Analysts: ECB will Keep GBP/EUR Rate Under Pressure

- Foreign Exchange Quotes:

- Pound to Euro exchange rate: 1 GBP = 1.1580 EUR

- Euro to Pound Sterling exchange rate: 1 EUR = 0.8635 GBP

The Pound to Euro exchange rate is forecast to fall for the duration of Brexit negotiations as monetary policy is set to tighten at a faster pace in the Eurozone than in the UK.

This is the view of analysts at ING Bank N.V who have pointed out there should be a pro-EUR and negative-GBP divergence in central bank policy over the duration of Brexit negotiations.

To tighten means to raise interest rates and withdraw extraordinary measures such as quantitative easing which involves the buying of government and corporate bonds.

Analysts at the bank tell clients they see the European Central Bank (ECB) winding up their bond-buying programme by 2018 and increasing interest rates by 0.25% in Q4 of 2018, whereas in the UK they don’t expect the Bank of England to raise interest rates for the duration of Brexit negotiations.

The negotations are likely to extend until February 2019.

Recall, the difference in interest rates between two countries has a significant impact on the flow of capital between the two countries as investors seek out higher yields. This of course has an impact on the demand for currencies.

Thus, higher interest rates and higher interest rate expectations in the Eurozone = a stronger Euro.

The Pound to Euro exchange rate is therefore seen falling under the scenario envisaged by ING.

ING are watching EUR/USD and we expect EUR/GBP to take a lead from this headline pair as is often the case.

The Euro / Dollar exchange rate is expected to rise in two ‘jumps’ – the first when the ECB announces that it is going to cut down its bond buying program, or ‘tapering’ as it is known, probably in September.

Some analysts warn that the call might come as early as June though.

The second move higher will come when it actually raises interest rates which ING believe will be around mid-2018.

They do not see a rate hike from the Bank of England however, as growth remains dampened during the Brexit talks.

They do not see a rate hike from the Bank of England however, as growth remains dampened during the Brexit talks.

This should ensure the same upward forces pushing the Euro higher over coming months will be absent from the Sterling complex.

ING do not expect the Bank of England hiking interest rates before 2019 because of a combination of three factors – a rise in the cost of living, slow wage growth and the fact there will be one less hawkish member of left at the BOE once Kristin Forbes has left.

Forbes was the only member of the BOE monetary policy committee to vote for a rate hike at the last meeting, however, she is set to leave this summer.

ING are forecasting EUR/GBP at 0.85 at the end of 2017, this equates to GBP/EUR at 1.1765.

Others agree with the notion that central bank policy should aid the Euro and keep the Pound subdued.

"We expect central bank monetary policy expectations to remain capped and such prospects should leav any GBP upside limited," says Valentin Marinov, Head of G10 FX Strategy at Credit Agricole.

Credit Agricole are forecasting the EUR/GBP to end the year at 0.87, which would mean a GBP/EUR exchange rate of 1.1494.

>> Update: Best international payment rate on GBP / EUR now seen at 1.1549, your bank is likely to be offering a rate in the region of 1.2346 to 1.1328. More details here.

Watch: ING on why it is "game on for the Euro":

This reinforces the view that from a technical perspective the pair appears to be in strong position for further gains.

Technical analysis is the study of price action, volume and market positioning, and can provide a more objective concrete basis for analysis and forecasting.

The main feature currently of interest on the EUR/GBP chart is that the pair has broken above a major trendline, which is a very bullish sign.

“EUR/GBP has recently eroded its 7-month downtrend and the market is probing the 200-day ma at 0.8597, but not yet managed to clear this level,” says Commerzbank’s technical analyst Karen Jones in a recent note to clients.

Jones says risks have shifted higher and above here the market should not bother the Pound until the top of the 2017 channel at 0.8714.

Jones says risks have shifted higher and above here the market should not bother the Pound until the top of the 2017 channel at 0.8714.

EUR/GBP at 0.8714 equates to 1.1475 from a Pound to Euro exchange rate perspective.

Pound Higher on Strong Economic Data, But Data Pulse Weakens

It should be mentioned that the ING note was written prior to the release of surprisingly strong Retail Sales data for April which shows a marked rise in consumer spending.

