Why Pound-to-Euro is Tanking

- Written by: Gary Howes

🔒Lock in today's exchange rate to secure a future payment. You may also book an order to trigger your purchase when your ideal rate is achieved. Learn more.

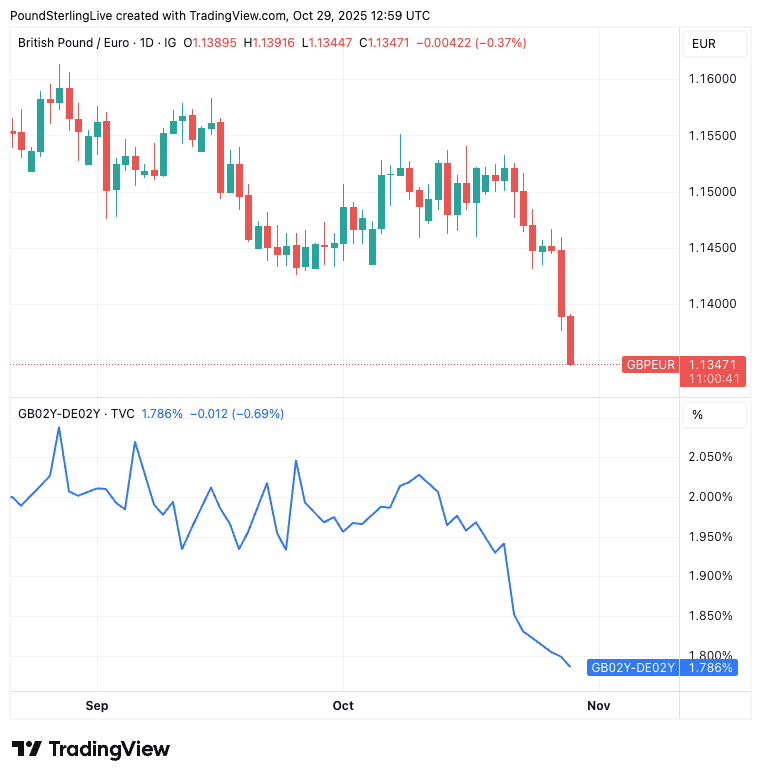

GBP/EUR is sliding as UK–German 2-year bond dynamics turn against sterling, pushing the pair to fresh 29-month lows.

Pound down 0.40% on the day to 1.1348, marking fresh 29-month lows view live rate.

Sterling weakness is broad-based across major peers and has intensified over the past 48 hours.

UK 2-year yield has fallen to 3.766% while Germany’s 2-year has risen toward 1.978%, narrowing the UK–DE spread.

Driving the news

The clue lies with falling short-dated bond yields in the UK relative to Germany.

For currency markets, it is the change in yields that matters – when UK yields fall faster than German yields, the spread compresses and GBP tends to underperform.

Reminder: A bond’s yield is its effective interest rate – capital tends to flow to where yields are higher, so a shrinking UK advantage redirects flows toward the euro.

"Sterling proving the major underperformer. The reassessment of immediate rate cut expectations resulted in EUR/GBP taking out the previous 2025 year-to-date high at 0.8769, opening the way for 0.8835," says Jeremy Stretch, CIBC Capital Markets. (EUR/GBP 0.8835 implies GBP/EUR ≈ 1.1320.)

Why 2-year yields are moving

Central bank rates drive the front end. The drop in UK 2-year yields signals markets are upping bets on Bank of England cuts.

Trigger 1 – Softer prices: UK shop price inflation eased to 1.0% in October from 1.4% in September (BRC), the first decline after seven months of rises - easing inflation fears.

Trigger 2 – Fiscal squeeze: Reports of a budget shortfall of £30bn+ flag a tax-tightening package next month, a growth headwind that would reinforce BoE easing expectations.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

So what does this mean for the pound?

"We stay negative on GBP," says Kirstine Kundby-Nielsen at Danske Bank, arguing that meaningful fiscal tightening would weigh on growth and likely prompt more substantial BoE easing.

Danske targets EUR/GBP 0.89 in 12 months - equivalent to GBP/EUR ≈ 1.1235. See how Danske's forecast compares with the consensus of investment bank peers for the next 3 to 12 months..

What to watch

UK–DE 2-year spread - further compression favours EUR, a re-widening would relieve GBP pressure.

UK fiscal headlines - concrete details on tax rises and spending plans will shape growth and rate expectations.

Inflation updates - confirmation that price pressures are fading would harden bets on earlier BoE cuts.

As the UK’s short-rate advantage narrows against Germany, GBP/EUR is likely to stay under pressure until yield dynamics turn.