Eurozone Inflation Opens Door for Euro-Dollar's Return to 1.10

- Written by: Gary Howes

Image © Adobe Images

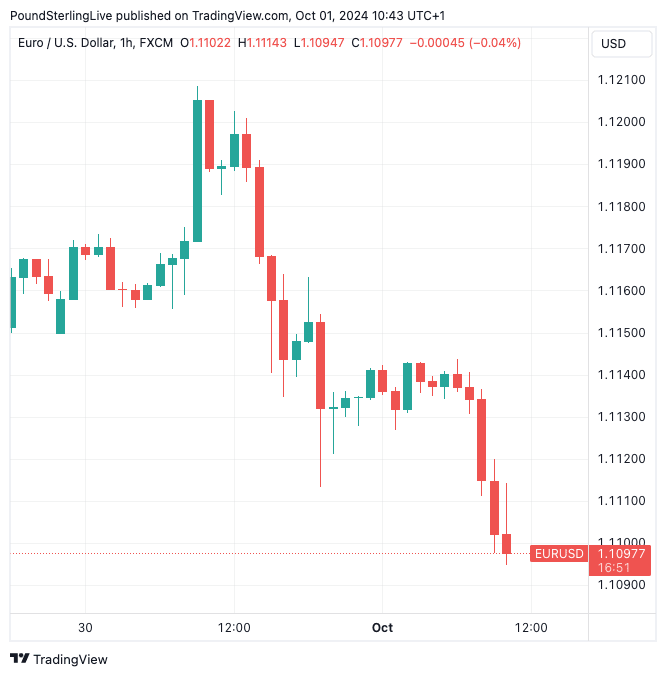

The Euro to Dollar exchange rate (EUR/USD) is on course for a third consecutive daily decline, helped along by an undershoot in September's inflation numbers from the Eurozone and diverging central bank communications.

Eurozone inflation read at 1.8% year-on-year in September, down from 2.2% in August, which is now comfortably below the European Central Bank's 2.0% target.

Core inflation, which is more of a bug-bear for the ECB, slipped to 2.7% from 2.8%.

The undershoot in the September inflation figures raises the odds of an October interest rate cut from the ECB and the potential for a sizeable 50bp move either in October or December.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Alongside these developments, EUR/USD is down 0.30% on the day at 1.1103, having been as high as 1.12 at one point on Monday.

"Headline year-on-year inflation at 1.8% met expectations and did nothing to alter the current dovish view of pending European rate policy," says Joe Tuckey, Head of FX Analysis at Argentex. "EUR/USD price action remains weaker, capped by robust technical resistance at 1.12, and is edging lower toward technical chart support at 1.1015."

In an appearance before European lawmakers on Monday, ECB President Christine Lagarde indicated that a rate cut in October was in play as she was comfortable with the idea inflation was now in a clear downtrend and upside risks were fading.

Above: EUR/USD at 1-hour intervals.

As recently as last week, the expectation was that the ECB would only cut rates again in December, opting to pursue a quarterly pace of rate cuts.

But these expectations were undermined by Friday's release of soft French and Spanish inflation data that signalled today's figure would surprise to the downside.

"What happened with this month's inflation data came as a huge surprise: we think the large downside surprises to French (1.5 %y/y) and Spanish (1.7% y/y) inflation readings changed the rate cut calculus for the ECB," says James Rossiter, Head of Global Macro Strategy at TD Securities.

"With recent inflation data coming in below target and below expectations, the conditions have been met for a more rapid pace of rate cuts by the ECB. We now look for sequential 25bps cuts from October to March, taking the depo rate to its terminal of 2.50% six months sooner than previously anticipated," he adds.

🎯 EUR/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Francesco Pesole, a foreign exchange strategist at ING, says swap rate continued to widen in favour of the dollar, and are now around -110bp, some 25bp below the -85bp mid-September levels.

"The notion that an inflation-concerned ECB would move more carefully than the Fed on easing is crumbling," says Pesole. "It’s looking increasingly likely that holding rates in October could mean cutting by 50bp in December, which explains market pricing for -52bp by year-end, with 22bp priced in for this month."

While ECB President Lagarde was encouraing markets to bet on a faster rate of rate cuts, her colleague at the Federal Reserve indicated pushed back against expectations of another 50 basis point cut in 2024.

Jerome Powell was clear that he thought two more 25bp moves were adequate, which is less than the 70bp the market currently anticipates.

According to Pesole, the large moves in the EUR:USD short-term rate differentials are pointing to a weaker EUR/USD now.

"We think EUR/USD can trade back below 1.110 in the next couple of days, and test 1.100 if US unemployment doesn’t tick higher on Friday," he explains.