Euro up on ZEW Survey Beat

- Euro to Pound Sterling exchange rate: 0.8536

- Euro to Dollar exchange rate: 1.0614

- Pound to Euro exchange rate: 1.1716

The Euro was seen outperforming the Pound and US Dollar following the release of better-than-expected data out of the Eurozone on Tuesday, April 11.

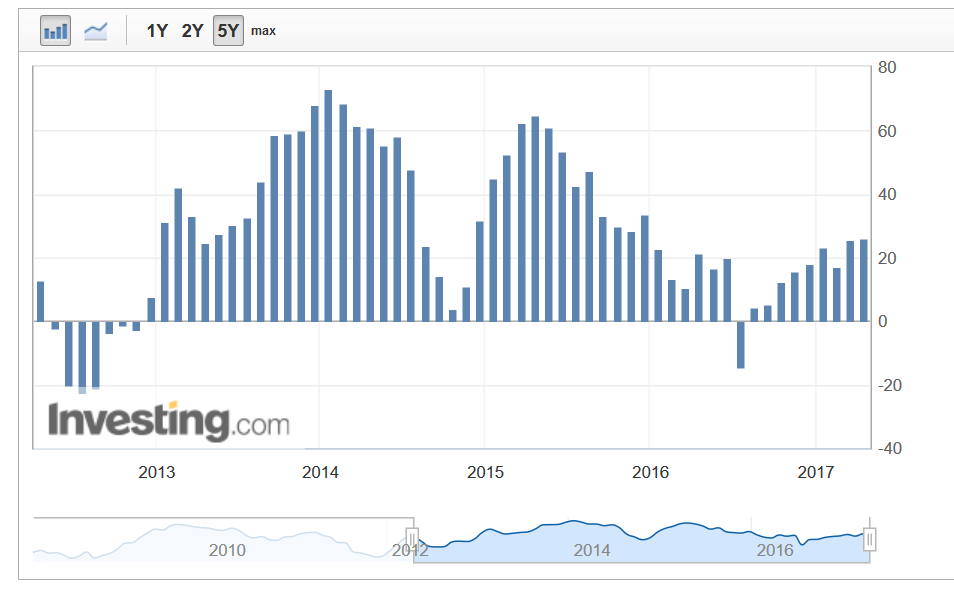

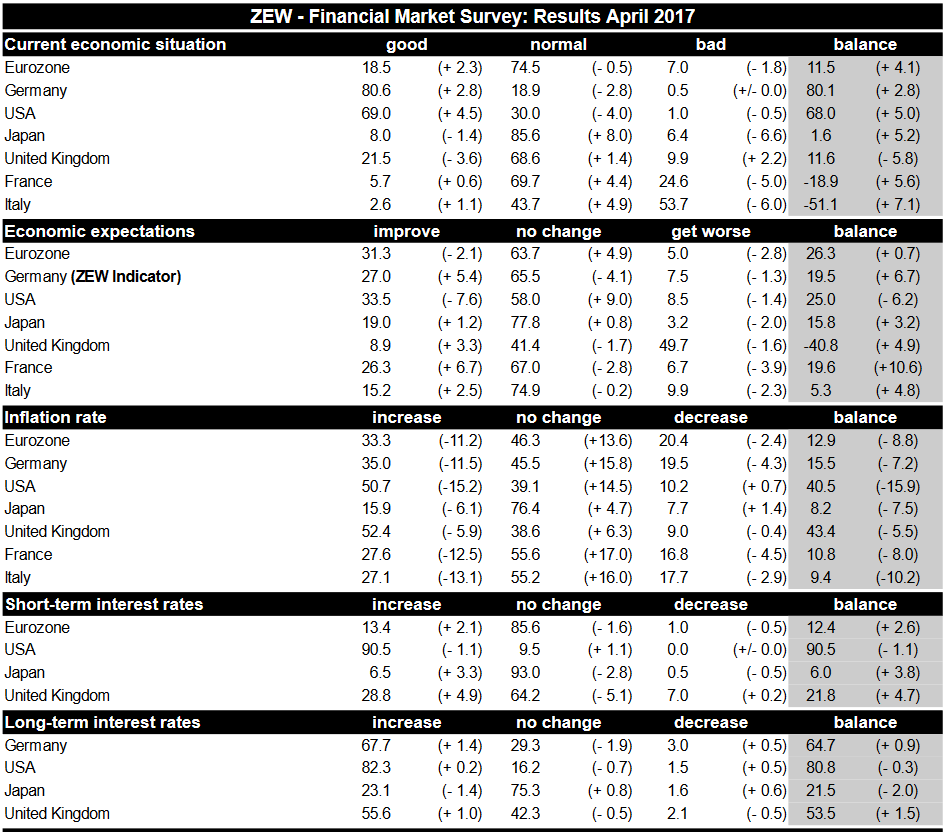

The ZEW Sentiment survey, which asks 300 financial experts for their views on the outlook for the Eurozone economy, showed a rise in the balance of positive responses versus negative responses, to plus 26.6 in April from +25.6 in March.

The market had expected the survey to show a moderate fall to 25.0.

The Euro rose marginally on the back of the data, with EUR/USD increasing by about a tenth of a cent to 1.0615 from 1.0605 before the release.

Against the Pound the Euro rose to a high of 0.8549.

The survey showed a 4.1% rise in positive responses for expert’s assessments of the “Current Situation” in the Eurozone to +11.5.

The number of respondents expecting inflation to rise, however, fell by -11.2%, although expectations for interest rates remained positive and even showed marginal gains.

Sentiment improved markedly for France and to a lesser degree Germany.

Economic expectations in France lifted by 6.7% in the number who thought they would “improve” reaching +26.3%. The balance rose from +10.6% to +19.6%.

Germany Economic Expectations also rose strongly by 6.7% to a new balance of +19.5%.

The ZEW is respected as a reliable leading indicator for financial markets and the economy.

Industrial Production Slows Down

Other European data out on Tuesday morning showed Industrial Production in the Eurozone slowing down more than analysts had expected.

Although Europe’s industrial sector rose by 1.2% in February it still fell below expectations of 2.0%.

The European Union's statistics office Eurostat said on Tuesday that industrial production in the 19-country single currency bloc rose by 1.2 percent year-on-year and fell by -0.3% month-on-month.

Strategists had forecast a 0.1% rise in February data from that of January.

The decline was blamed on a sharp fall in energy production, dampening prospects for robust economic growth.

January's output numbers were also revised lower to 0.3 percent month-on-month from an initially reported 0.9 percent and to 0.2 percent year-on-year from the 0.6 percent published a month ago.

The tepid production numbers contrasted with the more bullish ZEW sentiment indicators.

“At a national level, industrial production in Germany, the bloc's largest economy, grew by 0.8 percent, and in Italy by 1.0 percent.

However, it fell in France and Spain, by 1.6 and 0.3 percent respectively,” said a report on investing.com.

The data was disappointing, said Broker Xtrade’s Paul Siriani, adding: “Despite figures released today showing Europe’s industrial sector has recovered to 1.2% in February, they’ve still fallen far below expectations.”

However, he saw broader geopolitical issues as affecting markets more in the short-term:

“Away from the release of financial data, rising geopolitical tension looks set to govern European markets in the short term.”

A late surge by Marine Le Pen in French election polls also weighed on European markets and the Euro currency.

“The Euro suffered a disappointing start to the week amid concerns over the looming French election. With the polls showing Marine Le Pen is a genuine contender, the single currency is likely to remain an unattractive investment,” says Sirani.