GBP/EUR Exchange Rate: Inflation, Employment Data to Take Centre Stage as Brexit Takes an Easter Break

- Written by: Gary Howes

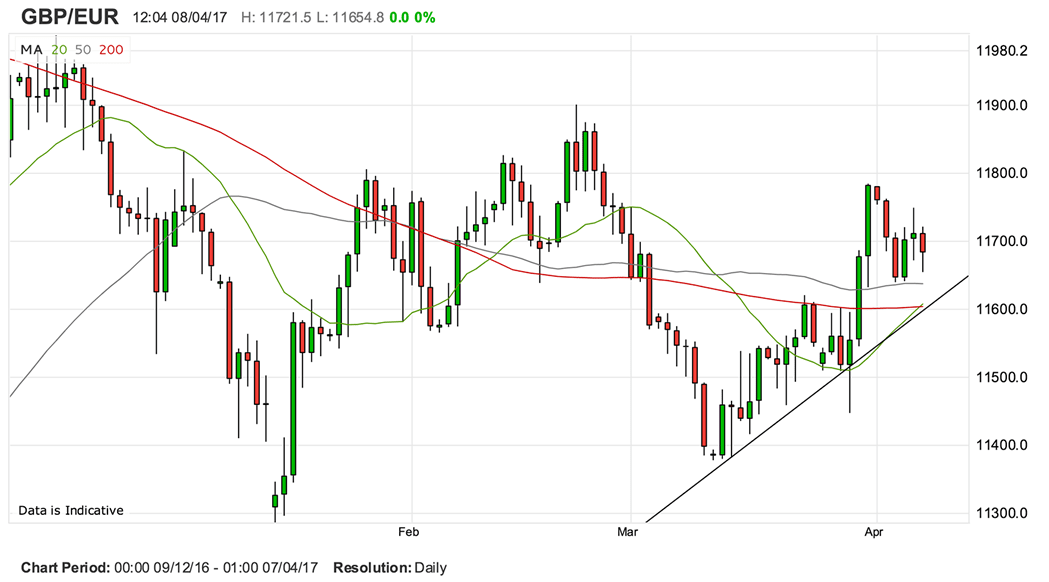

The GBP to EUR exchange rate ended the week virtually unchanged having closed at 1.1677. It hit a best at 1.1781 and saw a low of 1.1639 - this 142 pip range represents the tightest range of trade experienced since December 2016.

The inability to move either higher or lower is symptomatic of the broader quagmire that has befallen the Pound Sterling complex over recent days.

The tabloids are now full of daily reports of the Pound either SURGING or PLUMMETING when the currency has hardly moved. But then again, these sites are just after your clicks.

Traders are simply not looking to take the currency higher in the face of expected uncertainty posed by upcoming Brexit negotiations; neither are they willing to keep betting against a currency that is clearly one of the most oversold and undervalued currencies in the world.

In short, the Pound is too cheap relative to the economy’s performance.

But, there is the chance that big moves lie on the horizon, often static markets build up latent pressures that culminate in a big breakout. What should readers be watching going forward?

This is What Could Move the Exchange Rate Over Coming Days

“In the run up to Easter, we suspect we will see a relatively quiet period for political news, with few top tier political events,” says Victoria Clarke at Investec in London. “With the Easter holidays approaching and with UK Parliament in recess, there is likely to be little by the way of major developments in Brexit talks over the coming week.”

Luckily, for those looking for the Pound to move we have some big data events ahead.

“With fewer political happenings, data will likely move to the fore next week,” says Clarke. “In the UK, data is likely to take centre stage too.”

CPI inflation figures for March are due out Tuesday morning; markets expect to see inflation at 2.3%, unchanged on the previous month’s reading.

Should inflation beat expectations we would anticipate the Pound to move higher and potentially break towards the top of recent ranges against the Euro and Dollar.

But we think the core CPI reading will be more important as this presents a better reflection of the underlying strength of UK economic activity and is therefore the figure that would most likely interest decision-makers at the Bank of England.

Markets are forecasting core CPI to read at 1.9%, a little softer than the 2.0% reading seen in the previous month.

Again, should this number beat expectations then look for the Pound to jump.

Labour market data is the next big data event foreign exchange traders will be keeping an eye on and is due for release at 09:30 on Wednesday, April 12.

The claimant count is expected to fall by 3K while the unemployment rate is forecast to remain static at 4.7%.

But watch average earnings data as this is what gives a really good gauge as to the health of the economy and the potential spending power of the UK consumer.

Average earnings with bonuses included is forecast to publish at 2.2%, unchanged on the previous month’s reading.

If the figure comes in higher we would imagine the Pound will move accordingly and we would watch for the GBP/EUR exchange rate to edge up towards the 50-day moving average 1.1841.

Disappointment will likely be punished and we would anticipate GBP/EUR falling back towards 1.14.

What of the Euro?

In the Euro area, the week will open in the wake of the Eurogroup discussions on Greece, amongst other things.

“We would be very surprised to see Greece’s latest bailout review signed off this weekend however,” says Clarke.

On the data front next week, key releases to watch out for will be EU19 industrial production for February due on Tuesday, Germany’s ZEW survey for April also due on Tuesday.

Industrial production is forecast to read at 0.1% and the ZEW economic sentiment at 14.0.

Final German inflation figures for March are released on Thursday, April 13 and will confirm whether or not the ECB’s monetary policy is working.

If the expected figure of 0.2% is beaten (1.6% annualised) then the Euro could catch a bid.