"Huge" Interest Rate Cuts and Austerity to Send Pound Sterling Lower Against Euro and Dollar

- Written by: Gary Howes

29/07/2024. London, United Kingdom. Chancellor Rachel Reeves holds a press conference at HM Treasury. Picture by Zara Farrar / No 10 Downing Street.

A new analysis from UniCredit Bank shows that renewed austerity caused by the UK's fiscal rules means the feel-good factor for the Pound can soon end.

The analysis also shows the Bank of England will cut interest rates by more than the market expects in the coming months as the economy deteriorates, resulting in significant weakness in the Pound.

The Milan-based lender says the Bank of England won't cut interest rates for the first time on August 01 and will prefer to wait for September. However, the start point of the cycle is not as important as its overall depth.

A "huge" interest rate cutting cycle is forecast to send Pound Sterling back to crisis-era levels against the Euro and Dollar. This puts UniCredit well out of synch with its investment bank peers, whose median point forecasts are notably higher.

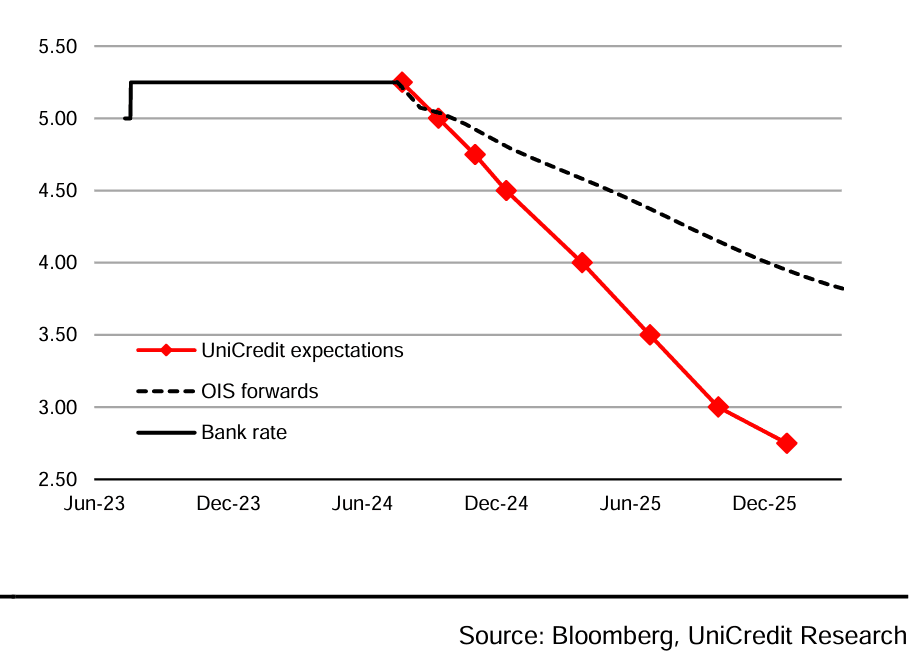

"We now expect the MPC to start cutting rates in September, but we continue to expect a total of 75bp of cuts this year, and a huge 175bp of cuts next year. This is a faster and deeper rate cutting cycle than financial markets expect," says Daniel Vernazza, Chief International Economist at UniCredit.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The reason for UniCredit's "dovish" view is it thinks the UK labour market is "clearly weakening, and once unemployment starts rising it tends to keep going as an adverse feedback loop takes hold."

Vernazza says this will likely slow wage growth fairly quickly. In addition, he says the estimate that the longer-run neutral interest rate is lower in the UK than in the U.S., so the Bank of England has further to cut.

The Pound is 2024's best-performing major currency, benefiting from the UK's elevated interest rates compared to elsewhere.

The concern for Sterling 'bulls' is that this outperformance is reversed once those interest rates start falling.

"Markets are already pricing in a BoE rate cut in September, which we also now expect. We therefore doubt that the GBP will benefit much if the BoE holds steady on Thursday. If the central bank kicks off the heavy easing cycle we still expect over the coming months and in 2025, this will likely weigh on sterling against both the US dollar and the euro," says Roberto Mialich, FX Strategist at UniCredit.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

UniCredit's forecast profile is stark. The Euro-Pound exchange rate is predicted to end the year at 0.86 and trade at 0.87 at the end of the first quarter of 2025. The target for the end of the second quarter is 0.89, 0.90 for the third quarter, and 0.92 for the end of 2025.

This gives a Pound to Euro exchange rate profile of 1.1630 for end-2024, 1.15, 1.12, 1.11 and 1.09 for the subsequent quarters.

For context, the only time we have seen GBP/EUR dip below 1.10 is during times of acute UK-specific or global financial stress. (Examples: Liz Truss-era selloff, 2008 financial crisis).

For the Pound to Dollar exchange rate, the respective point forecasts are 1.27, 1.26, 1.25, 1.24 and 1.22.

"We think that the outlook for sterling remains bearish, especially moving into 2025," says Mialich. "Given the intense easing we expect from the BoE. This will likely drag GBP-USD down towards 1.20 and push EUR-GBP back above 0.90 by the end of 2025."

Fiscal Straitjacket

29/07/2024. London, United Kingdom. Chancellor Rachel Reeves holds a press conference on Fixing the Foundations at HM Treasury. Picture by Zara Farrar / No 10 Downing Street.

But what about the feel-good factor around the new government that has been credited for much of GBP's recent outperformance?

"The UK economy remains weak and new fiscal policies in the UK will probably be important variables for sterling. However, stretched public finances and self-imposed fiscal rules leave little room for action on this front. Monetary policy, therefore, will probably play a greater role in helping the UK economy," says Mialich.

The straitjacket of the UK's fiscal rules was in plain sight on Monday when new Chancellor Rachel Reeves warned of fresh tax rises and spending cuts, which she said was needed to ensure the fiscal rules were met.

Critics of the rules say they risk killing any much-needed investments in infrastructure and productivity, which will be needed to boost UK economic growth.

"Yesterday’s fiscal statement by Rachel Reeves was a shambles. We are no wiser about problems with public spending or long term remedies. Instead, we now have a blame game with Labour & Tories blaming each other. This is not the stability promised pre-Election - more Truss Mk 2!" says economist Andrew Sentance, a former member of the Bank of England's Monetary Policy Committee.

"Rachel Reeves appears to have been captured by old-fashioned and outdated Treasury orthodoxy," he adds.

Reeves warned of a £22BN (0.8% of GDP) funding shortfall that needed to be filled and announced emergency savings totalling £5.5bn. "There will be more difficult decisions around spending, around welfare, and around tax," she said.

"Tighter UK fiscal policy can leave the Bank of England more room to ease policy," points out Elias Haddad, Senior Markets Strategist at Brown Brothers Harriman. "Our base case is for the BOE to start easing Thursday because UK headline CPI inflation has been at the BOE’s 2% target the last two months and leading indicators point to sharply lower inflation."