Pound to Euro Week Ahead Forecast: Downtrend Confirmed, Jobs Data Eyed

- Written by: Gary Howes

Image © Adobe Images

Pound Sterling has entered a technical downtrend against the Euro, with Tuesday's labour market report posing new downside risks.

The Pound to Euro exchange rate (GBPEUR) is at 1.1850 after falling for three weeks in succession, and there is little in the technical charts or fundamental setup to advocate for a major recovery.

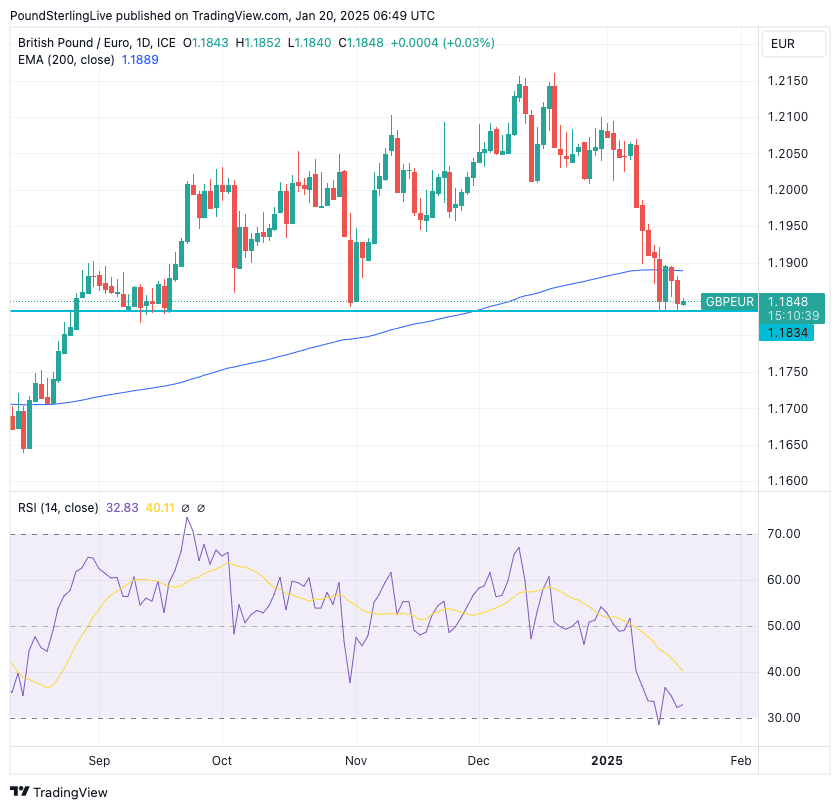

Weakness culminated in a break below the 200-day exponential moving average (EMA) last Tuesday (1.1890), and the exchange rate has so far failed to reclaim this technical level. A rule of Pound Sterling Live's Week Ahead model is that a break below the 200 EMA signals an exchange rate has entered a multi-week downtrend.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

In fact, it looks as though the 200 EMA will now act as a resistance level that will block any recovery attempts, suggesting any GBP/EUR strength in the coming days will be shallow.

The selloff has, nevertheless, slowed. The Relative Strength Index (RSI) reached oversold conditions last week (after hitting 30), which meant a period of recovery or consolidation was needed. It appears that consolidation has played out, allowing the RSI to unwind from oversold.

There also appears to be some graphical support forming at approximately 1.18450-1.1900, which goes back to periods of weakness in September and October of last year (see the turquoise line on the chart). This could offer some support in the run-up to Tuesday's UK labour market report before ultimately giving way to a fresh leg lower.

Above: GBP/EUR at daily intervals, showing the break below the 200 EMA and the recent recovery from oversold in the RSI (lower panel).

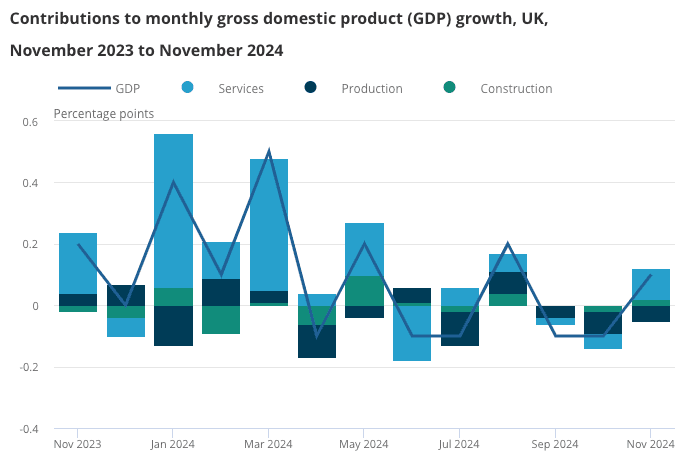

Pound Sterling has been hit by a run of poor data over recent weeks that speaks of an economy that has run out of momentum owing to the significant taxes placed on businesses by the government. In addition, an inflation-busting increase to the minimum wage is due to come into effect, as is further red tape on employing people.

