The Euro to Pound Rate (EUR/GBP) Outlook Turns Increasingly Positive, a Test of 2016 Best Possible Again

The EUR/GBP conversion hit its best levels in two weeks on Wednesday and an increasingly constructive outlook suggests a test of the August highs at 0.8650 remains possible.

After strenthening from mid-August through to early September Pound Sterling has started losing momentum once more.

Growing expectations for another interest rate rise at the Bank of England this November appears to be a big driver behind Sterling's failure to extend its recovery.

The EUR/GBP chart now advocates for further Euro gains.

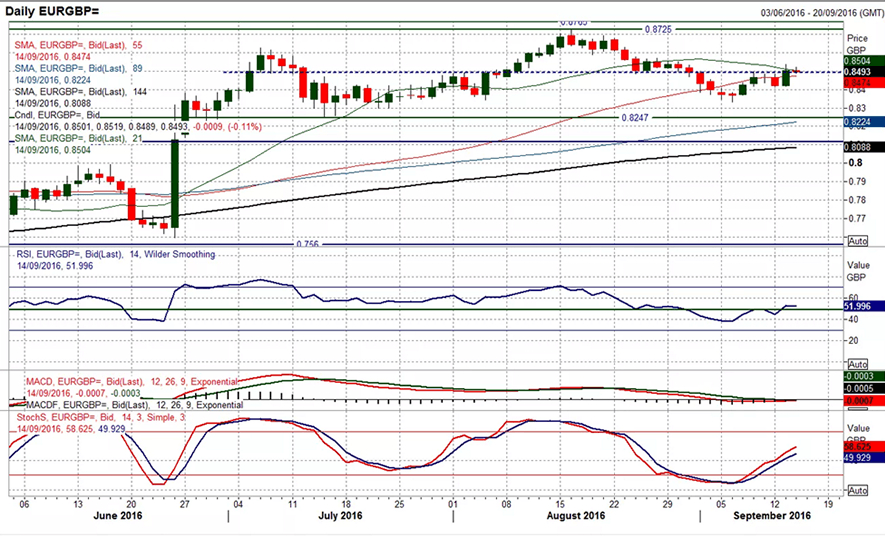

A study of the daily chart shows a strong bull candle that was posted on the 13th of September.

The move took the pair clear of a medium term pivot line around £0.8490 which has consistently provided support and resistance over the past two months.

From a technical perspective the strong rally, brings into the question the bullish GBP outlook which was beginning to take shape on most sterling charts.

"Although not deadly accurate the number of highs and lows posted between £0.8480/£0.8500 suggests that a pivot line around £0.8490 is a fairly strong gauge for the near term outlook within the range," says Richard Perry at Hantec Markets.

The bull break means that this line now becomes supportive (the level is holding in the early moves today) and the upside is open.

Interestingly this also has coincided with a move back above 50 on the RSI, whilst the Stochastics already pulling strongly higher following their bull cross last week.

"The immediate resistance now to be tested is £0.8570 and if this can be breached there is upside potential for a test of the August high of £0.8725," says Perry.

Latest Pound/Euro Exchange Rates

| Live: 1.1458▲ + 0.1%12 Month Best:1.2133 |

*Your Bank's Retail Rate

| 1.1068 - 1.1114 |

**Independent Specialist | 1.1298 - 1.1343 Find out why this is a better rate |

* Bank rates according to latest IMTI data.

** RationalFX dealing desk quotation.

Our studies also note that the big up-day recorded on the 14th cannot be ignored and suggests the pair has a new lease of life to the upside.

It broke straight through ‘titanium’ resistance from the 50-day MA, normally an incredibly tough level to breach, barely without a pause and continued higher.

The new spike higher took complacent short sellers by surprise, leading to a mini-short-covering rally higher.

The relatively low momentum as measured by MACD in the four-hour chart below, as well as the fact that the pair has formed an A-B-C correction with roughly equal length A and C waves means there is a possibility this freak spike higher could be a temporary ‘fat-finger’ event and the pair may start to resume its down-trend again, quite soon.

Any pull-backs, however, may struggle to break back below 0.8518, the level of the R1 monthly pivot and a strong line of support, and ideally only a clear break below 0.8500 would start to raise warning flags. .

Monthly pivots are used by many technical traders to gauge the strength and direction of the trend and as levels to place orders.

Draghi, UK Inflation Data Aid Euro Higher

One factor supporting the Euro was ECB President Mario Draghi’s speech restating and providing fresh support to the sagging European project after receiving an important ‘Europe builders’ award called the De Gasperi Prize in Trento, Italy.

He argued European integration was essential in areas such as the military, security and immigration, and that unresolved differences between member states in relation to economic and monetary union must be resolved as, “we cannot afford” to not move forward in these areas.

The Euro rose as his speech suggested he would do “whatever it takes” - to take a phrase of his from the past - to 'save' the Euro.

EUR/GBP had risen to 0.8533, up a full 1.30% after the speech, and following data released which showed no change in German Inflation and a modest recalibration of sentiment in the ZEW survey.

However, it appears that the key driver to the weakness stems from the GBP side of the equation.

The Pound fell steadily through the course of the day following the release of UK inflation data.

Inflation read at 0.6%, below analyst forecasts for 0.7%. The Pound dropped following the release, and it simply did not recover.

In fact the UK currency bled from 9:30 until 16:30 B.S.T. - there were simply no buyers out there willing to pick up the Pound which we find astonishing.

The data was hardly a shock, if anything the underlying numbers point to a sharp uptick in inflation over coming months and by November the Bank of England could find itself a little hot under the collar.

Nevertheless, markets suddenly decided that there was enough in it for the Bank of England to consider lowering interest rates again in November.