SNB to Keep Fighting Swiss Franc Valuations, Analysts Divided on Currency's Outlook

The Swiss Franc (CHF) will probably not stray far from its current 1.09 level versus the Euro despite concerted efforts by the SNB to keep a lid on the currency suggests new research.

As expected, the Swiss National Bank did not modify its monetary policy stance at its September 15 policy meeting.

The Bank reiterated that it will remain active in the foreign exchange market to prevent further Swiss franc appreciation.

The central bank also left its interest rate on sight deposits unchanged at -0.75% and the target for the three-month Libor at between -1.25% and -0.25%.

On the growth and inflation sides, as expected the SNB revised its growth and inflation forecast slightly lower.

Sideways for Longer

Whilst CHF rose significantly versus the pound following Brexit, it ended up changing little versus the Euro.

The EUR/CHF pair has been locked in a fairly narrow range since the UK referendum, between a ceiling at 1.10 and a base at 1.07.

New research on the currency pair suggests the pair is most likely to extend that range for the foreseeable future as the SNB continues selling Francs to keep its value down.

The forecast is likely to be of interest to option traders in particular who have strategies to profit from periods of low volatility such as Put/Call debit spreads, Ratio spreads and Put/Call Calendars.

The Swissie is a favourite safe-haven for international investors in times of global uncertainty as have been the case recently.

The heigthened demand during periods of uncertainty increases the value of the Swissie and this causes a problem for Swiss exporters since it pushes up the value of their exports, making them uncompetitive or unaffordable abroad.

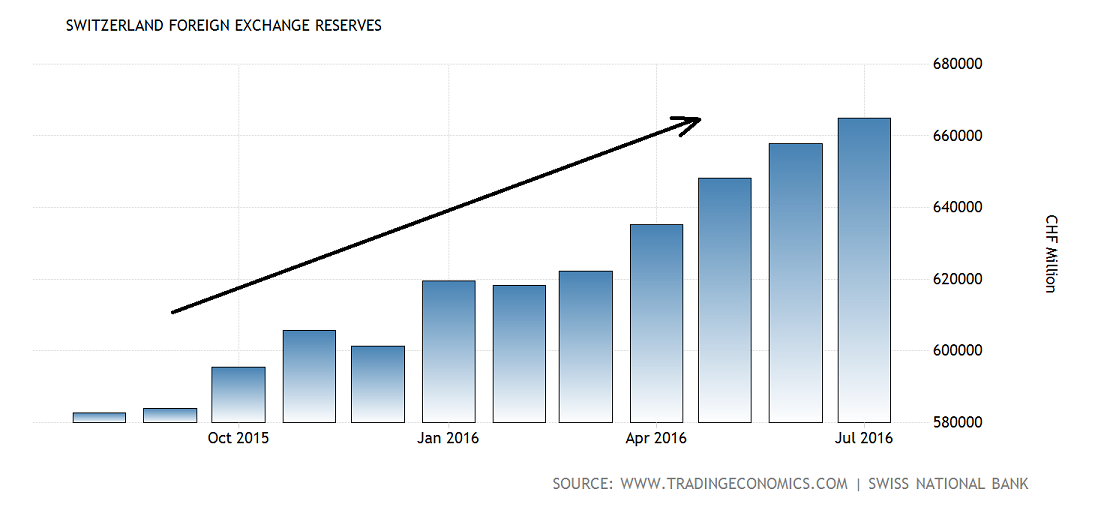

Lloyds Bank points to the rise in foreign exchange reserves at the SNB as a sign that the Bank is intervening in markets to keep the value of the Franc capped:

“The continued rise in SNB’s holdings of foreign currency reserves to a record high suggests that the central bank has remained active.”

The data strongly supports Lolay’s view, as illustrated in the chart below which shows a continued month-on-month rise in FX reserves held by the SNB, as a result of them intervening in markets, selling the Franc for counterparts.

