Euro’s Strength vs Pound Sterling Forecast to Stall

Analyst Karen Jones at Commerzbank says the Euro's impressive advance against the Pound could be about to fade.

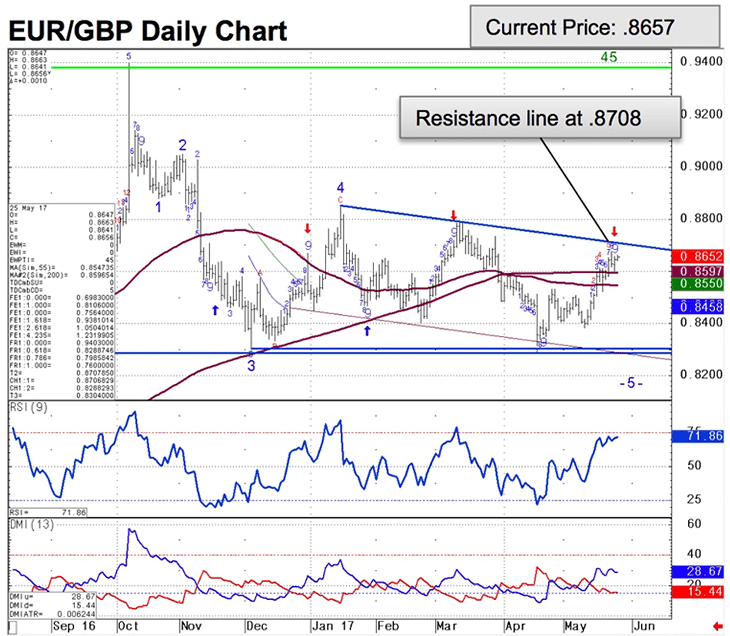

The EUR/GBP currency pair has been in an uptrend against the Pound through the course of May, but this could be as good as it gets.

Studies conducted by the technical analyst - Jones draws clues on future direction from the structure of the market - shows that the EUR/GBP uptrend could be about to stall.

“EUR/GBP is bid but is expected to stall ahead of the 2017 downtrend at 0.8708,” says Jones in a briefing to clients dated May 25.

This area equates to 1.1483 in Pound to Euro terms.

At the time of writing the Euro to Pound Sterling rate is at 0.8652 and the Pound to Euro at 1.1559.

So there is a little room to run yet for the European unit.

“EUR/GBP has extended gains towards but is showing signs of failure ahead of the 2017 channel at 0.8708. This was expected to hold the topside anyway,” says Jones.

Readers hoping for a stronger Pound should however not confuse this analysis with the suggestion Sterling is about to embark on some kind of big recovery.

For evidence of such a shift Jones wants to see the exchange rate fall below the 200 day moving average at 0.8596 to negate upside pressure.

This equates to a move back above 1.1731 in GBP/EUR terms.

“Last weeks low at 0.8524 guards the 0.8383 May low and failure here will retarget key support at 0.8334/04. If slipped through, the 0.8252 the July 2016 low would be in focus,” says Jones.

If Jones is wrong and the Euro does not stall at 0.8708 then there is the chance that the EUR/GBP rate can run up to the January high at 0.8852.

This equates to 1.1297 in GBP/EUR.