Euro Strength Capped as Traders Anticipate Further ECB Action Following September Meeting

The Euro exchange rate complex has fallen back from the highs achieved following the ECB's September meeting with traders clearly concerned further policy changes are coming.

The Euro strengthened notably against its rivals as the ECB opts to keep policy unchanged and ECB President Draghi is shown to be in no mood to change course for the time being.

The decision to keep the deposit rate at -0.4%, the refi rate at 0% and marginal lending facility at 0.25% were expected; however, that no major moves on the asset purchase programme were announced saw the Euro move higher.

"Clearly, markets expected more action or, at least, clearer signals from the ECB on additional stimulus measures," say Lloyds Bank Commercial Banking in response to the event.

There were risks that the ECB may fiddle with the asset purchase facility in which case the Euro would have been sent lower.

Instead, Draghi stressed that Eurozone governments need to step up and implement the necessary structural changes to get unemployment lower and their economies more business friendly.

This suggests that Draghi has acknowledged the ECB may be reaching the limits of its effectiveness and therefore no further growth-positive but Euro-negative policy changes are likely.

Euro Gives Up Gains - Why?

The Euro ultimately failed to capitalise on its positive momentum following the ECB event with traders apparently having had the time to digest the event and draw new conclusions.

"We believe it is still likely that the ECB will still announce further stimulus before the end of the year," say Lloyds confirming that expectations for further ECB action remain, despite Draghi's sanguine press conference.

Indeed, the President did repeat that the ECB has the will and capacity to act should inflation and growth falter.

The fact that some growth and inflation forecasts were downgraded should surely hint that further action lies ahead.

Many commentators have suggested the ECB will now be scheming up fresh and innovative ways to boost the Eurozone economy and boost inflation which will surely have negative implications for the Euro longer-term.

Economic growth forecasts updated

- 2016 GDP forecast at 1.7% vs 1.6% previously

- 2017 GDP growth at 1.6% vs 1.7%

- 2018 GDP growth at 1.6% vs 1.7%

Eurozone inflation forecasts updated

- 2016 inflation forecast 0.2%

- 2017 inflation forecast 1.2% vs 1.3% previously

- 2018 inflation forecast 1.6%

Analyst Reactions

Philippe Gudin at Barclays:

"We still expect the Governing Council to announce a QE extension in the coming months. We think that it is more likely to take place at the December meeting rather than October. Specifically, we continue to expect a time-extension of QE beyond March 2017 by 6-9 months, together with some modifications to the programme’s technical parameters."

Senior Analyst, Pernille Bomholdt Henneberg at Danske Bank: Today’s price action clearly suggests that some were looking for a removal of the deposit floor.

"Also, the 5bp sell-off in the 30Y reflected that there had been some anticipation in the market that the issue limit of 33% would be lifted. EUR/USD is a bit higher at 1.1307 but we expect the recent high of 1.1366 to hold."

Danske Bank still expect the ECB to extend the Q.E programme beyond the current end date at a meeting later this year.

Micheal Schbuert at Commerzbank:

"We continue to expect that the ECB will loosen the deposit rate tie by stipulating, for example, that

the average yield of purchases by each national central bank over the month must be above the deposit rate.

"We are still convinced that the ECB’s core inflation forecast is too high, and thus expect the central bank to act later this year."

Shilen Shah, Bond Strategist at Investec Wealth & Investment:

“Despite the market noise caused by the Brexit vote, the ECB believes the impact on Eurozone GDP is likely to be only moderately negative.

"Any extension of the ECB bond programme was only hinted at, with Draghi suggesting no extra stimulus for the time being. The scarcity of bonds that meet the bond buying programme’s criteria may however force the central bank’s hand before the programme’s scheduled end date of March 2017."

Lloyds Bank Commercial Banking:

"The committees mentioned by Mr Draghi will be given a ‘full mandate’ to explore further stimulus options – which could include removing the deposit rate floor on bond purchases, raising bond issue limits or adjusting the capital key – to enable the ECB to continue with asset purchases beyond March 2017, as is still highly likely (in our view), given the weak inflation outlook."

Alex Lydall, Senior Sales Trader at Foenix Partners:

"At first glance rhetoric from Mario Draghi appeared largely unchanged but a potential undertone was present as he specified he had tasked the ECB committee to evaluate stimulus options moving forward.

