GBP/EUR + Dollar: Why Next Week Could be Better

- Written by: Gary Howes

A rare bit of good news concerning the British pound following its dire run in February - next week could be better. We will be watching the 'Brexit Summit' and inflation data.

The decline in the British pound has been a key feature of 2016 for those watching currency markets with the trend lower against the euro, in particular, becoming more entrenched.

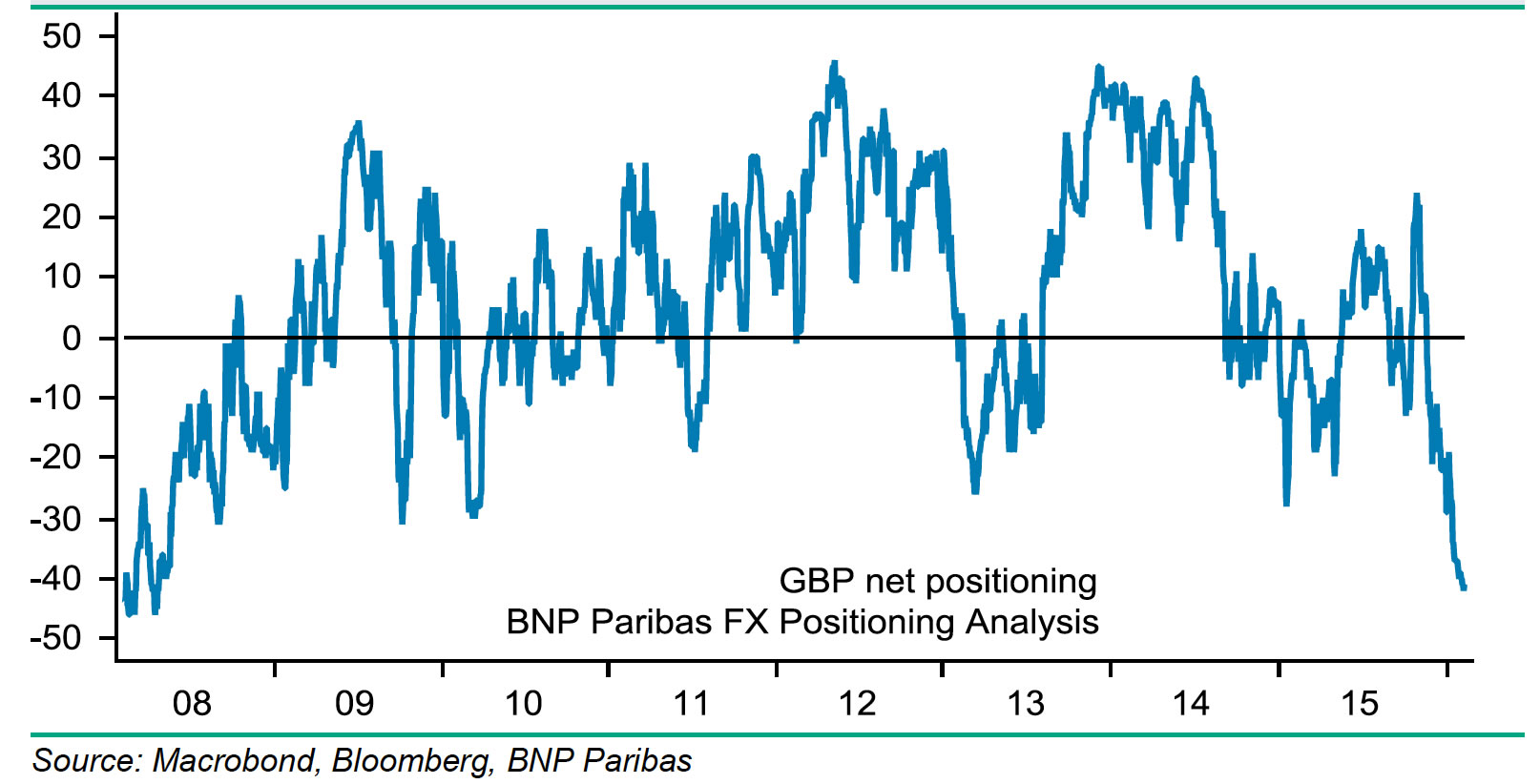

The GBP has depreciated 6.5% versus the EUR since December 2015, as short positioning has built to its most extreme level since 2008 in sympathy with an unwinding of Bank of England tightening expectations and an intensification of Brexit concerns.

