Stars Aligning for Euro to Pound Exchange Rate to Make Fresh Move Higher

The reasons for a higher EUR to GBP exchange rate over coming weeks are stacking up.

- Downgrades to UK labour productivity is main GBP-negative event in Budget 2016

- An impotent ECB unable to fight euro strength any longer

- Rate would need to break clearly above the 0.7928 highs for confirmation of further upside

A cut to forecasts for UK labour productivity in the UK budget went largely unnoticed by most commentators, but for those watching sterling, this is big news.

It is however negative news. The Office for Budget Responsibility, while still expecting the UK population to become more productive over coming years, slashed their forecasts for the rate of that growth.

We have heard time and again from the Bank of England that they are only willing to raise rates if inflation threatens to accelerate, and they believe this will only happen when pay rises start accelerating in response to a more productive work force.

Without the prospect of interest rate rises the pound looks at lost at sea without an anchor.

And this is before we even begin discussing that confidence sapping topic of the EU referendum!

Latest Pound/Euro Exchange Rates

| Live: 1.1455▲ + 0.08%12 Month Best:1.2133 |

*Your Bank's Retail Rate

| 1.1066 - 1.1111 |

**Independent Specialist | 1.1295 - 1.134 Find out why this is a better rate |

* Bank rates according to latest IMTI data.

** RationalFX dealing desk quotation.

Euro Building Up a Head of Steam

The EUR to GBP exchange rate has quickly left behind the 0.7800 barrier, advancing to 2-week tops in the vicinity of 0.7860 backed by a continuation of the offered tone around GBP.

The recent move higher in the EUR to GBP exchange rate has bestowed a marginally more bullish bias towards the euro after what has thus far been a soft March.

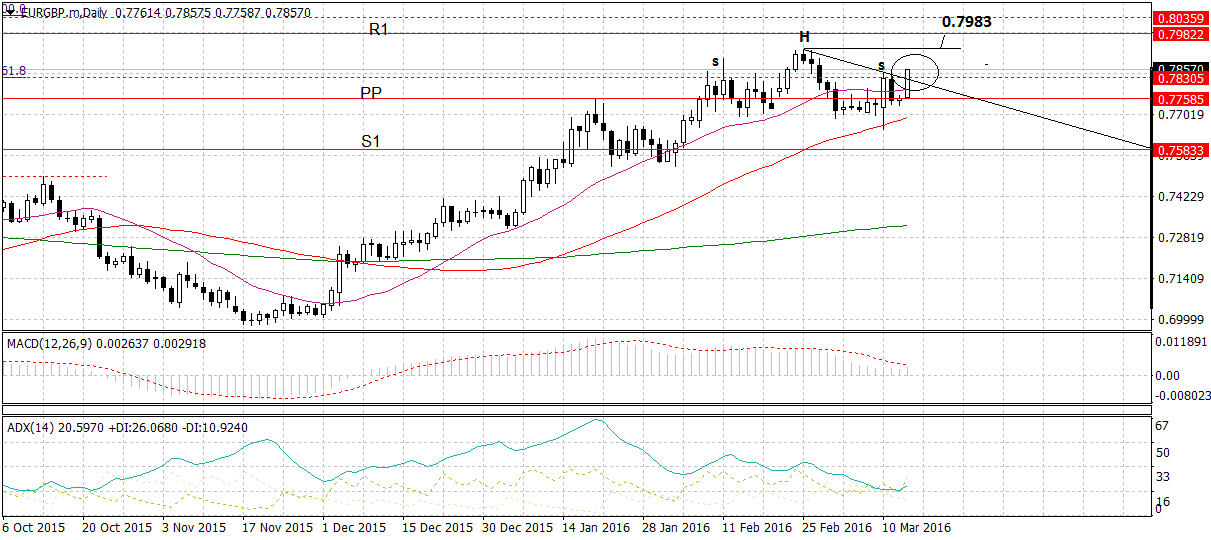

The pair was seen forming a small head and shoulders topping pattern as annotated on the chart below.

This had bearish connotations, with a break lower expected.

Hhowever, the break higher circled on Tuesday, has probably cancelled the pattern’s bearish potential, and a covering rally higher is now more likely.

Ideally the exchange rate would need to break clearly above the 0.7928 highs for confirmation of further upside, with a target at the R1 monthly pivot – a robust resistance level – at 0.7983.

