Pound to Euro Week Ahead Forecast: Sub-1.19 on Inflation and Job Undershoots

- Written by: Gary Howes

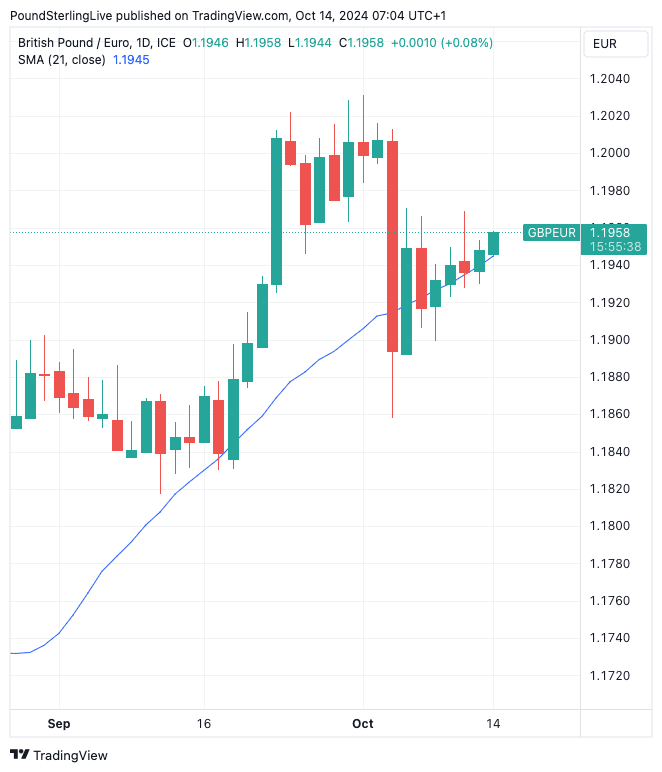

- Technicals are supportive of a retest of 1.20

- But we think fundamental risks make 1.1890 more likely this week

- Watch UK wage data Tuesday, inflation Wednesday

- ECB rate cut expected on Thursday

Image © Adobe Images

The Pound to Euro exchange rate (GBP/EUR) faces downside risks this week as any misses in inflation or wage numbers will be jumped on. And don't forget the ECB's interest rate decision on Thursday.

Ahead of Tuesday's UK wage data release, Pound Sterling is supported at €1.1950, which is where the GBP/EUR's 21-day moving average (DMA) is located.

If we look at the below, we can see the 21 DMA is rising and has held the exchange rate aloft since that significant pullback witnessed on October 03:

Above: GBP/EUR at daily intervals.

Although GBP/EUR has fallen from its highs near 1.20, technical studies remain broadly supportive (the exchange rate trades well above its 50, 100 and 200 DMA's).

Based on technicals alone, the recent grind higher would be expected to continue, with 1.1975 coming into view this week, and a retest of 1.20 could be expected at some point next week.

However, events risk undermining what is a positive technical setup for the GBP/EUR exchange rate.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Pound Sterling is highly sensitive to the market's expectations for the outlook for UK interest rates, and an undershoot in inflation and/or wage data will prompt investors to bet on two further successive rate cuts over the duration of 2024.

Currently, the Bank of England is expected to cut rates in November and leave them unchanged in December. But soft data this week would mean December comes back into play.

Tuesday's average earnings release should show growth of 5%, down from 5.1%, and when bonuses are included, the figure is expected to be 3.8%.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

Anything below this would put the Pound under pressure and make a restest of 1.1894 a real possibility.

Survey data has consistently pointed to a slowing in the UK economy since mid-summer, which has been creating slack in the labour market and easing pressure on wages. It is expected this will, in turn, press down on inflation.

Wednesday's inflation figures will be closely watched, with the headline CPI rate predicted to come in at 1.9%, which puts it back below the Bank of England's 2.0% target.

"We estimate that CPI inflation temporarily dipped to 1.7% in September, which would be the lowest reading since April 2021. Two factors are likely to have weighed on inflation last month," says a note from Oxford Economics. The primary factor cited by Oxford Economics is the fall in global oil prices that will impact the September data.

Bailey Activated

The Pound is sensitive to interest rate expectations; two weeks ago it dropped sharply after Bank of England Governor Andrew Bailey said the Bank would be more "activist" on cutting interest rates if the data allowed.

Could this week's fall in headline inflation below 2.0% give the "activist" Bailey the ammunition he is looking for?

We think it could, as the Bank will likely want to gloss over the fact that falling oil prices will be behind the fall in inflation.

"All of the undershoot relative to the MPC's call is accounted for by falling motor fuel prices," says Robert Wood, Chief UK Economist at Pantheon Macroeconomics.

Keep an eye on services inflation, which is expected to come in at 5.4%. This is arguably the most important figure in this week's inflation docket as it pertains to domestically generated inflation, the kind the Bank can target.

If services fall below 5.4%, the Pound will come under pressure as the market will ramp up bets that a December rate cut will be added to the roster.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"Underlying price pressures should remain on a downward path for the foreseeable future. This will further alleviate concerns about inflation persistence and therefore lower the bar for the MPC to adopt a progressively more “activist” stance on rate cuts," says Konstantinos Venetis, an economist at TS Lombard.

Also keep an eye on retail sales, due Friday, as we have seen over the course of the past year instances where the Pound reacted more to retail sales than it did to inflation and employment numbers from the same week.

This is because retail sales are a measure of consumer sentiment and demand, which in turn impact inflation and any sizeable deviation from consensus could impact the Pound.

ECB to Cut Interest Rates Again

The European Central Bank (ECB) is in focus on Thursday when it delivers its next policy decision.

The market looks for a second consecutive interest rate cut to follow September's 25bp cut.

The decision to cut again follows a particularly soft inflation report that shows Eurozone inflation is comfortably on target to fall below the ECB's mandated 2.0% level.

The cut is needed because Germany's economy is, at best, mired in stagnation and France is facing a fiscal contraction as the new Prime Minister Michel Barnier pushes through billions of euros of spending cuts and tax rises.

The cut is 'in the price' of euro exchange rates and is therefore not a major market-mover; instead, we will be watching the outcome of the ECB's guidance.

"A non-dovish rate cut by the ECB will probably limit further EUR-USD weakness," says Roberto Mialich, FX Strategist at UniCredit.

A non-dovish rate cut would be where the Bank cuts interest rates but says it is not committed to further cuts, instead preferring to watch the data.

It could signal that it thinks it has done enough in the near term to stabilise the Eurozone's economic outlook and that it wants to assess the impact of recent cuts, which would support the Euro.

However, the ECB is unlikely to be a source of enduring strength for the single currency.

"We expect the ECB to cut the policy rates again by 25bp which would bring the deposit rate to 3.25%, and markets agree with our view," says Minna Kuusisto, an economist at Dankse Bank. "Focus will again be on Lagarde's remarks and especially the Q&A session. Even if ECB's forward guidance has been non-existent, markets seem convinced that rates will be cut at a relatively steady pace from here."

We think any post-ECB strength in the Euro will be faded and downside risks to GBP/EUR would be limited as a result.

For sure, the risks to GBP/EUR are loaded on the UK side of the equation this week.