound to Euro exchange rate of 1.1522 which is down from highs just above 1.20.

Global investors are pouring large amounts of capital into Eurozone investments on the back of the region’s strengthening economic recovery and faded political risk environment.

According to Morgan Stanley investors are not taking out insurance against the Euro weakening, which in effect means they are not hedging by selling Euros when buying stocks, and this is supportive.

Macron’s win in France was a game-changer for the single currency as it removed the political risk of the Eurozone breaking apart.

The gap in EUR/USD which opened after the first round of the Presidential elections in April, and has still not been filled, bears graphical testament to the unburdening of political risk from the currency’s valuation matrix.

The Euro is now free to appreciate as long as growth in the region continues.

On the Pound Side...

In the UK, meanwhile, the outlook is hampered by political risks and lingering uncertainty on the Brexit process.

Theresa May now looks less likely to win a landslide majority which she needs to empower her in Brexit negotiations.

But even if she gets it, she will have difficulty in negotiating a middle-way given the extreme opposite positioning of the EU and her government’s stances on freedom of movement, for example, or the cost of Brexit.

We see further weakness for the Pound as the realisation a hard Brexit cannot be avoided sinks in, which could bring the exchange rate back down to the extremely low levels associated with hard Brexit fears in the autumn.

However, Morgan Stanley also allude to the fall in consumption in the UK as a further headwind for the Pound.

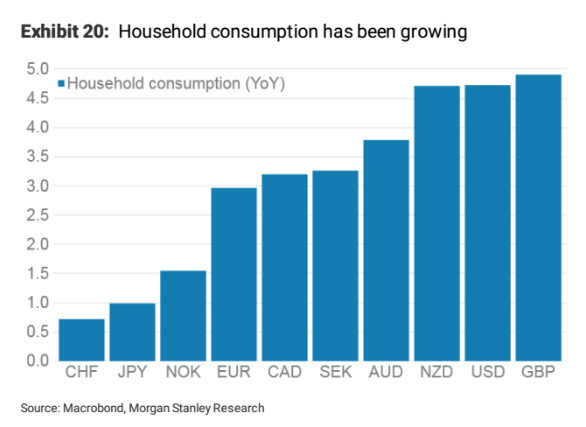

“On the GBP side, the rapid currency rally driven by perceived political stability has stalled. At the same time, consumption-related data isn't as strong as before. The chart shows that the UK has seen the fastest rise in consumption over the past year, suggesting it is unsustainable now that real wages are negative,” says Redeker.

This could offer the Pound a way back against the Euro.

Morgan Stanley are forecasting the EUR/GBP to reach 0.92.

This makes for a GBP to EUR conversion of 1.0869.

Elsewhere, Manuel Oliveri, an analyst at Crédit Agricole CIB agrees that the outlook for the Pound is now balanced to the downside.

“GBP buying interest rose marginally last week, regardless of spot hitting multi-week lows. As such it seems that speculative oriented investors have continued to buy the dip. With positioning now more balanced, we believe currency downside risks remain, especially as political uncertainty is high still,” says Oliveri in a noted dated May 30.

Euro Follow Through? Watch Inflation Data

Those banking on a strong follow-through higher for the Euro against the Pound, however, should be wary of falling into a trap of expecting a smooth ride.

Indeed, our expectations for a short-term rebound in the oversold Pound to take place at the start of this week appears to be accurate.

For more upwards propulsion investors will want to see the European Central Bank unwind their extraordinary stimulus measures and ‘normalise’ monetary policy, with the goal of eventually raising interest rates as conditions improve.

Yet for this to happen they will want to see core inflation rise from its current circa 1.0% level.

With that in mind we will be watching the release of Eurozone inflation data midweek.

Classical economic theory assumes that when employment rises so will wages and then inflation, yet this model does not appear to be working as it would normally in the current recovery.

“For some reasons, core inflation has recently been exceptionally slow to respond to the declining negative output gaps. One of the surprises has been experienced in the labour market. As we wrote half a year ago, the wage increases in the Euro area have been lower than expected even if improvement in employment has exceeded expectations. The ECB, for example, has been forced to revise its forecasts on compensation of employees continuously downwards,” says Nordea Bank’s Tuuli Koivu ahead of the inflation release.

The Nordea analyst is sceptical about the link between inflation and employment, otherwise known as the Taylor Rule.

“Even if wage increases become larger, the link between wage increases and core inflation is not straightforward. Especially, the causality may not be running from higher wage increases to higher inflation but actually to the opposite,” she says.

Germany has had exceptionally low unemployment for years now, for example, and yet this has not resulted in runaway inflation as a result of wage inflation.

“The relationship between wage increases and core inflation seems to be particularly opaque in Germany where core inflation has remained nearly constant irrespective of changes in pay rates since 2012. Overall, wage increases in Germany have remained surprisingly low despite the record-low unemployment rate, probably due to weak productivity development,” said Koivu.

So although this does not preclude Morgan Stanley’s forecast for EUR/GBP to be reached, we need to consider carefully how sustainable the gains made in EUR/GBP are in the long-term.

If inflation in the Euro-area fails to move higher the necessary shift in policy at the ECB for a sustained Euro rally might not be forthcoming.

Draghi Dents Euro

The Euro was broadly steady but below recent six-month peaks against the greenback.

The Euro descended at the start of the new week across the board, hitting a May 19 low against the Dollar, after ECB chief Mario Draghi on Monday sketched a steady outlook for monetary policy and political worries related to Italy, home to the bloc’s No. 3 economy, returned to the surface.

Reports indicated that Italian voters could head to the polls as soon as this summer.

Politics remain a hot button issue for currencies, contributing to recent falls in the U.S. and U.K. currencies.

Sterling Finds Footing after Horrible Week

Sterling firmed after shedding nearly 3 cents last week which amounted to the U.K. currency’s worst week since February.

Upside for the Pound is seen more limited after recent opinion polls indicate a shrinking lead for front runner Theresa May in next week’s national vote on June 8.

“Sterling had soared some 4 percent after Mrs. May in mid-April announced Britain would hold snaps elections to try to tamp down on deep divisions in Parliament and coalesce the nation around more of a singular Brexit strategy. Sterling will remain vulnerable to anything that suggests Mrs. May a landslide victory is fading from view,” says Joe Manimbo, an analyst with Western Union.