Pound to Euro Rate Week Ahead Forecast: Inflation, PMIs to Dominate

- Written by: Gary Howes

Image © Bank of England

Pound Sterling could lose further value against the Euro in the coming week if UK inflation and PMI data undershoot expectations.

The Pound to Euro exchange rate (GBP/EUR) fell 0.65% last week despite initially rallying to its highest level in two years at 1.21 on Monday 11.

The fresh high confirms the bigger picture remains one that is broadly constructive for the Pound against the Euro, thanks to the UK's elevated interest rates compared to the Eurozone.

"The pound continues to hold its own vs. the EUR," says Jane Foley, Senior FX Strategist at Rabobank. "We retain our forecast that EUR/GBP is likely to edge to the 0.8150 level on a 12-month view."

Political concerns in Germany and the fear of the impact of U.S. tariffs on the Eurozone under the next Trump administration are also weighing on the euro more broadly.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

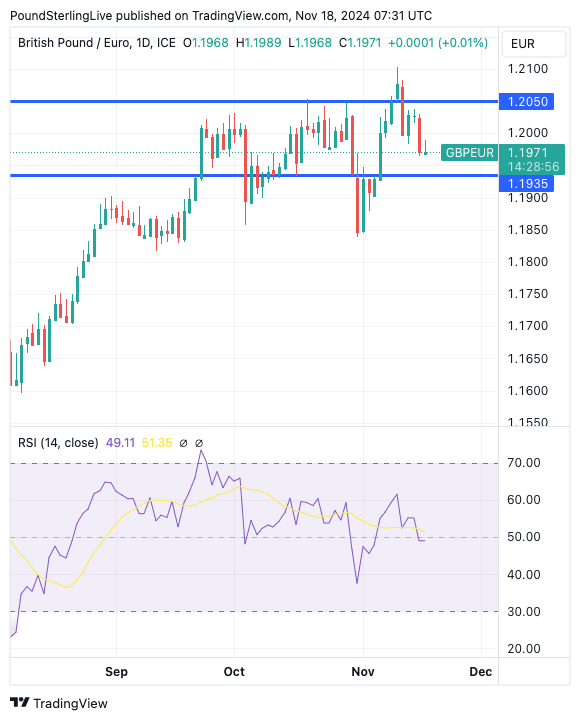

Near-term, GBP/EUR is in the process of consolidating its recent gains, which means strength will be capped at the 1.21 2024 highs.

To the downside, solid support comes in at 1.1850, the November, October and September lows.

However, we think a selloff to this level won't happen soon, and instead think support will emerge at 1.1935 as, tactically, the market will probably look for opportunities to buy GBP selloffs (sell EUR/GBP strength), limiting the downside for the UK currency.

This creates a well-defined band for GBP/EUR that should provide a guideline for those with GBP/EUR payment opportunities, helping them understand where to set limit and buy orders.

For instance, a break below the lower band could lead to a more protracted bout of weakness and even an end to the 2024 uptrend. However, a confirmed break above the band could mean a new leg of appreciation is at hand.

A lot will ride on this week's UK inflation data, due for release on Wednesday.

UK inflation is expected to have risen to 2.2% year-on-year in October from 1.7% in September, indicating an acceleration in inflation.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Recall economists at the Bank of England and the Office for Budget Responsibility recently upgraded their forecasts for the near term in the wake of the October budget, which saw the government announce a big increase in spending.

Also, household energy prices are rising again, so the easy part of the 2024 deflationary process is now behind us.

Core inflation is expected to remain at a sticky 3.2%, driven by strong services inflation. If these figures come in weaker, the pound could come under pressure, as this would open the door to a potential Bank of England interest rate cut in December.

"The services rate is set to remain hovering close to 5% y/y. A significant downside surprise would be needed to meaningfully boost the likelihood of a December rate cut," says Sam Hill, Head of Market Insights at Lloyds Bank.

Should inflation beat expectations, the Pound-Euro exchange rate could well rally back to its recent highs as investors reinforce expectations that the Bank of England will only be able to cut at a quarterly pace in 2025, meaning just four further rate cuts are likely.

This would leave UK interest rates above the Eurozone's, which can underpin the Pound.

However, a slowdown in broader economic activity could concern central banks in Europe and the UK.

Both the Eurozone and the UK will release November PMI data this coming week, which will provide a timely account of economic progress.

The rule of thumb is that the Euro and Pound will react according to which side of expectations their respective releases land.

We are particularly interested in the UK's PMI data, as they should incorporate the fallout from the October budget.

There are reports that business sentiment and hiring intentions took a hit following the budget, and this could be reflected in a poor PMI reading. If this is the case, the Pound-Euro exchange rate could close in the red for the second consecutive week.

"In the two weeks since the budget, various big names in the UK retail and hospitality sector have warned that Reeve’s hike to employers’ national insurance contributions would led to a jump of costs to consumers. Others have indicated that it could lead to job losses," says Rabobank's Foley.

The Bank of England could well respond to signs of a slowing economy by cutting interest rates again next month, judging that it can cut rates further without stoking inflation. It would suggest that the Bank thinks that if growth is allowed to collapse, then inflation would drastically undershoot current expectations in 2025-2026.

Any signs that it will accelerate the rate cutting process would weigh on the Pound.