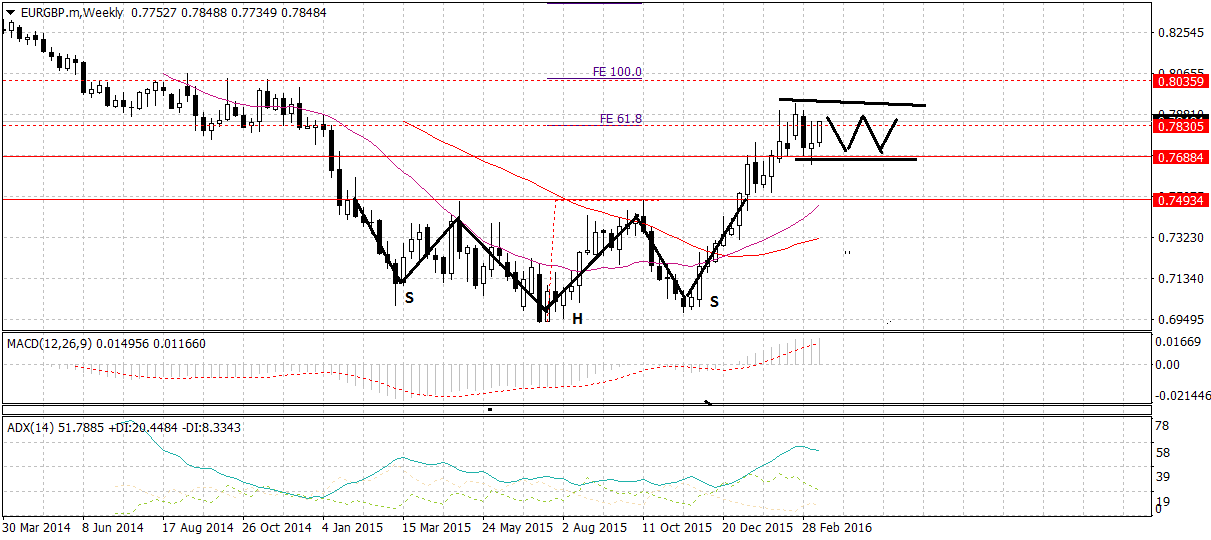

The weekly chart offers little sign of where the pair might move next.

EUR/GBP had built an inverted head and shoulders reversal pattern at the lows, made up of a trough (the left shoulder) followed by a recovery, then another lower trough (the head) followed by a recovery and the a final low (right shoulder) before the exchange rate finally broke clearly higher, and achieved the pattern’s minimum target we had forecast at 0.7830.

The current sideways consolidation appears to be extending further sideways after sterling weakness brought the rate back into the middle of the range.

The charts offer no significant clues as to future movement and the possibility of a lengthening of the sideways consolidtion remains a strong possibility, particularly in the run up to the June 23 referendum.

Central Bank Impotence Favours the Euro

Recent efforts by central banks, especially the European Central Bank (ECB) and the Bank of Japan, to weaken their exchange rates have failed in the eyes of many of the analysts we follow.

It is argued negative central bank deposit rates are failing to have any impact on exchange rates.

Negative deposit rates are used by central banks to dissuade banks in the real economy to park their money with them, as this then incurs a cost.

Their aim is to incentivise banks to lend to the wider economy. A secondary aim is the depreciation of the currency.

The European Central Bank, Bank of Japan, Swiss National Bank and Swedish Riksbank are all using negative interest rate policies.

In none of these examples have negative rates managed to depreciate the country’s currency.

Most recently the euro has so far failed to depreciate despite the ECB’s decision to cut deposit rates to -0.4%.

ECB Running Out of Policy Tools

Analysts at HSBC argue that negative rates have essentially failed while also creating a level of uncertainty which is contributing to a risk-off default backdrop.

“The fear of policy impotence is growing, in other words the idea that central bankers and governments cannot be relied upon to rescue the global economy and financial markets. The foray into negative rates and its fleeting negative impact on currencies have reinforced this fear. The resultant growing fear factor has, in turn, fostered a “risk off” mood in other markets,” says a foreign exchange research note from HSBC.

The negative sentiment caused by below-zero rates is having the unintended consequence of increasing demand for safe-haven currencies, which include the yen and the euro – the very currencies the policy was intended to weaken.

“In this way, cuts into negative territory by the ECB and BoJ are not only failing to generate EUR and JPY weakness, they may be contributing to their strength,” say HSBC.

Euro May Have Limited Downside Potential

HSBC’s assertion that neither the ECB nor the BOJ have the tools to effectively manage their exchange rate echo’s a theory propounded by Societe General’s Alvin Tan:

“The indirect attempts to weaken the exchange rate through asset purchases and negative rates appear to be hitting the proverbial brick wall. Neither the trade weighted euro nor yen has depreciated over the past twelve months, despite escalating unconventional monetary policies.”

Tan argues the euro has limited scope for further down-side in the headline EUR/USD rate which will be felt by the EUR/GBP cross:

“Further easing from the ECB is unlikely to push the EUR/USD exchange rate lower durably. We do not expect EUR/USD to break below the 1.04/1.05 low reached in 2015 over the course of this year, short of a Brexit scenario.”

The fact that the ECB seems unable to weaken its currency because of a negative feedback loop, which means heightened risk aversion actually supports the currency, diminishes the downside potential for the currency substantially.