Pound to Euro Rate Extends Losses on Growing U.S. Recession Fears

- Written by: Sam Coventry

Image © Adobe Images

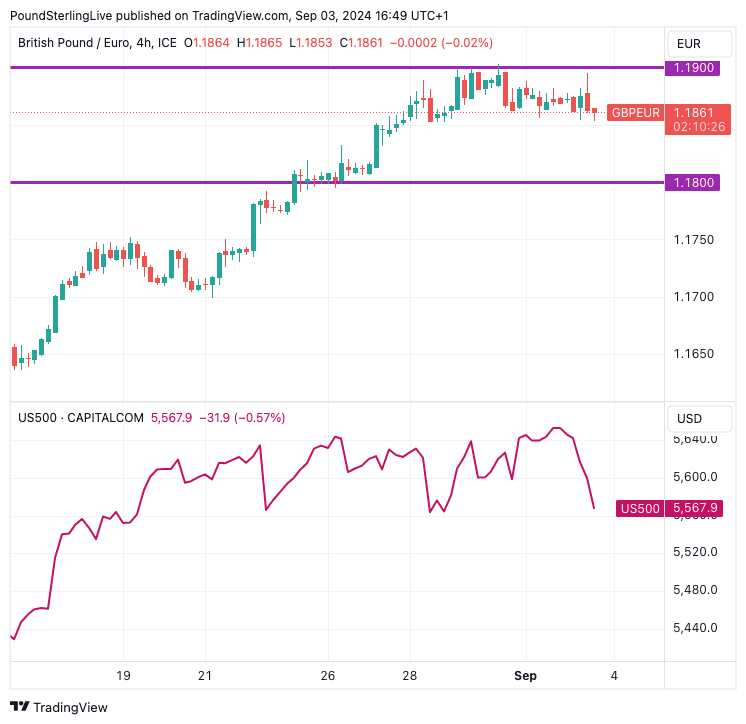

The Pound to Euro exchange rate (GBP/EUR) has fallen to 1.1860 as the September selloff extends, with losses linked to faltering global investor sentiment.

Investors sold stocks and bought dollars after data from the U.S. showed that the economy was at risk of falling into recession.

Pound Sterling is sensitive to global sentiment, tending to fall against the USD, EUR, CHF and JPY when stocks are sold while rising against the more vulnerable AUD, NZD, and Scandinavian currencies.

GBP/EUR losses could extend to at least 1.18 by the end of the week if current macroeconomic themes are confirmed by Thursday's ISM services PMI and Friday's non-farm payroll report.

Above: GBP/EUR (top) and S&P 500 index at four-hour intervals.

This theme was evident in early August when markets feared the Federal Reserve was too late and too slow in lowering interest rates, resulting in a recession. By August 08 the Pound-Euro exchange rate had slumped to a low of 1.16.

This should put those looking to buy euros in the near term that a market slowdown poses notable risks to their purchasing power.

Markets are concerned as the September 03 data docket also showed there was a risk that inflation could start rising again, creating a nightmare scenario whereby the economy falls into recession and inflation returns. The ISM manufacturing PMI services paid component unexpectedly jumped to 54, which was well above the 52.5 expected and July's 52.9.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Rejuvenated inflationary pressures would limit the Fed's ability to cut interest rates, worsening the economic slowdown.

"This morning has seen a trifecta of weak economic data. Aug. PMI & ISM manufacturing both came out even weaker than expected, while July construction spending unexpectedly fell. It's becoming clear the economy is entering a recession just as inflation is poised to turn higher," says Peter Schiff at Euro Pacific Asset Management.

ISM's headline manufacturing PMI read at 47.2% in August, below expectations for 47.5. Anything below 50 signals contraction.

S&P Global's PMI was also released alongside that from ISM, and it confirmed the sector is under pressure with a 47.9 print. The forward-looking new orders index of the report showed the situation was likely to deteriorate further, coming in at 44.6, down from 47.4 in July.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.