GBP/EUR Still Bullish Despite Month-End Slump

The pound sterling slumped by over a percent over the course of Friday trade bringing to a sudden end the late July rally.

The decline has no obvious catalyst leading us to suspect month-end portfolio rebalancing in the vast global investment community is to blame.

The impact of month-end flows will likely be more significant than normal owing to the light summer-inspired volumes. We don't see any prospect of the upward trend in GBP-EUR being broken.

The euro exchange rate complex had strengthened considerably over the mid-July period leaving us questioning how far the battering of GBP/EUR would extend.

Those looking out for a GBP-EUR level back above 1.44 will have despaired at missing out.

Then the 1.40 level came to the rescue - this region of support has proved true allowing bulls to take control of GBP/EUR once more and push the exchange rate back above 1.42.

As the below shows we are still in an uptrend with the lows reached in May forming the starting point:

Be aware! All quotes in this piece reference the spot-market exchange rate. Your bank will charge a spread when delivering currency for FX transfers. However, an independent FX provider can offer a rate closer to the market rate. In some instances up to 5% more currency can be realised.

Goldman Sachs See GBP at 1.54 v EUR

Golman Sachs analyst George Cole believes GBP/EUR’s relatively steady move higher reflects the ongoing outperformance of UK activity, firming price pressures in the form of wage growth which is trumping low inflation prints, and incremental hawkishness in central bank communication.

“Although the precise timing of the first rate hike remains the subject of much speculation, and the general policy mix of tight fiscal and loose monetary policy may limit Sterling outperformance on a broad basis, we continue to expect upward pressure on frontend rates further out the forward curve, leading to further currency appreciation vs EUR,” says Cole.

Goldman Sachs are forecasting the pound / euro rate at 1.5384 in 12 months.

Corporate Actions Could Boost the Pound Sterling Near-Term

Even though there has been little fundamental UK economic data this week, GBP has moved higher against both the euro and the US dollar, as investors looked to lock in their positions ahead of large proposed corporate acquisitions.

“Two British companies were the subject of takeover bid talk from overseas firms and, with the bidders needing to purchase potentially billions of sterling to finance these deals, the value of the British currency jumped higher,” says Carl Hasty, Director at Smart Currency Business.

Insurer RSA saw its share price surge more than 18 pct as a possible offer from Zurich stoked interest in the insurance firm as a takeover target.

The takeover could value RSA at £5.5bn, or 550p a share, although Zurich has not yet made an approach to the London firm’s management.

Eurozone Data: German Unemployment Falls But Spanish Economy Grows

The euro exchange rate complex came under pressure on the 30th following the release of some poor Eurozone data.

German unemployment actually increased by 9K people over the course of the month - currency traders had positioned the euro in anticipation of a fall by 5K.

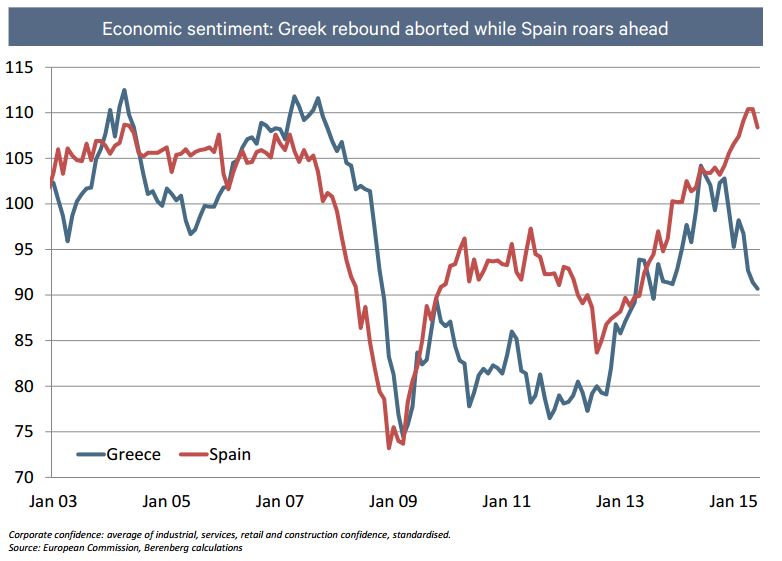

Spain has proved a bright spot once more with data showing the Spanish economy has grown by one percent confirming that the post-crisis recovery is well on track.

Data shows the Spanish economy grew by 1% in the second quarter of 2015 - what analysts were expecting.

The experiences of Ireland and now Spain shows that sticking to the plan of structural reform (aka austerity) pays off and longer-term sustainable growth can be achieved as a result.

Something the Greek simply won’t contemplate.

Month-End Weighs

Month-end activity helped the euro eke out a gain on Friday.

"No change in Europe’s fundamental backdrop on Friday should keep underlying negative sentiment intact," says Joe Manimbo at Western Union.

The euro zone’s jobless rate stayed at a high 11.1 percent for a third straight month in June while inflation remained at a low 0.2 percent. For the month, the euro was on track to shed nearly 2 percent in value to its better performing U.S. counterpart.