EUR/USD Exchange Rate: 1.0630 Forecast for Coming Days

Some economists predict another interest rate rise at the US Fed being announced as early as Q1 2016 - a view that could keep the EUR to USD conversion under substantial pressure should it become more popular.

With the first rate hike now already consigned to history, economists are already looking ahead and forecasting the next rate rise at the US Federal Reserve.

This speculation will be key to direction of the US dollar exchange rate complex over coming weeks and months.

Should markets believe more rises are coming than presently expected then the exchange rate will likely push back towards levels seen ahead of the December ECB meeting.

“We think that the Fed will look to tighten again in Q1 at the 16 March meeting, and then pause," says analyst Jeremy Stretch at CIBC in London.

Consequently, CIBC think that widening rate spreads into Q1 will support a positive USD bias.

@ Look for front-end spreads to continue to move in favour of the US. This comes as two-year yields have moved back above 1.0% for the first time since April ’10," says Stretch.

CIBC note the broader USD uptrend now looks increasingly mature, but they think that USD gains are likely to extend through Q1 as markets are forced to increasingly price the next leg of Fed normalisation.

"In terms of EUR/USD, in the near term we need to break below 1.0795/0805 to encourage a break towards 1.0650. Patience may be required,” says Stretch

German Ifo Disappoints But Economy Resilient

Turning to fundamentals, the euro exchange rate complex found a pothole to content with which came in the form of the latest release of German business confidence. The number fell in December to 108.7 points from November’s 109.0.

Assessments of the current business situation took a down turn but optimism about future business developments was unchanged, this perhaps helped the euro avoid any substantial declines.

CIBC's Stretch reckons, "resilient business expectations underpin our assumption of Eurozone growth beating expectations into next year.

"Stronger than expected economic activity underlines our supportive EUR bias over the medium to longer run.

"However, with front-end rate spreads set to move further in favour of the USD into Q1, we are likely to test the bottom of the 1.08-1.12 range highlighted post the ECB decision.

"While we favour a modest run lower in EUR/USD in Q1, potentially heading back towards 1.0650, expect such dips to provide long-run buying opportunities."

US Jobless Claims Down But Current Account Deficit Widens

Weekly US jobless claims showed a drop of 11,000 to a seasonally adjusted 271,000 for the week ended December 12.

This was below the forecasted 275,000.

It was the 41st straight week that US jobless claims fell below the 300,000 threshold, which is the benchmark for strong labour market conditions. Notably, this is the longest stretch since the early 1970’s.

Thus, this data pointed to another case for further US rate hikes in 2016.

However, while the US Labour Department reported good news, the Commerce Department reported a hike in the current account deficit for the third quarter.

The current account deficit rose by 11.7% to USD 124.1 billion, the largest shortfall since 2008.

However, the rising USD strength should be included when reasoning this surge.

EUR/USD Remains under Pressure

In the wake of the FOMC rate hike, the EUR is expected to decline against the USD.

After a weaker than expected German Ifo reading, the EUR/USD came under further pressure and the reduced number of US jobless claims did not help the pair either.

During the early trading session, EUR/USD was trading in the narrow range of 1.0875 and 1.0850.

At writing, the euro to dollar exchange rate is down at around 1.0825.

Looking ahead from a fundamental perspective, Siwssquote Bank in Switzerland note, “EUR/USD has weakened towards hourly support at 1.0796 (07/12/2015 low).

Stronger support lies at 1.0524 (03/12/2015 low). Expected to target resistance at 1.1096.

“In the longer term, the technical structure favours a bearish bias as long as resistance holds.

“Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation.

“The current technical deteriorations favour a gradual decline towards the support at 1.0504 (21/03/2003 low).”

EUR/USD in a step decline?

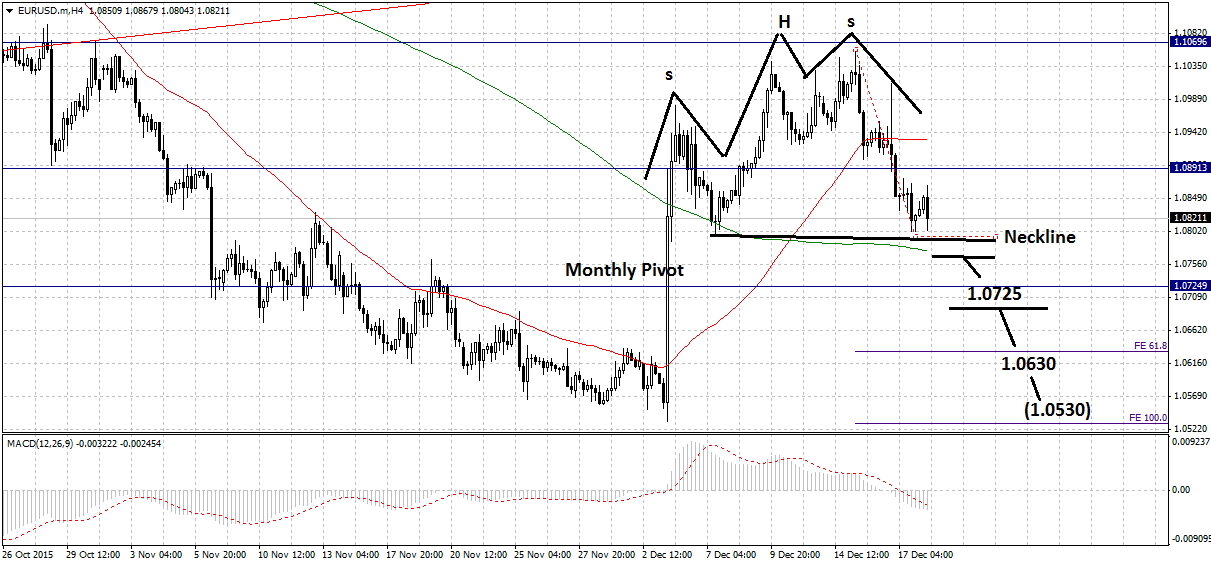

It looks increasingly like the pair could begin a 'step' decline from here, especially given the probable bearish head-and-shoulders which has formed on the 4-hr chart, shown below.

The 1.0800 lows are also key as a break below them would signal both a break of the H&S's neckline and the reversal of peak and trough progression from up to down in the short-term, indicating a probable reversal of the short-term trend.

Therefore, a move below 1.0790 would probably confirm such a neck-line breach, leading to a move down to the 200-4hr MA at 1.0775 and then probably even lower to the next major support level at the monthly pivot, at 1.0725.

A break clearly below the pivot, signalled by a move below 1.0690 would probably signal a continuation fo the down-trend towards the next target at the 61.8% Fibonacci extension of the H&S's height, at 1.0630.

That level could be the focus of much buying interest so a bounce or consolidation is possible, however, eventually there is a possibility of a move even lower to the 100% extension of the H&S and the early december lows at 1.0530.