"Reading between the lines, this could potentially suggest a road is being paved to further action towards the end of this year, most likely regarding Quantitative Easing.

"Thus far, monetary policy measures have seen limited upside for the bloc state and it seems Draghi is well aware that action will be needed, it is just what and when. Deflation is still particularly worrying and he noted that the probability of this occurring again has unfortunately not decreased."

ING: No Change = 0.8%-1.6% Gains for Euro

A poll of 70 analysts by Reuters showed consensus for no action today but an extension to QE by the end of the year, which would have to be coupled with some changes to the purchase programme to expand the universe of eligible assets.

Analysts at ING had expected a relaxation of the rules governing which bonds it can and can’t buy in the ECB's Public Sector Purchase Programme (PSPP).

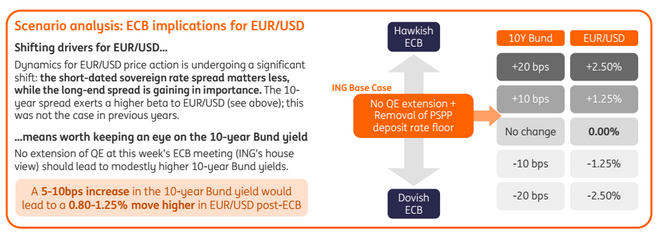

“Our economists expect the ECB to drop the deposit rate floor limit on the PSPP purchases tomorrow, yet refrain from extending the QE programme just yet,” says ING analyst Viraj Patel.

Therefore leaving QE unchanged whilst removing the deposit rate floor, would probably lead to a rise in the EUR/USD rate of 0.8% - 1.25% on the day.

An EUR/USD decline would certaintly drag the EUR/GBP cross along in sympathy.

Therefore, those with Sterling-Euro payments should be aware that the recent decline in Sterling's value we have witnessed in the mid-week session could extend.

Watch German Bonds

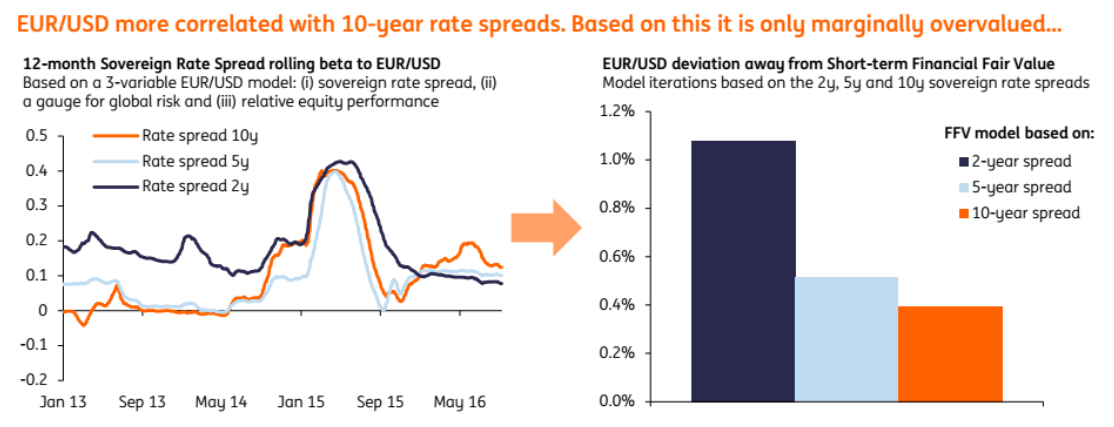

ING maintain that the best way to gauge the impact of the ECB’s meeting on EUR/USD is to watch the 10-year German Bund spread which is closely correlated to EUR/USD, and ultra-sensitive to ECB policy:

"Shifting drivers, with long-end sovereign spreads gaining in importance, mean the reaction in the 10-year Bund is key for EUR/USD."

Patel shows that the 10-yr bond spread between the US and Germany produces the closest fair value result to the current exchange rate using their FFV model:

Finally Patel notes how the Euro Index is only in positive territory because of the impact of the weak Pound:

“While the trade-weighted EUR has appreciated since Brexit, this was primarily due to a weaker GBP (hardly a controllable factor for ECB officials). Without GBP, the trade weighted EUR is actually weaker!”