The Bulls are in Charge as Euro to Pound Exchange Rate Pierces Major Trendline

Investors betting on a stronger Euro against Pound Sterling must have cheered after the EUR/GBP exchange rate pierced clearly above a major five-month trendline on Monday, March 6.

At the same time, those hoping for a stronger Sterling will have seen hopes shattered as the Pound to Euro exchange rate slips into negative territory.

The pop higher in Euro was easy to miss, but no less definitive for being discrete.

A break above a major trendline normally marks an important turning point for a pair as it conjures a much more bullish outlook.

Research has shown that the pair normally continues substantially higher after a break even if initially it might pull-back temporarily in what is known as a return more, to ‘air-kiss’ the trendline ‘goodbye’, in trader talk, before taking finally taking flight.

The trend-line break on EUR/GBP was noted by Commerzbank’s Karen Jones.

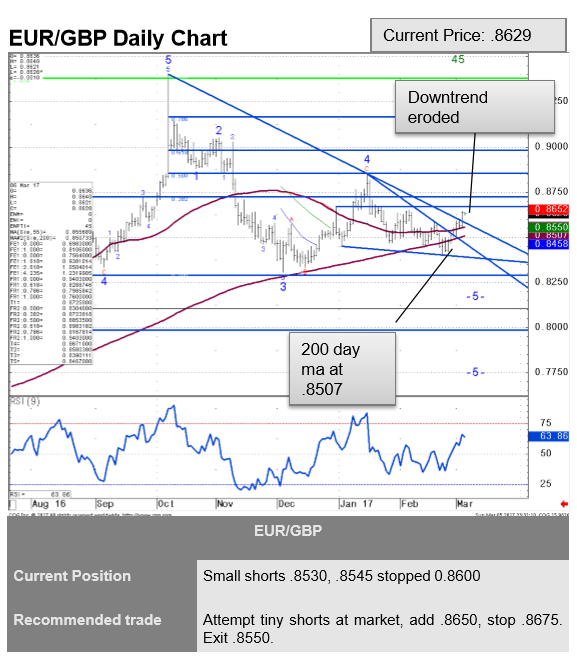

“The market has eroded its 5 month downtrend and we will head to the side lines as we suspect that the we will see further near term strength,” said Jones in a note seen by Pound Sterling Live.

She goes on to highlight a newly generated upside target at 0.8651/71, which is the February high and the 30th December high.

She further notes key resistance offered by Fibonacci resistance line, and the recent high at 0.8852/53.

“We assume that 0.8852/53 is a short term top for the market,” notes the Commerzbank analyst.

Evidence of a possible return move is supplied by her mention of short-term indicators flashing overbought on intraday studies.

“Very near term we note 13 counts on the 60 and 240 minute charts and will attempt small shorts very near term,” said Jones.

By “13 counts” she means the Demark Countdown indicator which is an indicator which flags up exhaustion when the count (which is based on sequences of up or down days) reaches 13.

The 13 count, therefore, means that there is a possibility the pair could fall back temporarily, move down in a return move to the trendline, sit on it for a day or two and then launch higher.

Our own analysis suggests 0.8800 as an eventual upside target.

Research suggests when a trendline is broken the asset tends to move the same distance as the move immediately prior to the break.

For EUR/GBP this is illustrated on the chart below as a green line, with the height prior to the trendline break (X) then extrapolated upwards from the breakout point (y), such that x=y in length.

The MACD has just poked above the zero-line indicating the trend has probably now turned up as well.

There are two separate ways in which the downtrend line over the last 5-months can credibly be drawn – Trendline A from the extreme 0.94 October highs, and then Trendline B which follows the contours of the downtrend more closely.

Whilst B is preferable to A because it follows the trend more closely both are valid.

But note how the exchange rate has now broken above both Trendline A and B, as well as both the 50 and 200-day moving averages.

This a potentially significant trend change moment.