UK Prime Minister David Cameron takes his UK-in-Europe compromise to other EU leaders this week, hoping to convince them it doesn’t give the UK too special a status in the union, while hoping to convince the British public that it does.

GBP is likely to see sharp swings on rumours as the meeting gets underway. Acceptance by other leaders should mean a June 2016 referendum.

GBP will need some good news. The pound to euro exchange rate has fallen from the 1.35 region at the start of the year to the 1.28’s we are presently seeing.

Latest Pound/Euro Exchange Rates

| Live: 1.1519▲ + 0.28%12 Month Best:1.2133 |

*Your Bank's Retail Rate

| 1.1127 - 1.1173 |

**Independent Specialist | 1.1358 - 1.1404 Find out why this is a better rate |

* Bank rates according to latest IMTI data.

** RationalFX dealing desk quotation.

But as we can see from the below, markets are now so negatively biased against the pound that the prospect of a relief-rally is now becoming increasingly likely.

Markets have not taken out such a negative position on sterling since 2008, this suggests that if a good piece of data were to cause a spike in the pound we could witness a huge amount of these negative bets forced to close. This would amount to a classic short-squeeze.

As these bets are closed traders are forced to buy up sterling ensuring it recovers.

Next week there are several key events for the GBP: January inflation data (16 February), the December employment report (17 February), January retail sales (19 February) and the EU leaders’ summit (18-19 February).

“Short GBP positioning is extreme with a score of -40, leaving the GBP very susceptible to a rally on positive news, especially related to the UK’s referendum on EU membership,” says James Hellawell at BNP Paribas in London.

An EU agreement will likely lead Prime Minister Cameron to set a referendum date for June. Echoing the Barclays position, BNP Paribas see upside potential for the pound against the euro on the Brexit story.

“Cameron declaring victory on a new EU deal and announcing his support for the UK to stay in the EU could prove decisive for the polls. We remain exposed to EURGBP downside via options,” says Hellawell.

The tone from BNP Paribas will be like a breath of fresh air for those watching currency markets in anticipation of a stronger GBP:

“The outlook for the GBP is positive, and we expect solid UK GDP and accelerating wage growth to prompt the BoE to deliver tightening sooner than the market expects. The UK’s balance of payments position is strong, with the current account deficit financed by FDI and portfolio investment inflows.”

If BNP Paribas are correct in their thinking, then the remainder of February could be better.

Inflation Data Could Boost the Pound

With markets betting so agressively against the pound, any good news would likely trick up the vast amount of speculators betting against the pound and prompt an agressive rally in sterling as they are forced to close their trades.

One of those pieces of good news, Brexit summit aside, could be found in the release of inflation data.

Markets are watching for annual inflation to read at 0.3% and core inflation to read at 1.3%. Anything above here could certainly boost the pound and trigger that sharp rally.

That said, some are not optimistic on higher inflation.

"Nothing in January suggests a monthly firming in prices, unless GBP weakness passed through to prices more rapidly than usual. Instead, we see myriads of reasons for somewhat weaker prices on the month, including a snapback in airfares, which had boosted the December number," say TD Securities in a client briefing.

Dollar Strength Put on Hold

Meanwhile the prospects facing the GBP/USD on the back of continued US dollar weakness have certainly improved.

In light of changing market circumstances, an appreciation of the USD now appears unlikely near term warn BNP Paribas.

"If equity and credit markets continue to deteriorate, financial conditions in the US will tighten further and markets are unlikely to start pricing in Fed tightening again and may even shift to pricing in Fed easing," says Hellawell.

If this is the case, the USD’s losing trend (especially versus the EUR and JPY) will persist, despite the fact that our medium-term forecasting model, BNP Paribas CLEER™, continues to signal USD appreciation.