Buy the Euro, Sell Pound Sterling say Soc Gen

The British Pound to Euro exchange rate has underperformed significantly over the course of the past week, and is likely to continue doing so we are told.

A trend for further weakness in Sterling against the Euro is expected to continue according to analysts at Société Générale whose forecasts both from their technical and their fundamental strategists indicate a greater likelihood of more upside for the pair.

Valuation

One reason the market has become more constructive for the Pound recently is its extreme undervaluation versus other currencies.

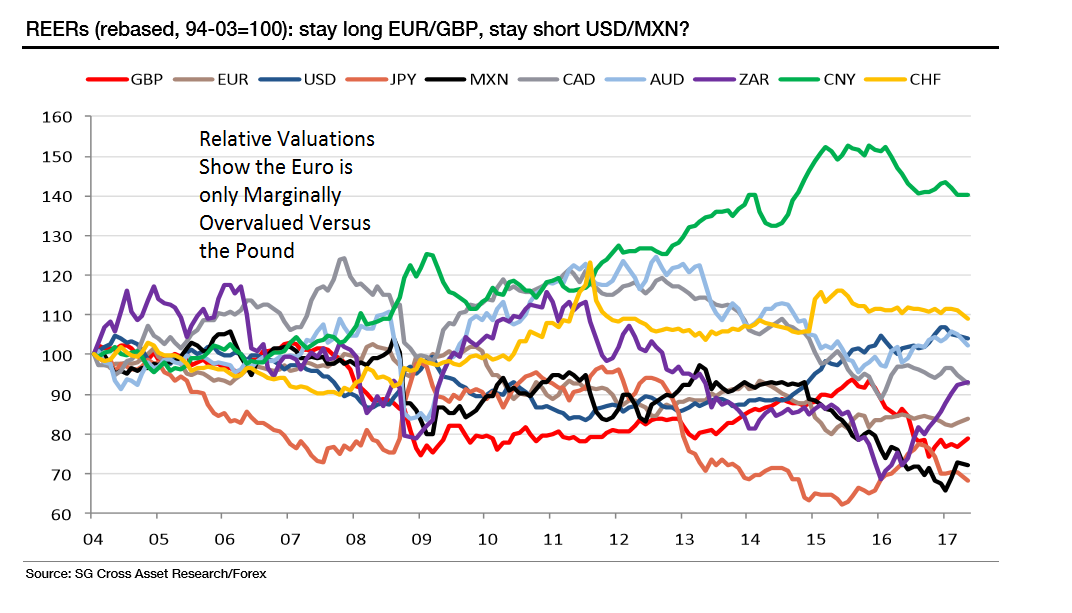

But Soc Gen note how long-term valuations suggest the Euro is actually only marginally overvalued compared to the Pound.

If the Euro – like the Dollar – was more overvalued there would be greater pressure for the Pound to rise and close the gap, however, given this is not the case in EUR/GBP, they retain a bullish outlook.

“And sterling remains at its lowest levels since the 1980s, but not that much lower than the euro. This is why long EUR/GBP still looks much more attractive to us than short GBP/USD,” said Kit Juckes in his analysis of the pair.

Another consideration is why the Pound is so undervalued, which seems to be because of the heavy weight of Brexit risk it is bearing, and which is highly unlikely to go away anytime soon given the uncertainty over Brexit negotiation outcomes.

Technicals Hint at Euro Strength vs the Pound

SocGen are also bullish from a technical perspective, arguing that the current choppy consolidation period is really just a precursor to more upside.

The pair is in a medium uptrend without any strong signs of reversal.

SocGen’s analysts argue that the pair has formed a triangle pattern the base of which at 08360 is a key level for the pair.

SocGen’s analysts argue that the pair has formed a triangle pattern the base of which at 08360 is a key level for the pair.

A break below would change the bullish tenor of the chart, but whilst the exchange rate remains above, they too stay bullish.

“EUR/GBP has been undergoing a choppy consolidation roughly within the January/March high of 0.88 and the graphical support of 0.8360/30, which also corresponds to the base of a multi-month triangle. This remains a key level, and only a break below will indicate the possibility a larger down trend. In the short term, the pair is likely to recover towards 0.8610, the 61.8% retracement from the March high, with the next hurdle at 0.88,” said SocGen’s Stéphanie Aymes.