Techs: GBP/EUR Exchange Rate Uptrend Not Yet Done

- Written by: Gary Howes

The Pound to Euro exchange rate (GBP/EUR) is seen trading at 1.1538 having gone as low as 1.1445 at one stage today.

There has been unprecedented media focus on the currency and at Pound Sterling Live we have noted a great deal more commentary on the day of Article 50’s trigger than there was on the night of the EU referendum.

This media attention comes despite the currency actually not doing anything spectacular.

"Article 50 happened with more of a whimper than a bang. Although the Pound initially rallied it has since backed off its highs as the market gets to grip with Theresa May’s letter to Donald Tusk and the EU’s response. Essentially both sides were polite to each other, which helped to keep volatility supressed and price action fairly muted," says Kathleen Brooks at City Index, a spread betting and brokerage based in London.

Yet the sheer interest in the topic does suggest those watching the currency remain apprehensive.

But as there is so much noise out there, we would advise readers to step back and take stock of the situation before jumping into any trades or international payments.

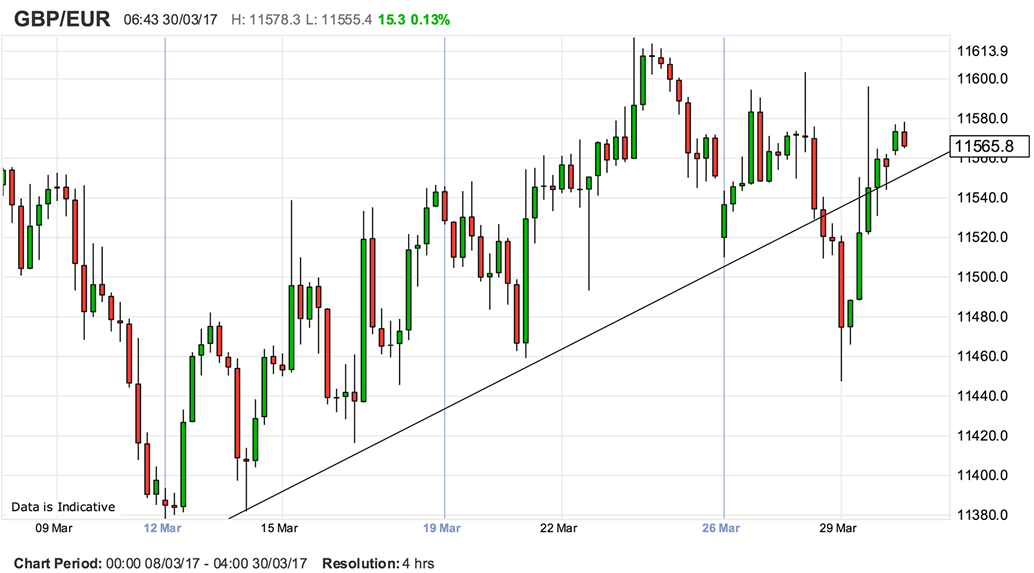

Pound to Euro: Watch the Trendline

No currency pair has come under more scrutiny than the GBP/EUR exchange rate over the past 24 hours.

The ‘quality’ titles like the Express and Star will tell you that Sterling is PLUMMETTING and then SOARING when all that has transpired is a move of maybe 0.15%!

This is why charts are important in delivering clarity and avoiding the click-bait content out there which tends to trigger emotional decisions when it comes to making decisions on currency markets.

A look at the above shows the guide is that upward sloping trend line, in place since mid-March.

Buyers are typically found when the exchange rate falls to the trend line and we would expect the same to be true on the present dip IF the uptrend remains valid.

Therefore, if the trend higher is to be kept alive the Pound must make a convincing attempt to move back above here today.

We have seen the exchange rate temporarily breach the line, but what is needed is a close above here today.

If this is achieved then we would suggest further gains are likely over coming days.

If not, then the gloomy projections made by some leading analysts might come true.

Our technical analyst Joaquin Monfort meanwhile notes the short-term uptrend is still technically intact as the correction lower, which saw the exchange rate pierce below the lower channel line, was only a three-wave move and thus potentially only corrective.

"A break below the 1.1449 lows would change the trend as it would establish a new sequence of lower highs and lower lows," says Monfort.

Bank of America: April Could be a Good Month for Sterling

Meanwhile strategists at Bank of America Merrill Lynch Global Research have updated clients on their views pertaining to Sterling's outlook.

"Our bias remains for renewed GBP weakness at the higher end of the 1Q17 technical range, but we are cognisant of the ongoing positioning unwind, positive April seasonal factors which has seen GBP rally in every April over the past twelve years and unconfirmed technical base," says a note from Kamal Sharma, FX Strategist at BofA Merrill Lynch.

Therefore, those watching Sterling could do well to allow it to advance a little further as the Article 50 triggering, "does not itself provide the catalyst for renewed GBP weakness".

But, upcoming Brexit negotiations could undo the currency which suggests gains will ultimately remain capped.

"Market complacency on the ability of the UK and EU to strike a comprehensive deal within the timeline with the least political/economic disruption is the motivation for a move back towards the bottom end and test of the trading range," says Sharma.

So while a move towards the lows of the range can be expected we note that no crash to fresh multi-year lows are envisaged.