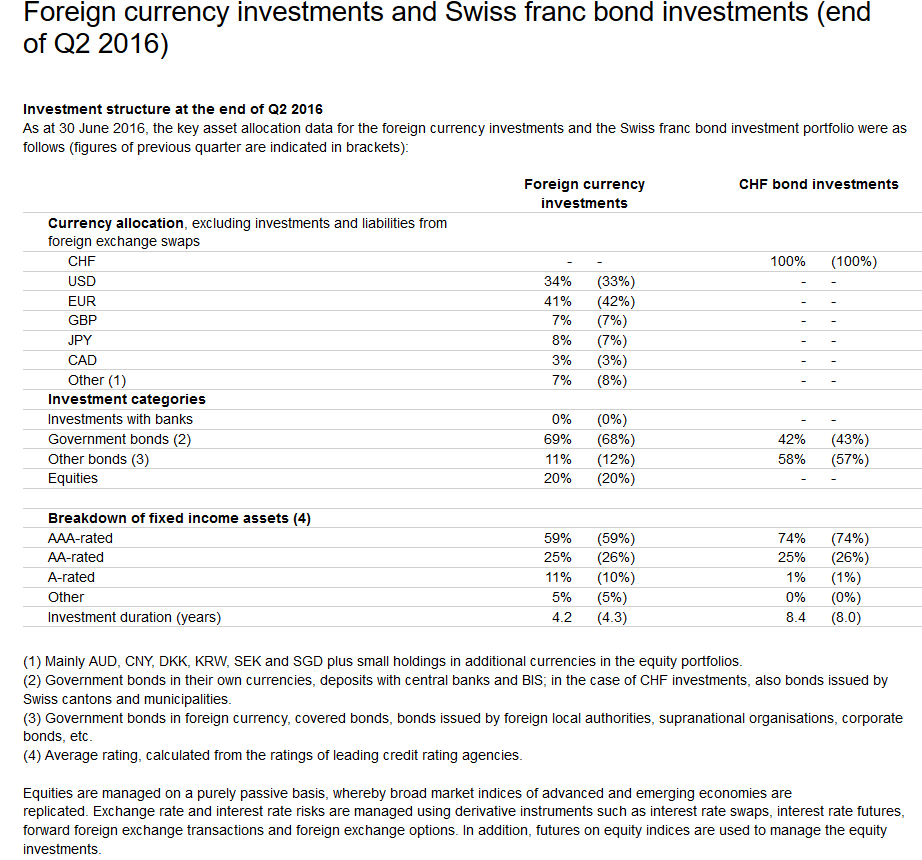

A more detailed breakdown of the SNB’s holdings shows which currencies they are prioritising when they intervene in markets.

The data suggests most of the defending has been against the euro , which accounts for the largest share of their reserves at 41%, followed by the USD at 36%; the pound meanwhile only accounts for 8%of SNB reserves.

This shows the SNB did not intervene much after Brexit – or the sterling reserves would probably have been higher – and that it not surprisingly focuses most of its intervention on the EUR/CHF pair.

Given most of Swiss trade is with the Eurozone, it is not surprising that the SNB would want to prioritise devaluing the Franc against the euro.

The SNB has been intervening in markets for years, and its FX reserves have steadily climbed from just under 200bn in 2010 to the current level of 664bn, which is over three times the amount.

What the SNB should do with its reserves is another major debate.

In an article written as far back as January 2015, Neil Maclucas of the Wall Street Journal (WSJ) posed the question after Swiss reserves were noted to have pushed above the key 500bn level for the first time.

The obvious problem is that if the SNB sells its reserves of euros, it will boost the Franc in the process, undoing its goal of keeping the Franc down.

“The SNB would love to reduce the reserves, but they can’t sell any of their euros as this would be counterproductive by boosting the franc,” says Lutz Karpowitz, a currency analyst at Commerzbank.

A more plausible idea would be for the SNB to swap the euros for dollars or putting them into European stocks.

Another option would be to buy bonds, however the problem with this strategy is that many bonds are now yielding less than zero, which means it would costs the SNB to hold them, making them an expensive investment.

It seems that compared to January 2015 the bank has actually reduced its bond holdings from 73% to 69% and increased its equity holdings from 15% to 20%, representing a shift away from bonds to equities in the last 18 months.

However, it is not surprising given the fall in bond yields to record lows over that time.

The WSJ article concludes that the SNB will not be able to offload its euro holdings until the euro starts to appreciate.

“For now, most analysts agree that the Swiss central bank’s ability to reduce its foreign-currency reserves depends upon a future strengthening of the euro, “ signed off Maclucas, ending with the quote:

“The SNB will remain a hostage to what happens in the Eurozone,” said Alessandro Bee, an analyst at J. Safra Sarasin.

CHF Most Overvalued Currency, Must Come Down

Meanwhile, analysts at Credit Agricole point out that CHF remains the most overvalued G10 currency and they expect it to underperform from here.

For now the currency remains mainly driven by global risk sentiment.

"This is unlikely to change unless there is rising scope of the SNB considering additional policy action," say Credit Agricole in a note to clients.

Yet, as the overvalued currency is keeping monetary conditions too tight and as forward looking indicators such as the KOF leading one paint a more lacklustre picture, Credit Agricole believe there is no scope of them considering a less dovish stance neither.

If anything the central bank should stick to a policy mix consisting of negative interest rates and currency intervention and such prospects should keep the franc’s safe haven appeal relatively low.

Still, risk sentiment will stay an important driver.

"As a result to the above outlined conditions we expect crosses such as EUR/CHF to remain well supported," say Credit Agricole.