Maxed Out: Euro to Pound Rate Fails at 6 Month Channel

The euro v pound sterling exchange rate (EURGBP) slumped in the wake of mid-week events in the UK which include strong employment data and a positive Bank of England.

Those looking for a stronger euro to buy the British pound may have just missed out on the best possible chance to do so.

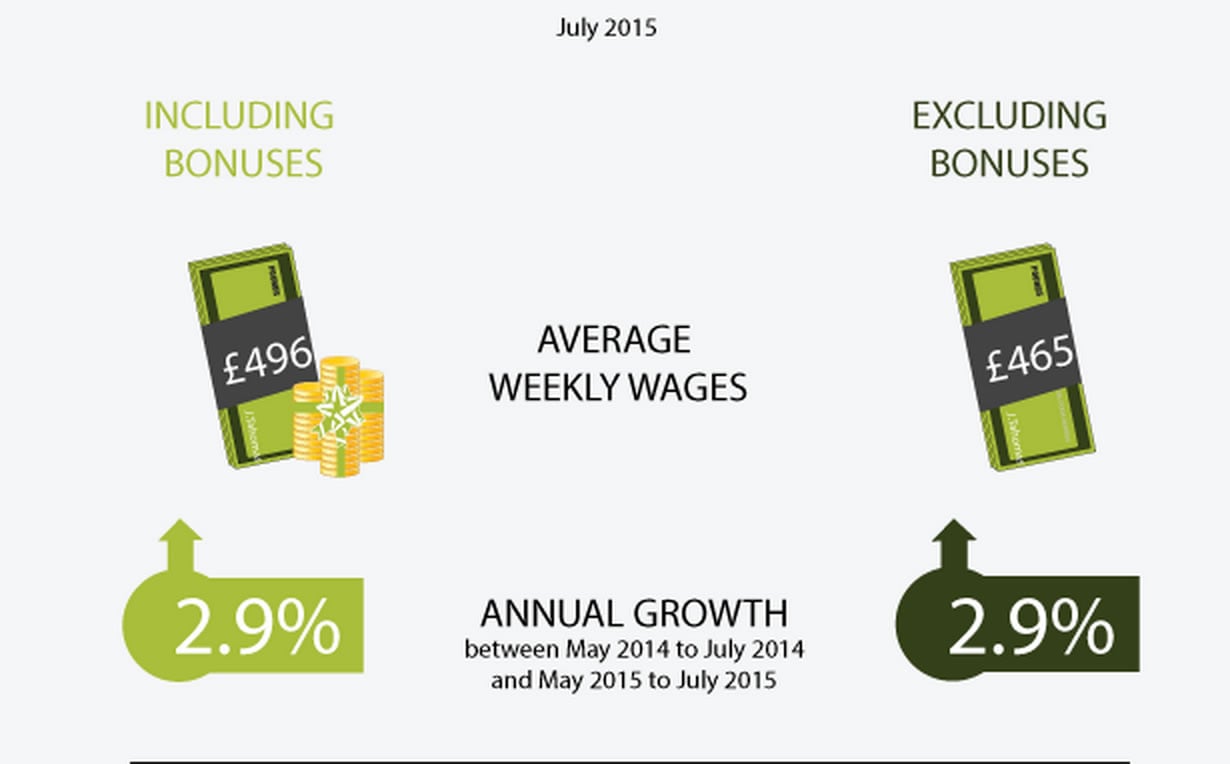

EUR/GBP dropped to the 0.73 area in the wake of data showing UK workers were seeing pay packets rise 2.9% year on year.

Many watching the market will have been awaiting a move back above 0.7400 proving just how punishing the currency markets can be.

The timing of the failure confirms 0.74 (1.36 if you turn the equation to GBPEUR) as as significant level of resistance that we feel will unlikely be broken for some time.

Analysts had only expected a more pessimistic 2.5% rise in pay, also spurring on sterling was news that the UK unemployment rate fell to 5.5% from 5.6%.

The euro and pound are now back to levels seen last week so this is by no means a game-changer for the exchange rate and confirms that a sideways pattern has established itself for now.

The idea that the EURGBP would advance beyond 0.74 always looked fanciful to us and we noted that with UK interest rates likely to rise in coming months the ability of the euro to push yet higher looked in doubt.

In short a comeback by the British pound was due.

Latest Pound/Euro Exchange Rates

| Live: 1.1519▲ + 0.28%12 Month Best:1.2133 |

*Your Bank's Retail Rate

| 1.1127 - 1.1173 |

**Independent Specialist | 1.1358 - 1.1404 Find out why this is a better rate |

* Bank rates according to latest IMTI data.

** RationalFX dealing desk quotation.

"EUR/GBP remains broadly sidelined, we look for dips lower to be contained by the uptrend at .7220 and while it holds, an upside bias will remain intact," notes technical analyst Karen Jones at Commerzbank.

Jones notes that the market has recently failed at the top of a 6 month channel (.7405) and will need to clear the .7421 recent high to retarget the .7482 May high ahead of the .7468 55 week ma. "We suspect from a longer term point of view that the market will fail in this vicinity."

Adding fuel to sterling's renaissance was the Bank of England's top decision making team.

Governor Carney and his lieutenants appeared befor UK lawmakers to give insights into their decision making.

Markets looked on, eyes sharpened, for any hint on whether they may soon raise interest rates.

Carney repeated a comment he made in July and again in August that strength in Britain's economy probably meant a decision on rates will come into "sharper relief around the turn of this year".

Kristin Forbes, another of the Bank's nine rate-setters, sounded a more urgent note, saying rates would need to increase in the not-too-distant future and there was already very little slack remaining in the British economy, if any.

The impetus behind these mid-week events could propel the pound to euro exchange rate higher and the prospect of 1.40 becomes real once more.

A Tough Month for the GBP Against the EUR

Those hoping for a stronger British pound to euro conversion will be relieved as September has not been kind.

The euro to pound exchange rate (EURGBP) rose as the pound failed to find support on news that UK inflation data read at 0%.

September has been tough on the GBP but buying interest should return as the euro rally appears overdone.

The euro / pound has rallied back to test resistance around 0.7360. "We still have a near term bias for a move up to and through the 0.7415 previous highs, but that renewed weakness back towards 0.7100/.6900 is likely in the medium term on policy divergences," say Lloyds.

Against the dollar it is certainly a case of sideways movement for now - particularly ahead of the all-important US Federal Reserve decision on interest rates due on Thursday.

Analyst Karen Jones at Commerzbank meanwhile notes that the euro to pound exchange rate is trading above the 6 week uptrend – a decidedly bullish signal.

“We look for dips lower to be contained by the uptrend at .7202 and while it holds, an upside bias will remain intact,” says Jones.

Jones does however warn that levels above 0.74 will be difficult to sustain:

“The market has recently failed at the top of a 6 month channel (0.7407) and will need to clear the 0.7421 recent high to retarget the 0.7482 May high ahead of the 0.7468 55 week ma. We suspect from a longer term point of view that the market will fail in this vicinity.”

For global currencies all eyes are now on Thursday’s decision at the Federal Reserve – will rates be raised?

Markets are unanimous in their view that the Bank of England will only embark on an interest rate raising cycle once the Americans have commenced their own.

So a rate rise in the US will be seen as a positive for the British pound which could well push the euro lower once more.

The market now assigns just a 30% probability to a September rate hike, while professional economists are split almost precisely 50-50.

We are inclined to side with financial markets in this debate, with the view that a rate hike is unlikely this month but could still happen in either October or November.

Thus, recent ranges in GBP/USD and GBP/EUR may continue to hold sway.