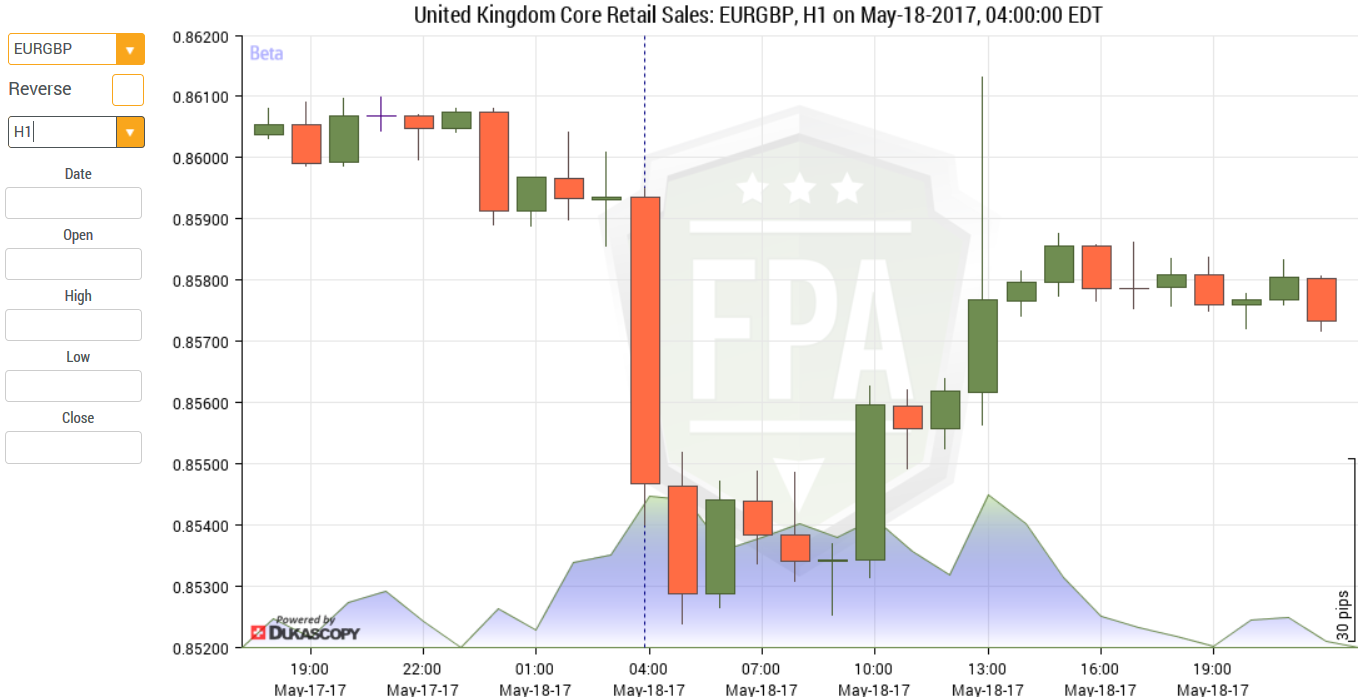

The data led to the Pound rocketing higher versus most currencies, although it is pertinent to note how the initial fall in EUR/GBP – though deep - was remarkably short-lived unlike in other pairs such as GBP/USD.

The one hour chart of the pair below graphically illustrates this point as it shows the losses – illustrated in the long red down candle immediately following the release – were reversed within only 9 hours of the release.

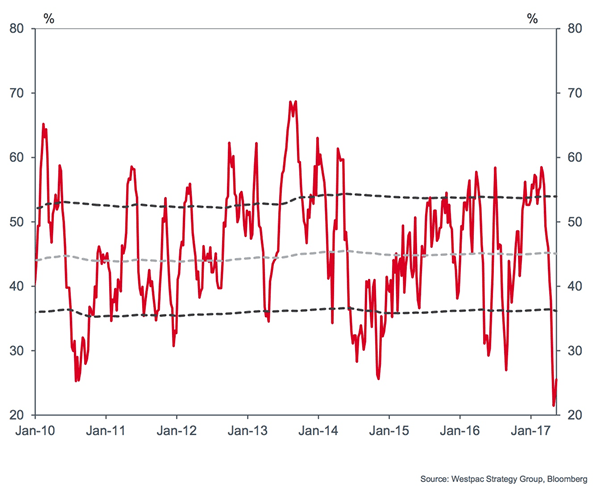

More broadly, UK data continues to slow and disappoint against analyst expectations.

Westpac’s UK data pulse has dropped sharply over the last few weeks; the data pulse is a % of data stronger than the previous release in a rolling 8 week window:

If the pulse starts to revert to mean again then perhaps the Pound will find support?

This could well be the case but we will only get a sense of how the economy is faring heading into the mid-year period with the month of June when the next savlo of economic releases are fired.