Pound to go Below 1.11 vs Euro Warn Societe Generale

- Written by: Gary Howes

- Pound to Euro exchange rate reference: 1.1685

- Euro to Pound exchange rate reference: 0.8559

The British Pound is undervalued but will get even cheaper before the year is out argues a new analysis released by French investment banking giant Societe Generale.

This prognosis on the Pound's outlook is therefore not one those hoping for a stronger currency would like to hear.

The reasons for Societe Generale’s belief Sterling faces more notable downside against the Euro lie largely with the ECB.

This in itself is quite refreshing at a time the discussion of the Pound’s future is dominated almost exclusively by talk of Brexit.

This in itself is quite refreshing at a time the discussion of the Pound’s future is dominated almost exclusively by talk of Brexit.

We are told by analyst Kit Juckes that a big move in the EUR/USD exchange rate and/or a major shift in UK economic data will propel the Pound on its next big journey.

The ECB will limit bond purchases which will in the process push up yields in the Eurozone which will in turn attract investor inflows and demand for the Euro.

The call comes as the Euro is seen falling amidst news reports that the ECB is unhappy with the recent rising of bond yields and the Euro which suggests this hypothesis has its risks.

“Eventually, I think we’ll see the ECB further slow the pace of bond purchases and trigger the repatriation of savings towards Europe, which will send EUR/USD higher and take EUR/GBP through 0.90 in its wake, or new evidence of UK growth slowdown,” says Juckes.

An exchange rate of 0.90 on EUR/GBP equates to 1.1111 in Pound to Euro terms.

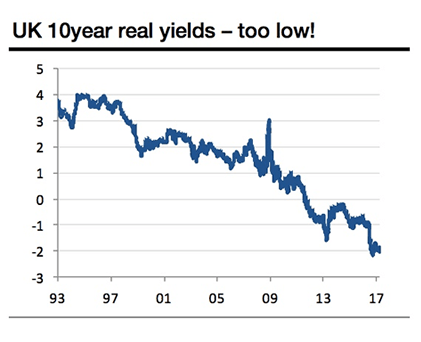

Meanwhile Juckes notes the UK faces huge uncertainty, and is handicapped by real 10-year bond yields that are not just the lowest of the major index-linked markets, but 90bop lower than anyone else’s.

“Super-low yields and a super-cheap currency form a fragile equilibrium,” says Juckes. “The next move will come either from a move in EUR/USD or new evidence about the trend in the UK economy. In the meantime, we wait for the economic data to deteriorate.”

The call on Sterling made by Societe Generale falls in line with that grouping of economists that anticipate Sterling to fall over coming months as Brexit negotiations churn.

The call on Sterling made by Societe Generale falls in line with that grouping of economists that anticipate Sterling to fall over coming months as Brexit negotiations churn.

Indeed, Deutsche Bank have gone one step further and suggested that the Pound could fall to parity with the Euro.

Countering this view are the likes of Morgan Stanley and Capital Economics who say markets will welcome the added clarity that upcoming negotiations provide.

Euro to Move Higher on Growing Inflation Data say Nomura

The Euro rose on the final day of March, despite some underwhelming inflation data being released by Eurostat which points to inflationary pressures starting to fade.

The disappointing data would suggest that the ECB has more work to do when it comes to stimulating EU inflation, and this would typically be a negative development for the Euro.

But could this recent development in inflation be nothing more than a setback in an upward trend?

This is a likely scenario argues Bilal Hafeez, a foreign exchange strategist with Nomura in London.

“Our analysis of slack measures in the eurozone suggests inflation pressures are brewing, warranting a more hawkish ECB, higher yields and a stronger euro,” says Hafeez.

The normalisation sequence will matter – if the ECB tapers and the EUR curve bear steepens, JPY would be the clear underperformer.

Meanwhile, an early rate hike would weaken USD, GBP and CAD more.

Nomura expect EUR/USD to test 1.15 by year-end.