All this points to the labour market as a key cost driver and headwind for businesses operating in the UK, and this is why this week's labour market report will be of particular interest. The outcome is likely to influence expectations for the amount of interest rate cuts the Bank of England will likely make this year.

The consensus looks for the unemployment rate to edge up to 4.4% from 4.3% in light of survey evidence of growing job losses and a slowdown in hiring intentions. In particular, the PMI surveys have been warning of a deterioration in the labour market for a couple of months now.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

"Employment indicators are pointing firmly to a decline in payrolled employment in the coming months," says Sam Hill, Head of Market Insights at Lloyds Bank.

The Pound is likely to fall should unemployment rise faster than was expected and the opposite reaction is likely if the data proves stronger than expected.

"A payrolls rise would be a big surprise, suggesting business sentiment is overegging the jobs slowdown and likely pushing the market back to pricing fewer than two cuts," says Robert Wood, an economist at Pantheon Macroeconomics.

Above: The economy has essentially flatlined following strong growth in the first half of 2024.

Of importance to traders will be the wage data that is released alongside the job figures. Here, The consensus expects wages to rise 5.5% in November, up from 5.2% in October. In isolation, the rule is that the pound will fall if wages undershoot expectations, but it will rise if the data beats.

The Bank of England is watching employment and wage dynamics, judging that high wages are inflationary and must be met with higher-for-longer interest rates.

However, rising unemployment will suggest to the Bank that wage pressures will fall notably in the coming months, which will allow them to cut interest rates further.

For the Pound, rising expectations for rate cuts will result in weakness and this is why we forecast further GBP downside in the coming days, judging that the process has further to run.

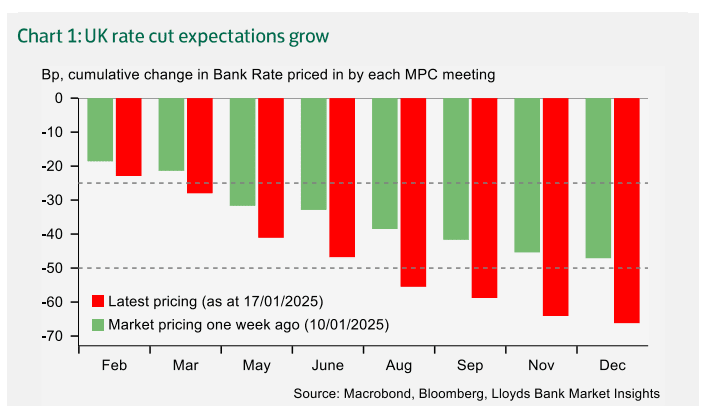

Money market pricing shows investors have raised bets for more rate cuts from the Bank of England this year, which has contributed to the weaker Pound. However, the market is still only expecting two rate cuts, with a third being a possibility.

Above: Markets see more rate cuts ahead than was the case just one week ago, and there is scope for this trend to continue.

Most economists we follow suggest four cuts is the most likely outcome. This means the market can continue to 'price in' rate cuts from here, resulting in further weakness in Pound Sterling.

Keep an eye on Friday's release of PMI survey data for January as this will be the first major snapshot of how the UK and Eurozone economies performed in January.

The consensus looks for Eurozone output to have improved, driven by a recovery in Germany. This can bolster the Euro relative to the Pound.

The UK is meanwhile expected to show a slowdown in activity:

"Flash PMIs on Friday will likely show continued weak momentum; we expect the services PMI to drop to 50.5. But the details are as important as the headline now. The crucial question for the economic outlook and the MPC’s decisions is how much tax hikes are cutting employment or raising prices," says Wood.

Our setup for the Pound-Euro is bearish owing to the event risks associated with the labour market data and the downbeat technical setup. However, we do note that some investment bank technical strategists now think weakness has gone too far and are looking to buy the pound against the euro at these levels.

"We go short EURGBP," says a strategy note from Citi, citing expectations for a reversal in negative sentiment towards the UK.

However, we think this week will be too soon for sentiment to improve, given expectations for a poor labour market report.